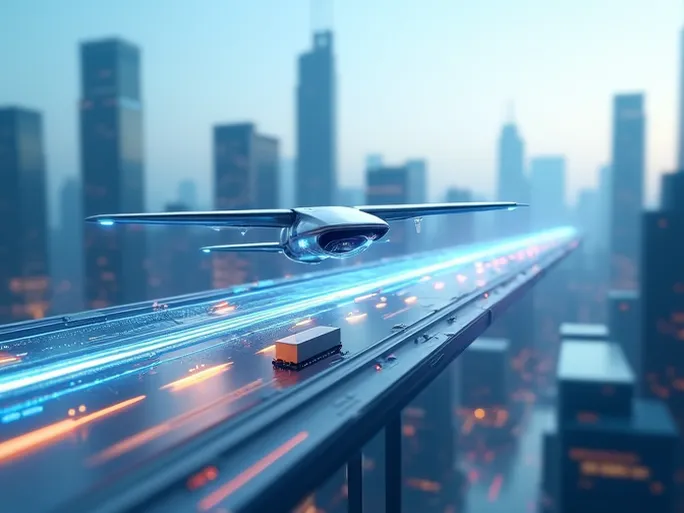

As traditional freight models face efficiency bottlenecks, Ameriflight, a U.S. cargo airline, is actively exploring whether drones could be the solution. The company recently announced plans to purchase 35 cargo drones from Sabrewing Aircraft Company, aiming to expand its rapid supply chain services and gain a competitive edge in the future logistics market.

Ameriflight Doubles Down on Drone Strategy for Last-Mile Delivery

In an official statement released on February 15, the Dallas-based company disclosed the signing of a letter of intent with Sabrewing. The agreement covers the purchase of 35 Rhaegal-A drones (also called "Alpha"), medium-sized vertical takeoff and landing (VTOL) cargo drones with payload capacities exceeding 2,000 pounds. These hybrid-fuel drones can operate on both conventional aviation fuel and sustainable aviation fuel, balancing environmental concerns with performance.

Ameriflight believes the Alpha drones can transport goods between facilities at speeds far exceeding traditional vehicles, with the added advantage of accessing locations where conventional aircraft cannot land—eliminating the extra costs associated with airport cargo transfers. This marks the company's second major drone investment this year as part of its strategy to diversify aviation services and explore new business opportunities in distribution center logistics.

The airline, which counts logistics giants like UPS among its primary clients, plans to leverage the Alpha drones' VTOL capabilities to quickly transport goods to alternative landing sites beyond airports, helping shippers build more efficient warehouse distribution networks.

De Reyes noted that drone deliveries are expected to commence after receiving type certification. "After receiving the type inspection authorization from the FAA, it will take about 18 months," he said. "If everything goes according to plan, deliveries could begin as early as December 2024."

Diversification Strategy: Partnering With Natilus for E-Commerce Solutions

Earlier this year, Ameriflight also announced an agreement with U.S. company Natilus to purchase 20 Kona cargo drones. These short-haul regional freight aircraft boast a 3.8-ton payload capacity and are designed to provide more diversified e-commerce solutions. These moves demonstrate Ameriflight's ambitious plans in the cargo drone sector.

Growing Market Potential Amid Intensifying Competition

With the rapid growth of e-commerce and increasing consumer demands for logistics efficiency, cargo drone companies are facing unprecedented opportunities. More carriers and supply chain participants are actively developing last-mile delivery and rapid logistics networks, injecting strong momentum into the cargo drone market.

For instance, in January, San Francisco-based drone developer MightyFly launched its second-generation cargo drone featuring an enlarged cargo bay capable of carrying 96 small USPS packages in a single trip, meeting continuous delivery demands.

Regulatory, Technical and Cost Challenges

Despite promising prospects, cargo drone development faces multiple hurdles. Regulatory frameworks remain incomplete, particularly regarding flight safety and airspace management in densely populated urban areas. Technical limitations in endurance, payload capacity, and wind resistance must also be addressed to meet complex operational requirements.

Cost remains another critical factor. Current production, operation, and maintenance expenses for cargo drones remain relatively high, impacting their economic viability. Reducing costs while improving cost-performance ratios presents a significant challenge for the industry.

Future Outlook: Reshaping Logistics Networks

Despite these challenges, cargo drones hold considerable promise. As technology advances and regulations mature, they are expected to play increasingly important roles in last-mile delivery, emergency response, and remote area supply transport. In the future, drone logistics may complement traditional methods to create more efficient, intelligent, and sustainable supply chain ecosystems.

As companies like Ameriflight continue to explore and implement drone solutions, these aircraft may significantly reshape logistics networks and enhance supply chain efficiency—potentially transforming both daily life and business models.

About Ameriflight: The largest U.S. regional cargo airline serving major logistics companies like FedEx and UPS, Ameriflight maintains an extensive fleet and route network. Its entry into drone logistics marks a strategic shift toward innovative technologies.

About Sabrewing Aircraft Company: This innovative firm specializes in VTOL cargo drones, with its Rhaegal-A model offering superior payload capacity, range, and reliability through advanced hybrid propulsion systems.

About Natilus: This U.S. manufacturer focuses on large, long-range autonomous cargo aircraft, with its Kona drone designed for economical short-haul regional freight services using advanced aerodynamics.

About MightyFly: The San Francisco-based developer's Centaur drone features modular designs for flexible logistics solutions, with capabilities for continuous parcel delivery.