For businesses engaged in cross-border trade, navigating complex international shipping procedures and unpredictable tax liabilities can present significant challenges. Comprehensive shipping solutions that handle both customs clearance and tax obligations have emerged as an efficient alternative to traditional logistics methods.

Core Components of Inclusive Shipping Services

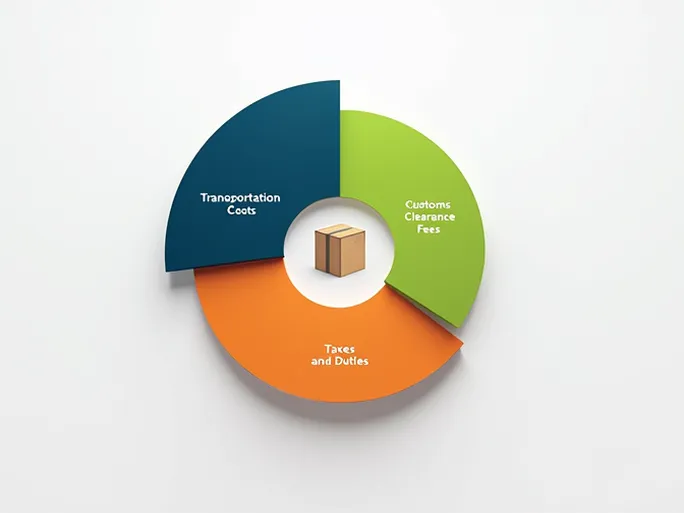

These comprehensive services typically include two primary elements: dual customs clearance (covering both export and import procedures) and prepaid taxes (including import duties and value-added taxes). The pricing structure generally consists of three fundamental components:

1. Transportation Costs

The base shipping fee varies according to the selected transportation method (ocean freight, air cargo, or express delivery) and is calculated based on either the actual weight or volumetric dimensions of the shipment. Each method offers distinct advantages:

- Ocean freight: Most cost-effective for large, non-urgent shipments with flexible timelines

- Air cargo: Higher pricing but preferred for time-sensitive, high-value, or lightweight items

- Express delivery: Premium service with the fastest transit times, typically billed by initial weight and subsequent increments

2. Customs Clearance Fees

This covers documentation processing, declaration submissions, and administrative handling required for both export and import customs procedures.

3. Prepaid Duties and Taxes

The service provider assumes responsibility for all import-related tax obligations, including tariffs and VAT, eliminating unexpected cost variables for shippers.

Additional Service Options

Beyond the standard offering, logistics providers may offer supplementary services that generate additional fees:

- Warehousing and inventory management

- Product sorting and quality inspection

- Repackaging and labeling services

- Final-mile delivery solutions

Operational Advantages

By consolidating multiple logistical requirements into a single service package, these solutions streamline international supply chains. The predictable cost structure allows businesses to accurately calculate landed costs while avoiding customs-related delays. Professional logistics consultants typically provide customized routing recommendations based on specific commodity characteristics and delivery requirements.