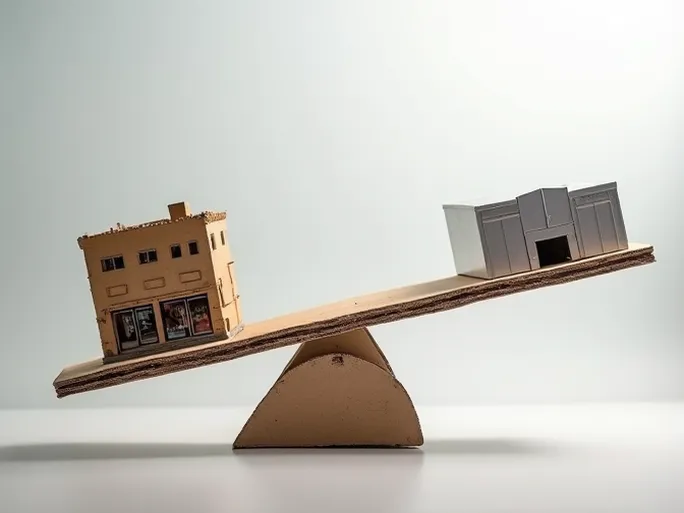

In the ever-evolving commercial landscape, adaptability has become the key to survival. Once-thriving shopping centers now face unprecedented challenges as e-commerce growth, shifting consumer behavior, and omnichannel retail models reshape traditional industry paradigms. Yet within these challenges lie opportunities for reinvention.

CBRE Report Reveals Industry Transformation

Global commercial real estate leader CBRE has identified this emerging trend in its comprehensive report "Space Reallocation: The Conversion of Retail Properties to Industrial Uses." The study examines the conversion of retail spaces into industrial/logistics facilities, analyzing driving factors, conversion models, potential value, and future prospects.

The Driving Forces Behind Conversion

The report identifies shifting consumer preferences toward e-commerce and omnichannel shopping as primary conversion catalysts. With increasing internet penetration and mobile device usage, more consumers opt for online shopping's convenience, leading to declining foot traffic at physical stores.

Simultaneously, e-commerce platforms' explosive growth creates unprecedented demand for efficient logistics networks. To meet expectations for rapid delivery, retailers require strategically located distribution centers near population centers - making well-positioned retail properties ideal conversion candidates.

Conversion Models: Adaptation vs. Reconstruction

CBRE's research reveals two predominant conversion approaches:

1. Adaptive reuse of existing structures: Suitable for structurally sound properties in prime locations. Modifications may include adding loading docks, improving parking configurations, and increasing ceiling clearances.

2. Complete redevelopment: Applied to obsolete structures, this approach demolishes outdated retail facilities to construct modern industrial spaces tailored to specific logistics needs, such as automated sorting centers or cold storage facilities.

Case Studies: From Theory to Practice

Since 2016, the U.S. has seen 24 retail-to-industrial conversions, transforming 7.9 million square feet of retail space into 10.9 million square feet of industrial facilities. These projects primarily occur in:

- Markets with median household incomes below national averages

- Areas with industrial vacancy rates below 5%

Standalone big-box stores near population centers (rather than traditional warehouse districts) prove particularly suitable for conversion, especially those featuring loading infrastructure, ample parking, and industrial-grade ceiling heights.

Case Study: Regional Mall to Fulfillment Center

A suburban shopping mall suffering declining foot traffic underwent conversion into a last-mile distribution hub. The transformation involved partial demolition to expand warehouse space, upgraded loading facilities, and enhanced parking configurations - creating value from underutilized real estate while supporting e-commerce operations.

Strategic Value of Conversions

These transformations deliver significant benefits:

- Omnichannel enablement: Converted spaces help retailers expand fulfillment capabilities

- Logistics optimization: Urban-located facilities reduce last-mile delivery distances

- Land use efficiency: Repurposing underperforming assets maximizes real estate utility

Implementation Challenges

Despite advantages, conversions present obstacles:

- Complex execution involving structural modifications and regulatory compliance

- Extended timelines for planning, approvals, and construction

- Geographic and structural limitations on suitable properties

Future Outlook

David Egan, CBRE's Global Head of Industrial & Logistics Research, notes that while retail landscapes are evolving dramatically, physical retail's "demise" is often overstated. "In challenging markets, conversion represents a viable solution," Egan observes. "However, this transition will unfold gradually over years rather than months."

Key Success Factors

Successful conversions require:

- Strategic site selection near transportation corridors and population centers

- Purpose-driven facility modifications meeting industrial specifications

- Advanced logistics management systems optimizing operations

Emerging Trends

Future conversions will likely emphasize:

- Smart technologies: IoT and AI-driven logistics management

- Sustainability: Energy-efficient designs and operations

- Customization: Tenant-specific facility configurations

This retail transformation represents more than real estate adaptation - it reflects fundamental changes in consumption patterns and commercial infrastructure. As the sector continues evolving, these conversions will play an increasingly vital role in meeting modern commerce demands.