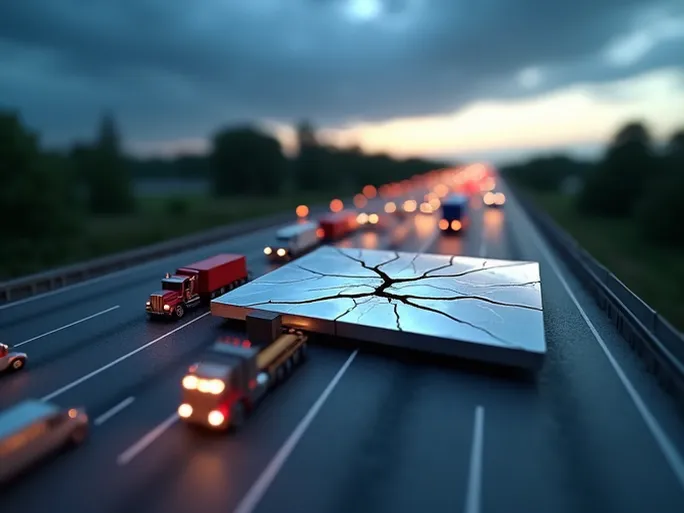

Imagine standing at the helm of a North American logistics company, holding a mountain of orders—each representing potential profit. Yet reality delivers a cruel joke: you find yourself immobilized by a lack of available trucks, watching revenue slip through your fingers. This isn’t hypothetical; it’s the current drama unfolding across the continent’s freight industry.

Class 8 heavy-duty trucks, the backbone of North American logistics, are straining under unprecedented demand. The pandemic-fueled e-commerce boom has transformed consumer behavior, triggering explosive growth in goods movement. But beneath this apparent prosperity lies an unsettling truth: manufacturers’ production capacity remains strangled, while global supply chain fragility manifests in chronic parts shortages.

Chapter 1: The Order Frenzy—Decoding Market Signals

February’s data from freight analysts FTR and ACT Research reveals historic highs in Class 8 net orders—a clear indicator of sustained demand. Though their figures vary slightly (44,000 vs. 43,800 units), both show year-over-year growth exceeding 200%, marking twelve consecutive months above 338,000 cumulative orders. This isn’t merely recovery; it’s a market redefining its limits.

Chapter 2: Demand Drivers—A Perfect Storm

1. Capacity Crunch: E-commerce expansion collides with a worsening trucker shortage. Aging fleets and pandemic-induced workforce exits compound the strain, spurring carriers to order aggressively.

2. Economic Revival: Resurgent manufacturing and construction sectors amplify freight needs. As factories hum and infrastructure projects advance, demand for heavy trucks escalates proportionally.

3. Rate Inflation: Record-high spot and contract rates incentivize fleet expansion. With profit margins swelling, operators prioritize securing new assets—even amid delivery delays.

4. Preemptive Buying: Fearing prolonged shortages, logistics firms place advance orders to lock in pricing and allocation, artificially inflating order volumes.

Chapter 3: The Supply Chain Breakdown

What should be manufacturers’ triumph has become a logistical nightmare. Critical component shortages—from semiconductor chips to wiring harnesses—have created a production bottleneck analysts liken to "trying to drink from a firehose through a straw."

"Every link in the chain is stressed," observes FTR’s Don Ake. "Chip shortages throttle smart truck production, port congestion strangles parts imports, and labor gaps persist across tiered suppliers."

The crisis exposes systemic vulnerabilities: over 80% of automotive-grade chips originate from Asian foundries, while just-in-time inventory models leave no buffer for disruptions. Even when components arrive, tire shortages and assembly-line staffing gaps further delay completions.

Chapter 4: Economic Crosscurrents

ACT Research’s Kenny Vieth notes contradictory signals: while industrial activity fuels freight demand, inflationary pressures may soon temper consumer spending. "The outlook remains bullish near-term," he cautions, "but carriers must navigate both opportunity and volatility."

Chapter 5: Pathways Forward

Relief may emerge gradually—chip supplies could stabilize by late 2023 as new factories come online—but port inefficiencies and labor mismatches require structural solutions. Manufacturers are adapting through localized sourcing and simplified truck configurations, yet backlogs now stretch 8-12 months industry-wide.

Global Implications

This crisis underscores three lessons for international players:

1. Supply Chain Resilience: Diversification beyond single-source dependencies is now imperative.

2. Technological Pivots: Investments in modular designs and alternative propulsion could future-proof production.

3. Strategic Expansion: North America’s unmet demand presents openings for manufacturers with agile global footprints.

For now, the industry remains locked in a paradox: unprecedented demand meets constrained supply. Those who navigate this turbulence—whether through operational ingenuity or strategic patience—may emerge stronger when equilibrium returns.