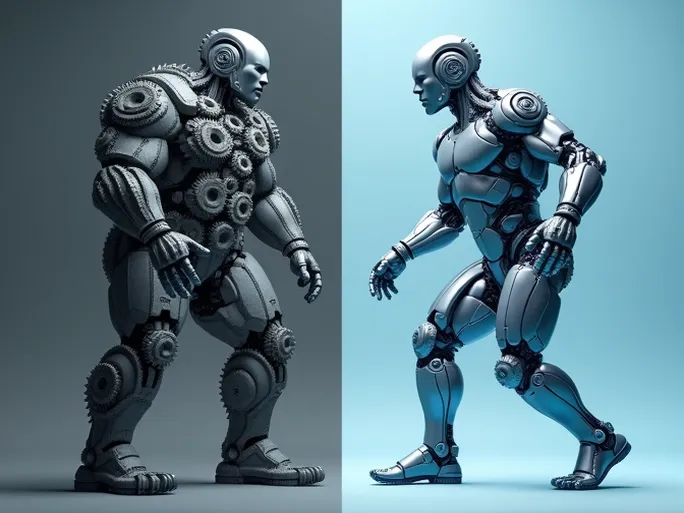

Imagine a muscular athlete with impressive strength, but whose massive physique makes them appear cumbersome, compromising speed and agility. This is where Under Armour finds itself today. After years of rapid expansion, the sports apparel giant now faces the challenge of "getting back in shape." To regain competitiveness, Under Armour has launched an ambitious "fitness plan" aimed at becoming "stronger, faster, and leaner."

I. Expansion Woes: Hidden Concerns Behind Growth

2017 proved to be a challenging year for Under Armour. A sluggish U.S. retail market combined with rapid global expansion led to multiple issues coming to a head.

- Failed ERP System Upgrade: Attempting to upgrade an ERP system while maintaining operations is akin to changing an engine in a moving car. Under Armour's botched upgrade severely disrupted supply chain operations.

- Stagnant Wholesale Growth: While wholesale channels traditionally accounted for significant revenue, changing consumer shopping habits slowed this business segment.

- Soaring SG&A Expenses: As revenue grew, so did selling, general and administrative expenses, which rose to consume 41.9% of total revenue by 2017.

Confronting these challenges, Chairman and CEO Kevin Plank acknowledged: "We must build a more operationally efficient company, but this will take time."

II. Three-Pronged Strategy: A Blueprint for Reinvention

Under Armour's recovery strategy focuses on three core pillars:

- Operate: Streamlining processes and optimizing supply chain management

- Fuel: Strengthening direct-to-consumer (DTC) channels

- Innovate: Delivering cutting-edge products that meet evolving consumer needs

III. Supply Chain Slimdown: Radical Internal Reforms

The supply chain transformation represents the most aggressive component of Under Armour's restructuring:

- Accelerating design-to-market cycles to improve responsiveness

- Comprehensive cost structure reevaluation of production, pricing and asset networks

- Aggressive SKU reduction targets: 25% by end of 2018, 30-40% by 2019

IV. The DTC Dilemma: Balancing Opportunity and Risk

While expanding direct-to-consumer channels promises higher margins and stronger brand connections, it requires significant investment that further pressures SG&A expenses. Under Armour remains committed to this strategic shift despite short-term financial impacts.

V. Financial Discipline: A Dual Approach

The company has allocated $129 million for restructuring in 2017 with an additional $110-130 million planned for 2018. These investments aim to yield annual savings exceeding $75 million through:

- Facility consolidations

- Contract terminations

- Inventory optimization

VI. Strategic Growing Pains: Short-Term Pain for Long-Term Gain

Under Armour anticipates temporary setbacks including slowed revenue growth and compressed margins during this transition period. Plank emphasized: "Optimizing operations requires time, but 2018 will be the pivotal year."

VII. Data-Driven Transformation: Technology as Catalyst

The restructuring heavily leverages data analytics and technology to:

- Refine product assortment through category segmentation

- Enhance supply chain visibility

- Improve inventory management

VIII. From "Big" to "Brilliant": Sharpening Competitive Focus

Under Armour is shifting from broad category coverage to concentrated excellence in core product lines, prioritizing:

- Best-selling product development

- Signature "hero" products that elevate brand perception

IX. Consumer-Centric Philosophy: The North Star

The transformation maintains consumer needs as the guiding principle, with initiatives including:

- Personalized product customization

- Enhanced omnichannel shopping experiences

Under Armour's comprehensive restructuring represents a complex operational overhaul. Successful execution could transform the company into a more agile, efficient competitor—much like an elite athlete refining their physique for peak performance. The sports apparel market will closely watch whether these reforms can restore Under Armour's competitive edge.