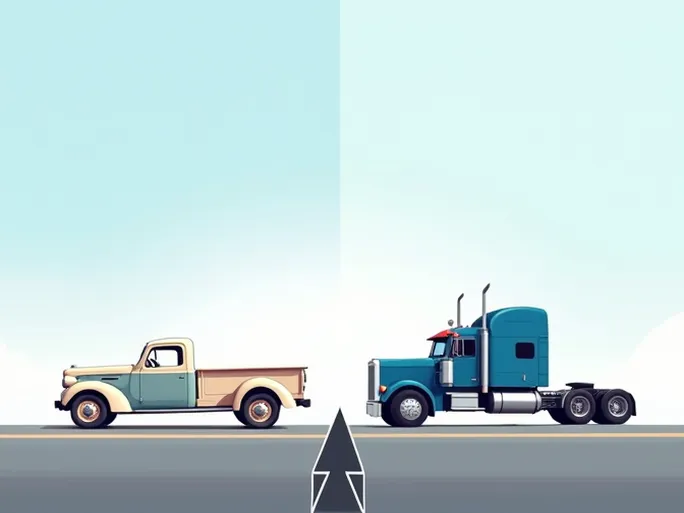

The trucking industry serves as the backbone of modern economies, facilitating the crucial movement of goods across supply chains. For decades, this sector has operated with a dual labor model, employing both company drivers and independent owner-operators. While the owner-operator model has long been valued for its flexibility and potential cost advantages, recent market shifts, regulatory pressures, and operational challenges have prompted major carriers to reevaluate their workforce strategies.

This analysis examines the case of Celadon Group, once among North America's largest trucking companies, which underwent a significant strategic pivot toward company drivers prior to its 2019 bankruptcy. The case offers valuable insights into the evolving dynamics of labor models in transportation logistics.

Part 1: The Context Behind Celadon's Strategic Shift

Celadon's financial struggles culminated in a quarterly loss exceeding $10 million immediately preceding its strategic realignment. Chief Operating Officer John Russell attributed these losses primarily to the escalating costs associated with recruiting and maintaining owner-operators and lease-purchase drivers. Operational inefficiencies became particularly apparent in equipment utilization metrics, with excessive empty miles, prolonged dwell times, and suboptimal asset deployment plaguing the fleet.

Key Challenges of the Owner-Operator Model

The company's experience highlighted systemic industry challenges:

- High Turnover: The trucking sector consistently faces elevated driver churn, particularly during strong economic periods when labor competition intensifies.

- Management Complexities: While theoretically reducing fixed costs, owner-operators introduce significant supervisory challenges due to their operational autonomy.

- Compliance Risks: Growing litigation around driver misclassification has created substantial legal exposure for carriers utilizing independent contractors.

Part 2: Evaluating Labor Model Tradeoffs

Advantages of Owner-Operator Arrangements

- Enhanced operational flexibility to scale capacity with market demand

- Potential cost efficiencies through shifted maintenance and fuel expenses

- Greater driver investment in equipment care and performance

- Rapid scalability through contractor networks

Limitations of Independent Contractor Models

- Reduced control over equipment utilization and routing

- Inconsistent service quality affecting customer satisfaction

- Heightened legal and regulatory compliance burdens

- Increased recruitment costs due to contractor mobility

Part 3: The Case for Company Drivers

Celadon's transition toward employee drivers reflected several potential benefits:

- Improved asset utilization through centralized dispatch control

- Enhanced service consistency and customer experience

- Reduced legal exposure from classification disputes

- Stronger driver retention through benefits and career stability

Part 4: Industry-Wide Implications

Celadon's strategic shift signals broader industry trends that may reshape competitive dynamics:

- Intensified competition for qualified employee drivers

- Potential consolidation pressures on smaller carriers

- Upward pressure on driver compensation and benefits

- Increased regulatory scrutiny of labor classifications

Part 5: Future Outlook for Trucking

Several emerging factors will influence the industry's trajectory:

Technological Disruption

Advancements in autonomous systems, IoT-enabled fleet management, and data analytics promise to transform operational efficiency and safety standards.

Market Evolution

E-commerce growth and globalized supply chains continue to reshape freight demand patterns, while customers increasingly prioritize reliable, transparent service.

Regulatory Developments

Anticipated policy changes may address driver working conditions, emissions standards, and labor classification guidelines.

Conclusion

Celadon's experience underscores the complex tradeoffs carriers face in balancing workforce strategies. As the industry evolves, successful operators will need to carefully assess their operational models, invest in technology adoption, and navigate an increasingly complex regulatory environment. The path forward will require innovative approaches to driver recruitment and retention, regardless of labor model selection.