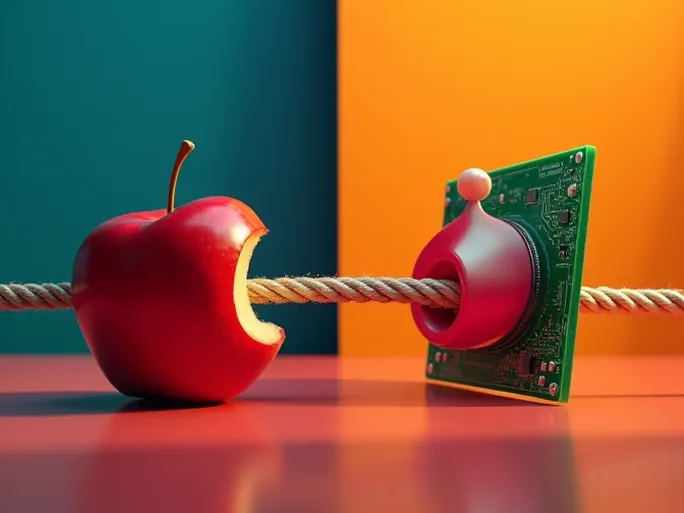

A high-stakes battle over patent licensing fees between tech giants is sweeping through the global technology supply chain with unprecedented intensity. The longstanding intellectual property dispute between Apple and Qualcomm has now evolved into a full-scale war at the supply chain level, with profound implications for innovation models and industry profit distribution.

Core Development: Qualcomm Sues Apple Suppliers

Qualcomm, the mobile communications technology leader, has filed lawsuits against four of Apple's key suppliers—Foxconn (Hon Hai Precision), Quanta Computer, Pegatron, and Wistron—accusing them of refusing to pay patent licensing fees related to Apple products. This legal action marks a significant escalation in the protracted conflict between the two tech giants and demonstrates how Apple's entire supply chain has been drawn into the dispute.

The Heart of the Conflict: A Battle Over "Fair Pricing"

At the core of this years-long dispute lies Qualcomm's patent licensing fees. Apple has consistently argued that Qualcomm's rates are excessive and has employed various strategies to reduce costs. The iPhone maker contends that Qualcomm's licensing model amounts to monopolistic practices that unfairly impact Apple's profitability. Qualcomm maintains that its patented technologies form the foundation of modern cellular communications and deserve appropriate compensation.

Qualcomm's Patent Empire: Cornerstone of Mobile Technology

With decades of innovation in cellular technology, Qualcomm has established a dominant position in the field. The company asserts that nearly all modern smartphones utilize its patents, from 2G to 5G technologies. These patents cover fundamental aspects of mobile communications, including chip design, wireless protocols, and signal processing. While patent licensing fees are common in manufacturing, Apple argues Qualcomm's rates may be disproportionately high—a claim Qualcomm strongly disputes.

Apple's Supply Chain Strategy: Suppliers as "Agents"?

Court documents reveal that Apple allegedly instructed its suppliers to stop paying Qualcomm's licensing fees. While these manufacturers continue paying for non-Apple products, they've reportedly suspended payments for Apple devices at the company's direction, with Apple promising to cover any resulting liabilities. This strategy effectively turns suppliers into negotiation proxies in Apple's effort to pressure Qualcomm for lower rates.

Supplier Dilemma: A High-Stakes Gamble

For Apple's suppliers, this situation presents both opportunity and risk. While they stand to benefit from reduced patent costs if Apple prevails, they face potential legal repercussions should Qualcomm win its case. Though Apple has pledged financial protection, suppliers risk damaging their relationships with Qualcomm—a consideration that could impact future business opportunities.

Qualcomm's Challenges: Financial Pressure Mounts

The suspension of payments from Apple's supply chain threatens Qualcomm's cash flow, as patent licensing constitutes a significant revenue stream. Qualcomm alleges Apple seeks to inflict "severe, immediate, and irreparable harm" to force below-market licensing terms. Beyond immediate financial concerns, Qualcomm faces long-term strategic challenges should Apple succeed in establishing lower industry-wide licensing benchmarks.

Apple's Direct Licensing Push: A Play for Greater Control

Apple appears to be pursuing direct licensing agreements rather than reimbursing suppliers—a move that suggests broader ambitions to strengthen supply chain control and pricing leverage. This approach could enable more favorable terms while reinforcing Apple's position as the dominant force in its manufacturing ecosystem.

Broader Implications: Industry Reshaping Ahead

This conflict extends beyond corporate rivalry, representing a fundamental debate about innovation models and intellectual property valuation. The outcome could reshape smartphone industry dynamics, potentially influencing how technology patents are licensed across the sector. Experts suggest the dispute may prompt reevaluation of current licensing frameworks to better balance innovation incentives with manufacturing costs.

Strategic Undercurrents

Analysts observe that Apple's aggressive stance coincides with increased investment in proprietary modem technology—a long-term play for technological independence. Meanwhile, Qualcomm must defend its patent portfolio while navigating growing competition in the 5G era. The legal battle's resolution could accelerate industry consolidation and prompt regulatory scrutiny of patent licensing practices.

Consumer Impact

While the immediate effects on consumers remain limited, prolonged conflict could eventually influence product pricing and innovation cycles. The industry faces pressure to develop sustainable licensing models that preserve both technological progress and market competition.