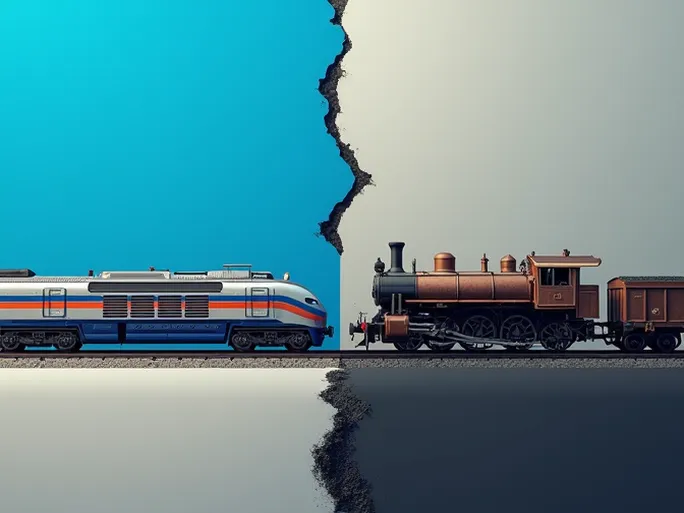

As the global economy pulses with uneven rhythms across industries, U.S. rail freight presents a complex and nuanced picture. The latest report from the Association of American Railroads (AAR) reveals a clear divergence between rail carloads and intermodal traffic during the week ending May 9, offering unique insights into structural changes within the American economy.

Rail Carloads: Mixed Performance Amid Overall Decline

Total U.S. rail carloads fell 7.9% year-over-year to 273,433 units, marking a decline from previous weeks and potentially signaling broader economic challenges. However, the detailed data reveals important sectoral variations—four of the ten major commodity categories tracked by AAR showed year-over-year growth.

Automotive shipments rose 8.9% to 18,997 carloads, suggesting recovery in vehicle manufacturing and stronger consumer demand. Petroleum products also increased by 6.1% to 15,464 carloads, likely influenced by energy price fluctuations and refinery activity.

The most significant decline came from coal shipments, which dropped 16.1% to 93,691 carloads. This continuing slump reflects both the ongoing energy transition and growing preference for cleaner energy sources—a structural shift presenting both challenges and opportunities for rail operators.

Intermodal Traffic: The Resilient Performer

In contrast to declining carloads, intermodal volume grew 3.8% to 277,601 containers and trailers. While slightly below recent weekly levels, this growth underscores intermodal's expanding role in modern logistics, driven by demand for flexible, efficient transportation solutions and ongoing port congestion.

Intermodal's strength lies in combining rail, truck, and ocean transport for door-to-door service—a model particularly suited to e-commerce fulfillment. As online retail continues expanding, intermodal appears positioned for sustained growth.

Year-to-Date Data Confirms Structural Shift

Cumulative figures through May 9 show rail carloads down 1.8% (5,043,559 units) while intermodal rose 1.7% (4,679,513 units), reinforcing the divergence between traditional rail freight and multimodal solutions. These trends suggest railroads must adapt to energy transitions while expanding intermodal operations to remain competitive.

Strategic Adaptation for Rail Operators

Rail companies face dual imperatives: optimizing traditional operations through efficiency gains while developing new capabilities. Strategic priorities include increased intermodal investment, customized logistics solutions, and deeper collaboration with ports and trucking firms to build integrated networks.

Such partnerships could create seamless multimodal services that better meet evolving customer needs—particularly important as supply chains grow more complex and demand patterns shift.

Balancing Challenges and Opportunities

The U.S. rail sector stands at an inflection point, with declining traditional freight and growing intermodal demand reflecting broader economic transformation. Success will require innovation and adaptation—from operational improvements to strategic investments in emerging logistics models.

For industry observers, these trends offer valuable indicators of economic health across multiple sectors. The data provides a nuanced view that resists simple characterization, revealing both vulnerabilities and growth potential within the transportation ecosystem.