Market Overview: Diverging Trends

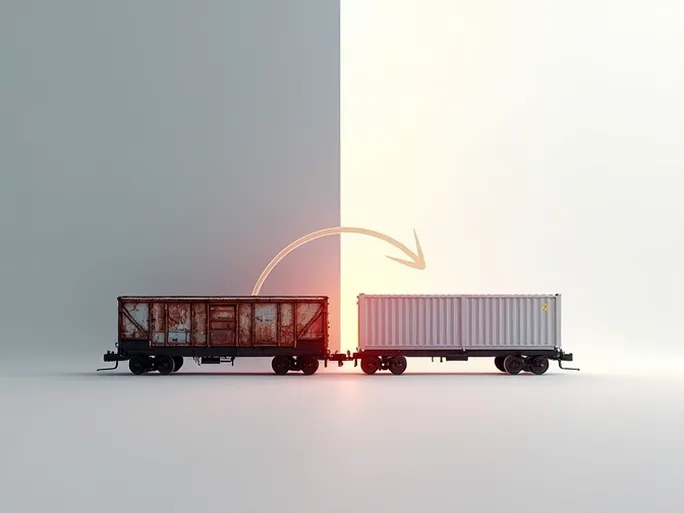

Recent data from the Association of American Railroads (AAR) reveals a striking divergence in the US rail freight market during the week ending April 4. While carload traffic declined, intermodal shipments showed robust growth, presenting both challenges and opportunities for industry stakeholders.

Carload Traffic: Short-Term Pressure, Long-Term Potential

Total US carload traffic reached 277,894 units during the reporting week, marking a 1.5% year-over-year decline. This continues a downward trend observed in previous weeks, indicating persistent short-term challenges.

Sector-Specific Variations

- Growth sectors: Grain shipments increased by 5.7%, while forest products rose 2.3%, demonstrating resilience in specific commodity segments.

- Declining sectors: Coal shipments plummeted 11.7%, significantly impacting overall performance. This reflects broader energy transition trends, environmental policies, and shifting coal market dynamics.

Industry analysts suggest the carload decline shouldn't be viewed as catastrophic. Strategic adjustments focusing on high-potential sectors like grain exports and lumber transportation, coupled with operational optimizations, could help railroads regain momentum.

Intermodal: The Rising Star

Intermodal traffic reached 271,127 containers and trailers, representing a 3.8% year-over-year increase. This consistent growth highlights intermodal's growing importance in the transportation ecosystem.

Key Growth Drivers

The sector benefits from its cost-efficiency, operational flexibility, and ability to integrate multiple transport modes. The e-commerce boom has particularly amplified demand for seamless door-to-door solutions that intermodal provides.

Strategic Implications

Rail operators are increasingly prioritizing intermodal investments, focusing on infrastructure upgrades, process optimization, and enhanced partnerships with ports, shipping lines, and logistics providers to build comprehensive intermodal networks.

Market Insights: Balancing Risks and Opportunities

Cumulative data for the first 13 weeks of the year shows carload traffic down 0.2%, while intermodal grew 0.4%, confirming the bifurcated market trend.

The industry faces multiple challenges including economic headwinds, energy transitions, and competitive pressures. However, emerging markets, e-commerce expansion, and sustainability initiatives present significant growth potential.

Strategic Priorities for Rail Operators

- Focus on intermodal: Position it as the primary growth driver through targeted investments and network enhancements.

- Market segmentation: Develop tailored solutions for specific commodity and customer segments.

- Technology adoption: Leverage big data, IoT, and AI to improve operational efficiency and service quality.

- Collaborative approach: Strengthen partnerships across the transportation value chain.

Conclusion

The US rail freight market is undergoing significant transformation. While traditional carload traffic faces pressure, intermodal emerges as the new growth engine. Strategic adaptation and targeted investments will be crucial for rail operators to navigate this evolving landscape successfully.