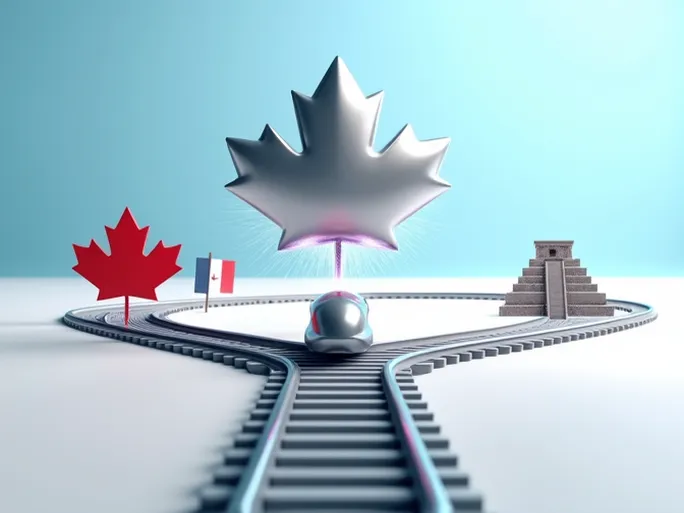

If railroads are the arteries of a nation’s economy, then Kansas City Southern (KCS) serves as a critical junction connecting the economic powerhouses of the United States, Mexico, and Canada. The fierce competition over this rail company is not merely a corporate duel between two Canadian giants—Canadian Pacific (CP) and Canadian National (CN)—but a harbinger of transformative changes in North America’s transportation network. Recent developments suggest the scales are tipping in favor of Canadian Pacific.

The Strategic Stakes: A Gateway for North American Trade

Kansas City Southern may not be the largest railroad operator in North America, but its unique geographic footprint makes it indispensable. Its network links the U.S. Midwest to the Gulf Coast and serves as a vital corridor for cross-border trade with Mexico. The implementation of the United States-Mexico-Canada Agreement (USMCA) has further amplified KCS’s strategic value. Controlling this railroad means commanding a logistics lifeline for North American free trade, with the potential to significantly boost regional commerce and economic growth.

The Bidding War: A Rollercoaster of Corporate Maneuvers

The acquisition saga began in 2020 when Canadian Pacific made the first move, proposing a $29 billion merger to create a seamless rail network spanning Canada, the U.S., and Mexico. The vision promised enhanced efficiency, lower costs, and accelerated trade. However, Canadian National disrupted the process in April 2021 with a $33.6 billion counteroffer—a 21% premium—setting off a protracted battle.

- Canadian Pacific’s Initial Bid: The 2020 proposal aimed to establish North America’s first tri-nation rail system.

- Canadian National’s Intervention: Its higher offer projected $1 billion in annual EBITDA synergies, largely from diverting freight from roads to rails.

- Regulatory Roadblock: The U.S. Surface Transportation Board (STB) rejected Canadian National’s voting trust mechanism in August 2021, citing risks to competition and KCS’s operational independence.

- Canadian Pacific’s Resurgence: With its STB-approved voting trust, CP regained momentum, presenting a revised $31 billion offer (a mix of stock and cash) on September 12, 2021.

- KCS’s Pivot: The railroad’s board declared CP’s offer superior, triggering a five-day window for Canadian National to respond. Failure would entitle CN to a $1.4 billion breakup fee.

Why Canadian Pacific Holds the Edge

Three factors explain CP’s advantage:

- Regulatory Clarity: The STB’s pre-approval of CP’s voting trust eliminates a major hurdle, unlike CN’s stalled proposal.

- Strategic Fit: CP’s western Canadian routes and KCS’s U.S.-Mexico network complement each other, creating a cohesive continental system.

- Financial Prudence: CP’s stock-heavy offer reduces cash burdens, ensuring post-merger stability.

Canadian National’s Challenges

CN’s bid faltered due to:

- Regulatory Pushback: The STB’s rejection underscored concerns about market concentration and service quality.

- Network Overlap: Limited synergy potential with KCS’s Midwestern lines, unlike CP’s natural extension into Mexico.

- Financial Strain: The higher bid risked overleveraging CN’s balance sheet.

Implications: Reshaping North America’s Rail Industry

The merger’s outcome will redefine the sector:

- Market Consolidation: A CP-KCS entity would dominate, potentially reducing competition but improving economies of scale.

- Service Enhancements: Integrated networks could streamline operations, cut costs, and upgrade infrastructure.

- Trade Acceleration: A unified rail system would facilitate cross-border commerce under USMCA.

What Lies Ahead

While KCS leans toward CP, the deal awaits shareholder and regulatory approvals. The STB will scrutinize its competitive impact, and successful integration—blending corporate cultures, technologies, and operations—will be pivotal. Regardless of the winner, this battle marks a watershed moment for North American rail transport.