Introduction: The Convergence of Energy Transition and Logistics Transformation

The resurgence of "Made in America" reflects not just policy initiatives and technological advancements, but also the silent revolution of shale gas development. As an abundant and relatively low-cost energy source, shale gas is fundamentally altering America's energy landscape while creating profound impacts on freight transportation and logistics industries. This analysis examines shale gas's transformative effects through data analytics, trend analysis, and predictive modeling.

Part I: The Rise of Shale Gas in America's Energy Portfolio

1.1 Shale Gas: Definition, Extraction Technology and Reserve Estimates

Shale gas refers to natural gas trapped within shale formations, extracted primarily through hydraulic fracturing (fracking) technology. The U.S. possesses substantial shale gas reserves, with the Energy Information Administration (EIA) reporting 497 trillion cubic feet of proven reserves as of 2022, distributed across major basins including Marcellus, Utica, Bakken, Eagle Ford, and Haynesville.

1.2 Shale Gas's Position in U.S. Energy Structure

The shale boom transformed America from a net natural gas importer to a global exporter. EIA data demonstrates this shift occurred post-2010 as domestic production outpaced consumption.

1.3 Shale Gas's Impact on Energy Prices

Massive shale gas production depressed natural gas prices, subsequently lowering electricity generation costs. EIA data reveals the strong correlation between natural gas and electricity price movements.

Part II: Shale Gas's Impact on U.S. Freight Transportation and Logistics

2.1 Shale Gas and Manufacturing Reshoring

Cheap energy created favorable conditions for manufacturing reshoring. Bureau of Economic Analysis data indicates measurable recovery in manufacturing output and employment post-shale revolution.

2.2 Effects on Freight Demand

Manufacturing revival increased domestic freight needs. Bureau of Transportation Statistics data shows rising freight volumes and revenues corresponding with shale development.

2.3 Railroad Transportation Impacts

Railroads directly benefited from transporting fracking sand, pipes, and extracted hydrocarbons. Association of American Railroads data shows growing energy-related freight share.

2.4 Road Transportation Effects

Liquefied natural gas (LNG) trucks emerged as cost-effective alternatives to diesel vehicles. Department of Energy data confirms LNG's growing adoption and fuel cost advantages.

2.5 Waterway Transportation Changes

Barges transport materials to shale regions while LNG carriers facilitate exports. U.S. Army Corps of Engineers and EIA data demonstrate increased energy-related waterborne freight.

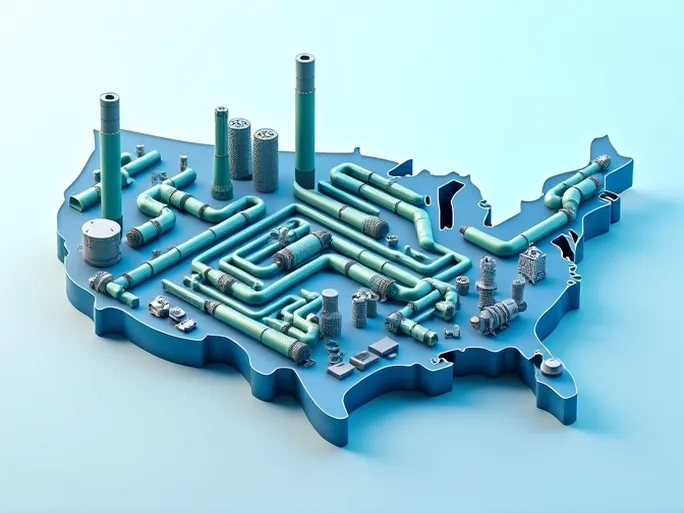

2.6 Pipeline Transportation's Role

Pipelines remain the most efficient long-term transport solution. Department of Transportation data shows continuous expansion of pipeline infrastructure.

Part III: Shale Gas's Influence on U.S. Manufacturing Landscape

3.1 Chemical Industry Transformation

Energy-intensive chemical production expanded with cheaper feedstock. American Chemistry Council data shows rising output and exports.

3.2 Steel Industry Effects

American Iron and Steel Institute data indicates production growth alongside energy cost advantages and increased pipe demand.

3.3 Broader Manufacturing Impacts

Shale development stimulated equipment manufacturing sectors. BEA data reveals growth in related industrial production.

Part IV: Challenges and Opportunities in the Shale Revolution

4.1 Environmental Considerations

EPA monitoring data tracks water and air quality impacts from extraction activities.

4.2 Infrastructure Development Needs

DOT data highlights gaps in pipeline networks and LNG refueling stations.

4.3 Policy and Regulatory Landscape

| Policy Name | Implementation Year | Key Provisions |

| [Sample Policy] | 2015 | [Brief description] |

4.4 Economic Opportunities

BEA metrics demonstrate shale gas's macroeconomic benefits through GDP growth and employment.

Part V: The Future of Shale Gas Transportation

5.1 Evolving Transport Mode Dynamics

Predictive modeling suggests pipeline dominance with continued rail and road roles for specific applications.

5.2 Technological Innovations

| Technology | Features | Potential Impact |

| [Example Tech] | [Description] | [Expected benefit] |

5.3 Sustainable Development Strategies

| Strategy | Implementation | Outcomes |

| [Sample Approach] | [Methods] | [Results] |

Conclusion: Data-Informed Strategic Decisions

The shale revolution continues reconfiguring America's freight landscape. Logistics enterprises must adapt through:

- Supply chain optimization leveraging domestic energy advantages

- Strategic investments in LNG fleets

- Rail transport partnerships

- Pipeline infrastructure monitoring

- Technology adoption for efficiency

- Environmental stewardship integration

Data analytics enables enterprises to navigate this transformation effectively, identifying opportunities while mitigating risks in this dynamic sector.