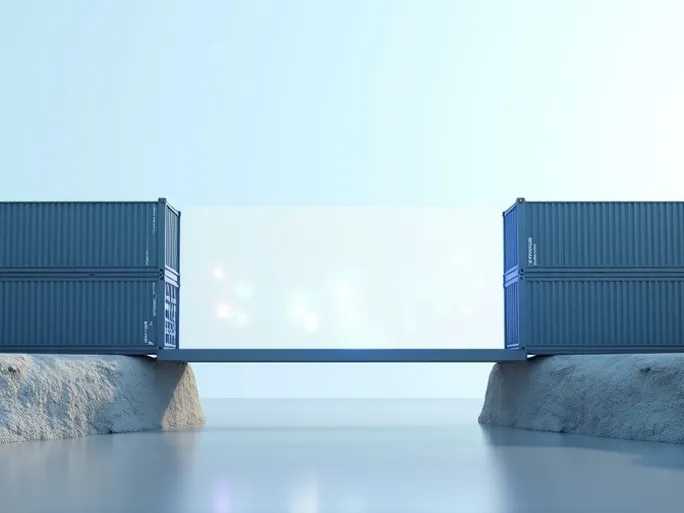

In the complex chessboard of international commerce, there exists a strategic maneuver that deftly conceals the true supplier while allowing intermediaries to construct an informational barrier between buyers and sellers. This practice, known as bill switching, operates with remarkable finesse in global trade. It functions as an invisible bridge connecting suppliers with end buyers while simultaneously keeping them apart, granting intermediaries greater operational flexibility and profit margins.

I. Bill Switching: A Specialized Component of International Trade

Originating in the shipping industry, bill switching has evolved into a common operational model in global commerce. At its core, this process involves intermediaries facilitating the transfer of cargo control rights during transportation, ultimately replacing original bills of lading with new ones. This practice serves distinct needs for different trade participants: suppliers gain flexibility in shipment arrangements, while buyers obtain clean bills that prevent direct contact with original suppliers, thereby protecting commercial interests.

II. The Core Mechanism: Triangular Trade and Dual Documentation

The essence of bill switching lies in its three-party trade structure and dual documentation system:

- Triangular Trade: A typical bill switching transaction involves suppliers, intermediaries, and actual purchasers. Suppliers sell goods to intermediaries who then resell to final buyers. The intermediary serves as both buyer and seller, functioning as the crucial nexus in the transaction.

- Dual Documentation: The process generates two critical bills of lading. The first lists the supplier as shipper and the intermediary as consignee. Upon receiving the goods, the intermediary holds this document before requesting the shipping company to void it and issue a second bill. This new document shows the intermediary as shipper and the actual buyer as consignee, effectively masking the original supplier's identity while establishing the intermediary's control over information flow.

III. Essential Conditions for Successful Bill Switching

Successful execution requires fulfillment of several key conditions:

- Control Transfer: The intermediary must obtain complete cargo control by legally holding the first bill of lading—the fundamental prerequisite for initiating the switching process.

- Shipping Company Cooperation: The carrier must accept the switching request, cancel the original bill, and issue its replacement. Carrier compliance is indispensable to the operation's success.

- Precise Timing: The switch must conclude before vessel arrival at the destination port. Delayed processing risks cargo detention and subsequent complications for the ultimate buyer.

IV. Risks and Operational Considerations

While offering flexibility in international transactions, bill switching carries inherent risks. Untimely execution or uncooperative carriers may lead to port detention and additional costs. Intermediary credibility issues could also precipitate disputes. Participants should therefore engage reputable intermediaries and carriers while meticulously reviewing contractual terms to mitigate potential complications.

V. Strategic Value in Global Commerce

Bill switching holds significant value in international trade, enabling intermediaries to maximize profits while facilitating smoother transactions. By controlling information flow, intermediaries protect commercial interests while offering flexible solutions to both buyers and suppliers. In certain contexts, the practice may also help circumvent trade barriers and expand market access.

Ultimately, bill switching represents a specialized trade mechanism where intermediaries facilitate documentation replacement to obscure supplier identities and safeguard business interests. Understanding its operational framework, critical requirements, and potential risks proves essential for all international trade participants.