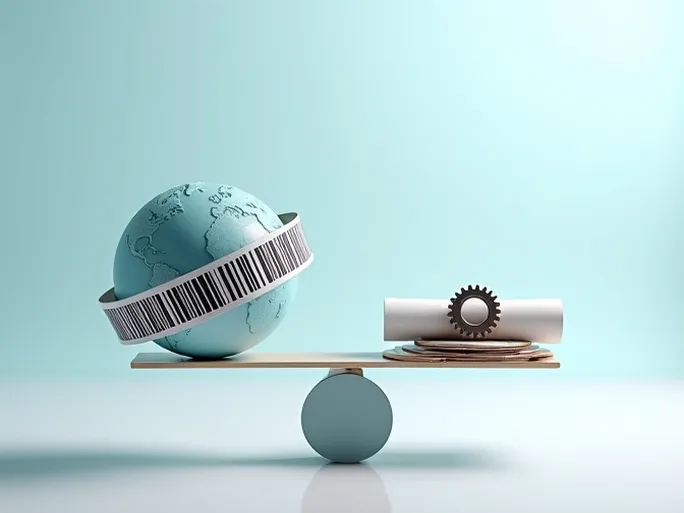

If product codes serve as passports for international trade, then precise HS code classification becomes the key to mitigating trade risks and optimizing supply chain costs. This article examines classification challenges under HS code 21069022 and explores its tariff implications along with strategic supply chain optimization approaches.

HS code 21069022 falls under the broader category of "Food industry residues and waste; prepared animal feed" in the Harmonized System, specifically classified as "Other food preparations." According to General Rule 15 of the tariff schedule, accurate classification requires thorough examination of product composition, intended use, and manufacturing processes. For instance, food preparations containing specific proportions of sugar or milk powder may require consideration of alternative, more specific HS codes.

Risks of Misclassification

Incorrect HS code classification can trigger multiple operational and financial consequences:

- Inaccurate tariff payments

- Customs inspection delays

- Heightened compliance risks

- Potential penalties and legal repercussions

To mitigate these risks, businesses must establish robust HS code classification systems with regular review protocols. Advanced tariff simulation tools can provide real-time analysis of duty impacts across different classification scenarios.

Supply Chain Optimization Strategies

Companies can implement several strategic approaches to enhance trade efficiency:

Precision Classification and Compliance Audits: Implement rigorous HS code verification processes with periodic compliance reviews to preempt trade disputes.

Tariff Impact Analysis: Leverage digital tools to simulate duty costs across alternative classifications, enabling data-driven trade decisions.

Supply Chain Process Enhancement: Streamline customs clearance procedures to accelerate border crossings and reduce logistical expenditures.

Expert Consultation: Engage specialized trade consultants to maintain current knowledge of evolving classification standards and regulatory changes.

Accurate HS code classification forms the foundation of competitive international trade participation. Through systematic code management and supply chain refinement, enterprises can significantly reduce trade expenses while strengthening market position and operational sustainability.