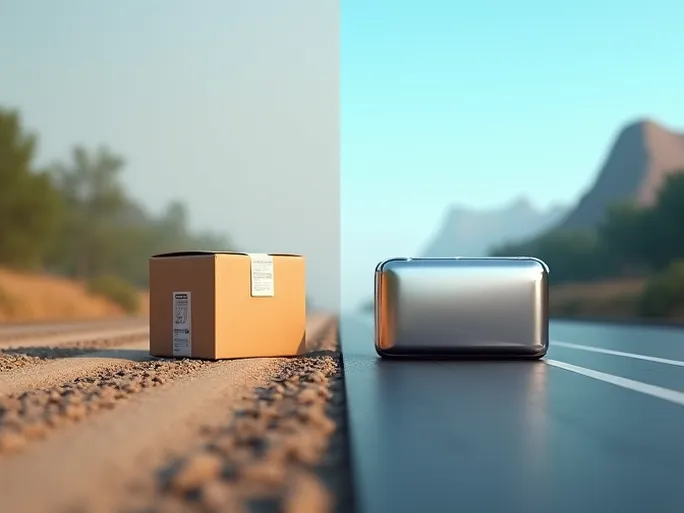

Shipping products internationally as a cross-border e-commerce seller is akin to sailing through fog—the choice of logistics route is crucial. Should you opt for cost-effective but slower postal services, or fast yet expensive commercial couriers? This decision goes beyond a simple binary choice, requiring careful balancing of cost control, delivery speed, and customer experience. This analysis examines the strategic applications of postal logistics versus commercial couriers for self-fulfilled cross-border e-commerce orders.

I. Fundamental Differences: Understanding Postal and Courier Services

In the logistics landscape of cross-border e-commerce, postal services and commercial couriers serve distinct roles with unique advantages and limitations.

Postal Logistics: The Economical Choice for Broad Coverage

Postal networks, operating through the Universal Postal Union's extensive system, function like global capillaries reaching most countries and regions—including remote areas. Their core advantages include affordability, wide coverage, and low barriers to entry.

- Cost Efficiency: Postal services typically charge by weight, offering significant savings for lightweight packages under 1kg. Most don't impose remote area surcharges.

- Global Reach: Postal networks access many locations commercial carriers can't serve effectively.

- Simplified Requirements: Postal services maintain relatively lenient restrictions on goods and streamlined declaration processes.

However, postal services present notable drawbacks:

- Extended Transit Times: International small packets typically take 15-45 days, with specialized services like ePacket reducing this to 7-15 days.

- Inconsistent Reliability: Delivery times fluctuate significantly due to weather, customs, and seasonal factors.

- Limited Service Guarantees: Tracking information tends to be basic, customer support responses slower, and claims processes for lost/damaged items often cumbersome.

Commercial Couriers: Premium Service for Speed and Reliability

Global couriers like DHL, FedEx, UPS, and TNT leverage proprietary networks to deliver rapid, consistent, and secure shipping. Their strengths include speed, reliability, and comprehensive service guarantees.

- Expedited Delivery: Most provide door-to-door service within 3-7 days, extending to 5-10 days for remote locations.

- Consistent Performance: Delivery timelines show minimal variation.

- Enhanced Protection: Features include full tracking visibility, responsive customer service, efficient claims processing, and value protection for high-worth items.

Commercial couriers aren't without limitations:

- Higher Costs: Charges apply to either actual or volumetric weight (whichever is greater), with numerous surcharges (fuel, remote area, etc.).

- Coverage Gaps: Service excels in major commercial centers but may be limited or prohibitively expensive for some less-developed regions.

Comparative Analysis: Key Dimensions

| Dimension | Postal Logistics | Commercial Couriers |

|---|---|---|

| Transit Time | 15-45 days (standard), 7-15 days (express services) | 3-7 days, 5-10 days for remote areas |

| Reliability | Variable, significant fluctuations | Consistent, minor variations |

| Cost Structure | Low, weight-based pricing, no remote surcharges | High, actual/volumetric weight pricing, multiple surcharges |

| Service Features | Basic tracking, slower support, complex claims | Full tracking, responsive support, efficient claims, value protection |

| Coverage | 200+ countries and territories | Strong in commercial hubs, limited in some regions |

II. Order-Based Selection: Matching Logistics to Shipment Characteristics

Choosing between postal and courier services requires careful analysis of order attributes across two primary dimensions.

1. Shipment Volume and Weight Considerations

Lightweight Orders (≤2kg, ≤0.01m³):

- Primary Option: Postal services. Products like electronics accessories, beauty tools, or stationery benefit from minimal shipping costs through international small packets or ePacket services.

- Alternative: For shipments exceeding 2kg but under 20kg with flexible delivery timelines, postal express services (e.g., EMS) balance cost and speed. Time-sensitive shipments require commercial couriers.

Medium-Heavy Orders (20-50kg):

- Major Markets: Commercial couriers often prove more economical for clustered shipments to regions like North America or Europe when considering both cost-per-unit and delivery speed.

- Emerging Markets: For dispersed shipments to multiple developing countries, postal bulk services avoid expensive remote area fees from couriers.

Bulk Shipments (≥50kg):

- Concentrated Markets: Negotiated bulk discounts with couriers can optimize cost and speed for single-destination shipments.

- Dispersed Markets: Postal services simplify multi-country shipments without requiring channel segmentation.

2. Destination Market Factors

Developed Markets (North America, Western Europe, East Asia):

- Premium Products: Commercial couriers better serve high-value customers (e.g., Amazon premium buyers, boutique store clients) with faster delivery and superior tracking, potentially reducing returns by 20-30%.

- Value Products: Price-sensitive buyers (e.g., AliExpress customers) tolerate slower postal delivery for lower-cost goods.

Emerging Markets (Southeast Asia, Middle East, Africa, Latin America):

- Primary Option: Postal networks. Couriers often lack coverage or impose steep surcharges in these regions, while postal systems leverage local infrastructure for better clearance and delivery.

Regulated Markets (EU, U.S.):

- Time-Sensitive Compliance: Commercial couriers streamline processes for regulated goods (e.g., EU VAT, FDA clearance) with standardized declarations and priority customs channels.

- Low-Value Exemptions: Postal services efficiently handle sub-threshold shipments (e.g., EU ≤€22, U.S. ≤$800) with minimal formalities.

III. Product-Centric Selection: Mitigating Shipping Risks

Product characteristics significantly influence logistics choices to prevent transit-related issues.

1. Value and Special Attributes

Low-Value Standard Goods (≤$50, e.g., apparel, household items):

- Primary Option: Postal services. Minimal profit margins justify cost savings over speed, and standard goods face lower security requirements.

High-Value Items (≥$100, e.g., electronics, luxury goods):

- Mandatory Option: Commercial couriers. Enhanced security, comprehensive tracking, and rapid claims processes protect valuable shipments while aligning with premium brand positioning.

Specialty Items (battery-powered, magnetic, liquids, powders):

- Regulated Expedited: Commercial courier specialty services (e.g., DHL Dangerous Goods) suit fully documented shipments requiring fast delivery.

- Cost-Conscious: Postal services accommodate many special items with simpler packaging requirements when documentation is incomplete.

Fragile Goods (glass, ceramics, precision components):

- Time-Sensitive: Commercial couriers minimize handling and enforce strict packaging, reducing breakage.

- Budget-Conscious: Postal specialty fragile services with reinforced packaging (bubble wrap, rigid boxes) offer damage protection at lower costs.

IV. Strategic Balance: Optimizing Cost and Customer Experience

Successful cross-border sellers strategically balance logistics expenses against customer satisfaction.

1. Cost-Driven Strategy: Prioritizing Postal Services

Businesses focusing on low-price-point items (≤$30), operating with narrow margins, or managing limited capital should emphasize postal logistics. For example, sellers of inexpensive apparel or small commodities can maintain 10-20% profit margins using international small packets while setting clear delivery expectations (15-30 days).

2. Experience-Driven Strategy: Investing in Commercial Couriers

Premium brands (≥$100 average order value), independent stores, or Amazon featured merchants benefit from couriers' speed and reliability. Case studies show 20-30% higher repeat purchase rates compared to postal shipping, particularly for time-sensitive orders like gifts or samples.

3. Hybrid Approach: Combining Both Solutions

Most sellers implement blended strategies:

- Postal Services: Handle low-value, lightweight, geographically dispersed orders.

- Commercial Couriers: Manage high-value, heavier, concentrated shipments.

Practical applications include offering customers shipping options (standard postal vs. expedited courier) or using postal networks for bulk pre-positioning before peak seasons while reserving couriers for urgent orders.

V. Critical Considerations: Avoiding Common Pitfalls

Key precautions for logistics selection:

- Destination Regulations: Research country-specific postal restrictions (e.g., Brazil's $50 duty threshold) and courier clearance requirements (EU VAT, FDA compliance).

- Hidden Costs: Avoid ultra-low-cost postal channels with unreliable delivery (60+ days) and scrutinize courier surcharges (fuel, dimensional weight, remote fees).

- Product Suitability: Verify prohibited items lists for both postal and courier services, preparing necessary documentation (MSDS, UN38.3) for regulated goods.

- Tracking and Support: Prioritize postal services with full tracking (ePacket, EMS) or reputable couriers, clarifying claims processes for lost/damaged shipments.

Cross-border e-commerce logistics presents no universal solution—only the optimal approach for each business's unique requirements. This analysis equips sellers to navigate the postal-courier decision with greater clarity, strategically balancing cost, speed, and customer satisfaction for sustained international growth.