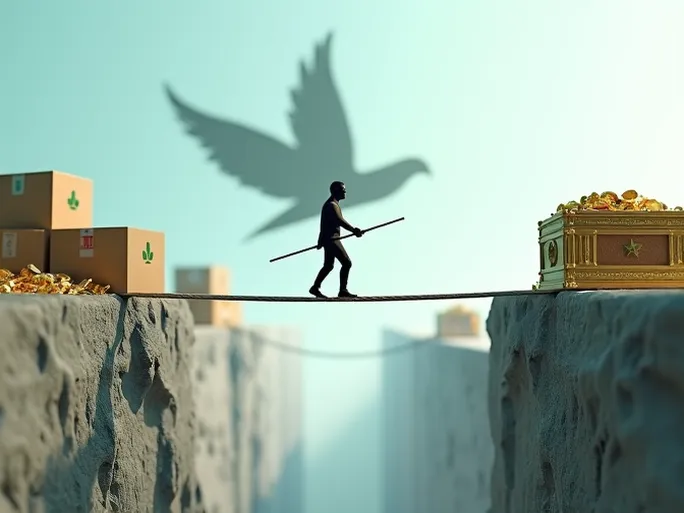

Many cross-border e-commerce sellers face a puzzling dilemma: despite offering identical products and maintaining consistent operations, their profit margins inexplicably shrink. Often, this phenomenon can be attributed to tariffs—the "invisible hand" that quietly reshapes commerce across borders.

Tariffs, the taxes imposed by importing countries on foreign goods, directly impact sellers' logistics costs, final retail prices, and ultimately, profitability. In an era of rising trade protectionism, these tariff barriers have become increasingly volatile and difficult to predict.

The World Bank's 2023 Global Trade Monitoring Report reveals that the global average most-favored-nation tariff stands at 9.7%. However, for popular cross-border categories like consumer electronics (HS 85) and apparel (HS 61), tariff policies in major markets such as the United States and European Union demonstrate significantly greater complexity.

This regulatory landscape demands constant vigilance from sellers. Maintaining profitability in competitive markets requires continuous monitoring of tariff policy adjustments, followed by strategic adaptations to pricing models and supply chain configurations. The ability to precisely respond to tariff fluctuations has emerged as a critical determinant of success in cross-border e-commerce.

Industry observers note that sellers seeking to mitigate tariff-related risks should prioritize understanding destination markets' customs regulations. Specialized e-commerce service providers can offer valuable assistance in tracking real-time policy changes, though the ultimate responsibility for compliance rests with individual businesses.