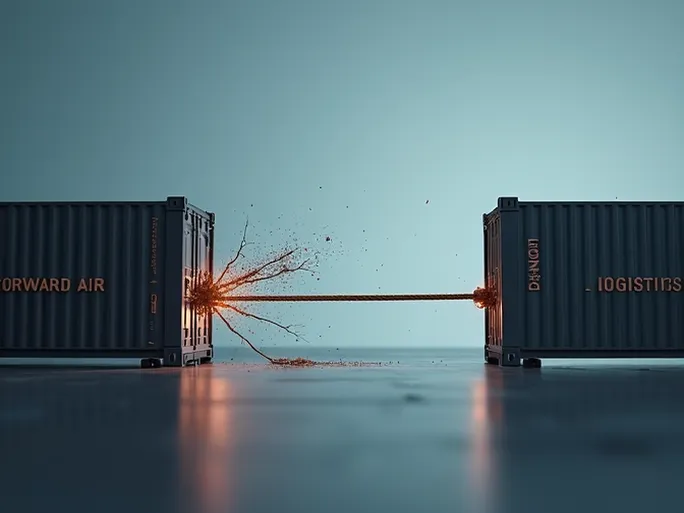

When a highly anticipated corporate marriage approaches collapse, the aftermath is rarely amicable. The proposed merger between Forward Air and Omni Logistics has transformed from what appeared to be a strategic alliance into a contentious legal battle, leaving industry observers questioning how these former "perfect partners" became adversaries.

The Escalating Dispute

Forward Air, a Tennessee-based asset-light freight and logistics provider, recently escalated its legal confrontation with Dallas-based Omni Logistics by filing a confidential counterclaim in Delaware's Court of Chancery. The legal action targets the merger agreement both parties signed on August 10.

This corporate drama began on October 31 when Omni initiated legal proceedings, alleging Forward Air violated its obligations under the merger agreement by refusing to complete the transaction. Omni sought court intervention to enforce the agreement. Forward Air responded on November 10 with both a legal rebuttal and its own counterclaim seeking declaratory relief, promising to disclose a non-confidential version by November 17.

In its statement, Forward Air accused Omni of failing to meet obligations under Sections 7.03 and 7.14 of the merger agreement. The company asserted that Omni's "continued delays and repeated misrepresentations" demonstrated bad faith, making it impossible to satisfy closing conditions outlined in Section 8.02(b). Forward Air now seeks judicial confirmation that it may rightfully terminate the agreement.

From Promise to Peril

The merger's collapse became apparent on October 26 when Forward Air signaled potential abandonment of the deal, prompting Omni's legal action five days later. Omni maintains it has fully complied with all agreement terms, calling Forward Air's claims "baseless" and vowing to enforce the contract.

When announced in August, the merger promised significant benefits:

- Creating a scaled industry leader: Forming a premier less-than-truckload (LTL) carrier specializing in complex, high-service freight solutions

- Expanding commercial capabilities: Combining Omni's commercial network (7,000+ customers) with Forward Air's operational expertise

- Enhancing customer experience: Offering faster transit times, superior on-time performance, and reduced claims

Forward Air CEO Tom Schmitt previously praised Omni's "best-in-class commercial engine" for high-value freight, envisioning a category leader in premium logistics. However, during Forward Air's Q3 earnings call (where profits plummeted 82.2% year-over-year), Schmitt reversed course, stating termination remained an option while acknowledging Omni as a valued customer.

Market Reactions and Analyst Perspectives

Robert W. Baird analyst Garrett Holland viewed potential termination as positive, allowing Forward Air to refocus on core LTL operations. "Maximizing LTL profitability remains our preferred strategy until execution improves," Holland noted, characterizing Forward Air as "more of a special situation" until the Omni dispute resolves.

Legal Showdown: Uncertain Outcomes

The merger's disintegration presents complex challenges for both parties. Forward Air's counterclaim signals aggressive legal positioning to exit what it now considers an unfavorable deal. Omni, conversely, maintains contractual rights to enforce completion, believing the combined entity would strengthen competitive positioning.

Delaware's Court of Chancery now faces the task of untangling competing claims about contractual compliance. Regardless of outcome, this dispute serves as a cautionary tale about merger execution risks—the importance of clear terms, mutual diligence, and shared commitment to successful integration.

For Forward Air, escaping the merger could enable operational refocusing but may carry reputational costs. Omni, if unsuccessful, must reassess its strategic path forward. As litigation unfolds, the logistics industry watches closely for precedents that may shape future merger agreements and dispute resolutions.