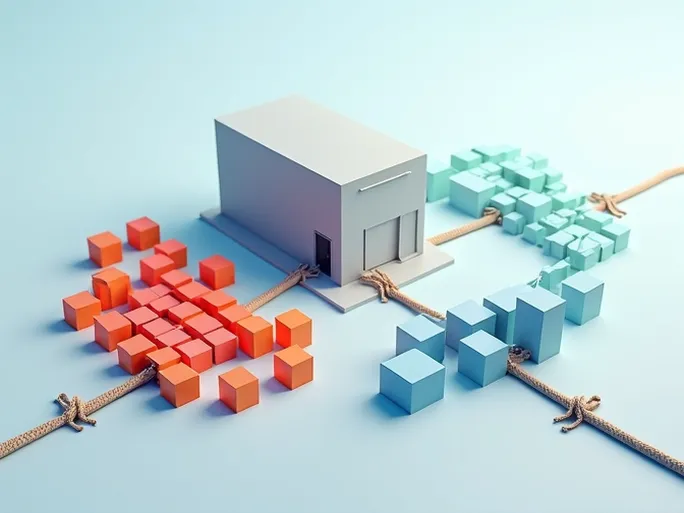

As the dust settles from another major shopping season, with millions of packages delivered to consumers nationwide, the backbone of this logistics network—industrial real estate—faces unprecedented challenges. The U.S. warehouse market is experiencing an intense "space race," with vacancy rates hitting record lows and supply struggling to keep pace with demand.

Key Findings and Market Analysis

Recent data from CBRE's "U.S. Industrial Availability Index" reveals several critical trends:

- Record-low vacancy rates: Industrial space availability dropped to 7.0% in Q4, marking the lowest level since 2000.

- Prolonged decline: This represents the 34th consecutive quarter of declining availability—the longest streak since CBRE began tracking this metric in 1988.

- Persistent supply-demand imbalance: Warehouse demand outpaced new supply by nearly 600,000 square feet in Q4, with net absorption (63 million sq. ft.) exceeding completions (57 million sq. ft.).

- Regional disparities: Among 55 major U.S. markets, 38 saw availability decline while 20 experienced increases.

- Gap narrowing: The quarterly supply-demand gap shrank from 9.3 million sq. ft. in Q3 to 6.2 million sq. ft. in Q4, though the annual deficit remained at 29 million sq. ft.

Understanding Availability Metrics

CBRE defines "available" space as the combination of vacant properties plus occupied spaces actively marketed for sublease. This comprehensive measure reflects all industrial real estate resources currently accessible to businesses.

Declining availability creates significant operational challenges, forcing companies to accept higher rents, less desirable locations, or outdated facilities—all of which impact logistics efficiency.

Regional Variations

Market conditions vary dramatically by location, influenced by several factors:

- Transportation infrastructure: Proximity to ports, rail hubs, and highways increases demand

- Economic vitality: Stronger local economies correlate with higher warehouse needs

- Population density: Urban centers require more last-mile distribution facilities

- Industry composition: Manufacturing-heavy areas need large warehouses while e-commerce hubs require smaller fulfillment centers

Market Outlook and Expert Perspectives

CBRE analysts maintain that "industrial fundamentals remain strong," noting that demand continues to exceed supply. Their projections suggest:

- Availability declines will initially stabilize as new supply comes online

- Long-term growth drivers (e-commerce expansion, supply chain optimization) remain intact

- Potential headwinds include rising interest rates and trade policy uncertainties

The Rise of "Pop-up Logistics"

CBRE's Global Chief Economist Richard Barkham highlights growing interest in flexible, short-term warehouse solutions: "If economic growth continues as expected, we're concerned logistics operators won't find suitable space. The development of pop-up logistics markets warrants close attention."

These temporary facilities, often in urban cores, help businesses respond quickly to fluctuating demand while maintaining operational flexibility during tight market conditions.

Market Drivers and Risk Factors

Growth Catalysts

- E-commerce expansion: U.S. online sales reached $1.1 trillion in 2023 (15.4% of retail)

- Supply chain optimization: Companies seek strategically located facilities to improve efficiency

- Demographic shifts: Urbanization and population growth increase goods demand

- Manufacturing reshoring: Production returning to the U.S. creates new warehouse needs

Potential Risks

- Economic downturn: Reduced consumer spending could decrease warehouse demand

- Interest rate hikes: Higher borrowing costs may discourage industrial real estate investment

- Trade disruptions: Supply chain reconfigurations could temporarily reduce space needs

- Overbuilding: Excessive new development could create localized oversupply

Strategic Responses for Businesses

Flexible Leasing Approaches

- Consider short-term leases to maintain agility

- Explore shared warehouse arrangements to reduce costs

- Utilize scalable spaces that can adjust to changing needs

Location Strategy

- Prioritize sites near major transportation nodes

- Establish multiple regional facilities to improve responsiveness

- Balance urban proximity with cost considerations

Technology Integration

- Implement automation (robotic picking systems, AGVs) to boost efficiency

- Adopt warehouse management systems for better inventory control

- Utilize IoT sensors for real-time facility monitoring

Supply Chain Diversification

- Develop multiple supplier relationships to mitigate risk

- Consider domestic production for critical components

- Maintain flexible procurement channels

Long-term Planning

- Improve demand forecasting to anticipate space requirements

- Monitor market trends and economic indicators regularly

- Build adaptable logistics networks that can scale with growth

Conclusion: Navigating a Competitive Landscape

The U.S. industrial real estate market presents both significant challenges and substantial opportunities. While e-commerce growth and supply chain evolution continue driving demand, businesses must remain vigilant about market fluctuations and emerging risks.

Success in this competitive environment will belong to organizations that combine strategic foresight, operational flexibility, and technological innovation to optimize their logistics networks amid ongoing space constraints.