Introduction: The Lifeline of Economic Navigation – Supply Chain Dynamics

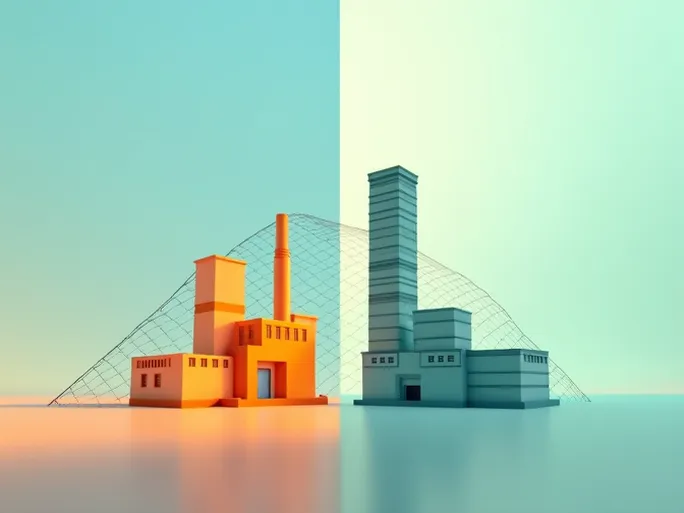

The global economy resembles a massive vessel navigating turbulent market seas, with supply chains serving as its vital lifeline. This critical network connects raw material acquisition, production processes, and the final delivery of goods and services to consumers. In 2024, global supply chains faced unprecedented challenges from economic headwinds. The Institute for Supply Management (ISM), a leading professional organization, released its December 2024 "Supply Chain Planning Forecast" report, revealing divergent growth trajectories for manufacturing and service sectors in 2025 based on comprehensive surveys of US procurement and supply chain professionals.

Part I: Manufacturing Sector – Gradual Recovery Building Momentum

1. Revenue Growth: From Sluggish to Revival

US manufacturing revenue grew modestly by 0.8% in 2024, falling short of May's 2.1% projection. However, 2025 forecasts predict 4.2% growth, with 60% of respondents expressing optimism about revenue expansion.

2. Structural Industry Variations

Among 18 tracked manufacturing industries, 10 sectors achieved revenue growth in 2024, including:

- Computer and electronic products (driven by digital transformation)

- Furniture and related products (benefiting from housing market recovery)

- Transportation equipment (supported by infrastructure development)

- Food, beverage and tobacco products (demonstrating recession resilience)

3. Capital Expenditure: Investment-Driven Growth

Manufacturing capital investment grew 5.2% in 2024, significantly exceeding projections. This trend is expected to continue through 2025, with 33% of expanding firms reporting average increases of 30%.

4. Key Performance Indicators

Additional metrics reveal sector health:

- Input prices rose 3% (2024) with similar 2025 projections

- Employment grew 0.8% (2024)

- Production capacity increased 1.7% (2024), projected 4% (2025)

- Capacity utilization reached 82.3%

5. Expert Perspective

ISM Manufacturing Chair Timothy Fiore notes: "Purchasing executives anticipate comprehensive 2025 growth with particular enthusiasm for second-half acceleration." However, he cautions that the sector's recovery remains fragile after 28 months of expansion followed by 14 months of contraction through 2024.

Part II: Service Sector – Robust Expansion with Sustained Vitality

1. Business Revenue: Exceeding Expectations

Service sector revenue grew 3.7% in 2024, surpassing May's 2.9% forecast. Among respondents, 51% reported revenue gains (averaging 9.6%), while 11% experienced declines (averaging 10.5%).

2. Industry-Wide Growth

All 18 service industries reported 2024 expansion, demonstrating broad-based strength and economic diversification benefits.

3. Capital Investment Trends

Service sector capital expenditure is projected to grow 5.1% in 2025, with 33% of firms anticipating average 21% increases focused on technology upgrades and market expansion.

4. Operational Metrics

Key service sector indicators include:

- Capacity utilization at 87.4% (down from 88.6% in May 2024)

- Production capacity grew 3.2% (2024)

- Input prices rose 5.2% (2024), projected 5.3% (2025)

- Employment expected to grow 0.8% (2025)

- Labor costs projected to increase 3.5% (2025)

5. Leadership Insight

ISM Services Chair Steve Miller observes: "Supply managers report strong capacity utilization and anticipate continued 2025 growth with increased capital investment. They forecast 2.8% service delivery capacity improvement alongside 5.1% capital expenditure growth."

Part III: Synthesis and Projections

The ISM report outlines complementary growth patterns for 2025: manufacturing's gradual recovery supported by investment acceleration, and services' sustained expansion through diversified demand. While inflationary pressures persist at manageable levels, both sectors face structural challenges requiring strategic adaptation.

Manufacturing Opportunities and Challenges

The sector must balance global demand recovery with technological transformation pressures, geopolitical risks, and supply chain reconfiguration needs.

Service Sector Dynamics

Continued growth requires quality enhancement, talent development, and technological integration to address rising competition and cost pressures.

Policy Considerations

Supportive measures could include:

- Regulatory streamlining

- Research investment incentives

- Workforce development programs

- Trade facilitation measures

- Intellectual property protections

Enterprise Strategies

Businesses should prioritize:

- Market-responsive operational adjustments

- Innovation investment

- Supply chain optimization

- Talent retention programs

- Risk mitigation frameworks

Conclusion: Collaborative Progress Toward Shared Prosperity

As 2025 approaches, coordinated efforts across manufacturing and service sectors can reinforce US economic recovery foundations through strategic investment, innovation, and workforce development.

Appendix: ISM Report Highlights

Manufacturing Sector:

- Revenue: +0.8% (2024), projected +4.2% (2025)

- Capital Expenditure: +5.2% (2024), projected +5.2% (2025)

- Input Prices: +3% (2024), projected +3% (2025)

Service Sector:

- Revenue: +3.7% (2024)

- Capital Expenditure: projected +5.1% (2025)

- Capacity Utilization: 87.4% (2024)