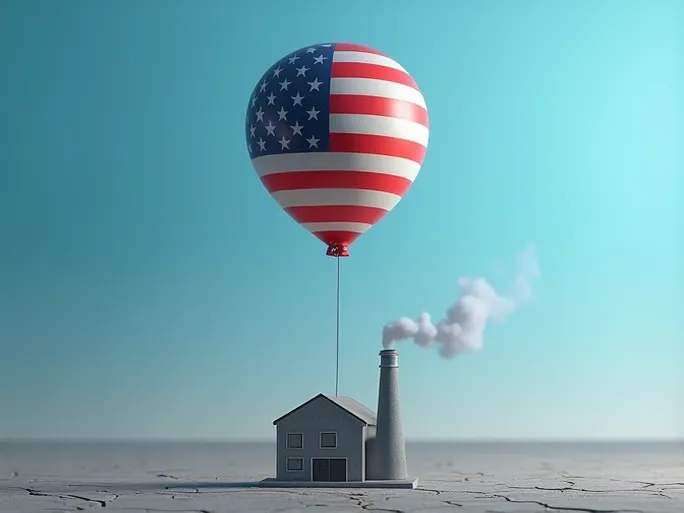

The latest manufacturing report from the Institute for Supply Management (ISM) reveals a mixed picture of the U.S. industrial sector, showing continued expansion but at a decelerating pace. The April PMI reading of 55.4 marked a 1.7-point decline from March's 57.1, signaling potential headwinds for the world's largest economy.

Key Indicators Reflect Moderation

The Purchasing Managers' Index (PMI), a crucial barometer of manufacturing health, has now remained above the 50-point expansion threshold for 23 consecutive months. However, April's figure fell below the 12-month average of 59.3, suggesting weakening momentum across several critical metrics:

- New orders dipped slightly to 53.5 (-0.3 points), with 17 of 18 industries reporting growth

- Production declined to 53.6 (-0.9 points), though 14 industries maintained output expansion

- Employment saw a sharp 5.4-point drop to 50.9, reflecting persistent labor shortages

- Supplier deliveries remained constrained at 67.2, marking 74 months of extended lead times

Structural Challenges Persist

Industry comments compiled by ISM highlight three systemic issues constraining manufacturing performance:

Supply chain disruptions: "Shanghai supplier shutdowns created ripple effects across our network," noted a chemical products executive. "Port delays continue to challenge our operations."

Inflationary pressures: "Runaway inflation makes sustainable growth difficult," the same respondent added. "Fuel costs and freight expenses are driving this cycle upward."

Labor market strains: An electrical equipment manufacturer reported, "Strong demand meets constrained capacity - component shortages remain our primary production bottleneck."

Expert Analysis: Temporary Setback or Sustained Slowdown?

ISM Manufacturing Business Survey Committee Chair Timothy Fiore offered nuanced interpretation of the data:

"The apparent slowdown may reflect timing issues rather than fundamental weakness. We're still processing record backlogs with extended lead times. Seasonally adjusted, the PMI would likely show stronger performance."

Fiore specifically noted that export orders showed particular softness, likely impacted by China's pandemic restrictions, while customer inventories remain historically lean at 37.1.

Sector Performance Breakdown

The report detailed varied performance across manufacturing segments:

Growth leaders: Apparel, machinery, plastics/rubber, computers/electronics, food/beverage, and transportation equipment all showed moderate-to-strong expansion.

Lone decliner: Petroleum and coal products registered contraction, the only industry to do so in April.

Macroeconomic Context

The manufacturing slowdown occurs against a complex backdrop:

- Global supply chain realignments post-pandemic

- Persistent inflationary pressures across input costs

- Geopolitical uncertainty from the Russia-Ukraine conflict

- Ongoing labor market tightness with record job openings

Price indices, while still elevated at 84.6, showed modest deceleration from March's 11.5% surge - the largest single-month increase since December 2020.

Forward Outlook

The report suggests U.S. manufacturers face competing pressures:

Challenges: Input cost volatility, skilled labor shortages, and logistics constraints continue to limit output potential.

Opportunities: Strong underlying demand, technological innovation, and reshoring trends provide growth avenues.

As Fiore concluded, "Considering omicron, $100 oil, and Ukraine, manufacturing has shown remarkable resilience. The fundamentals remain solid despite surface-level softening."