LONDON – As winter approaches, the UK economy has received a glimmer of warmth. The latest inflation data shows that UK consumer prices rose 3.2% year-on-year in November, below market expectations of 3.5%, while core CPI unexpectedly dropped to 3.2%, hitting its lowest level since January this year.

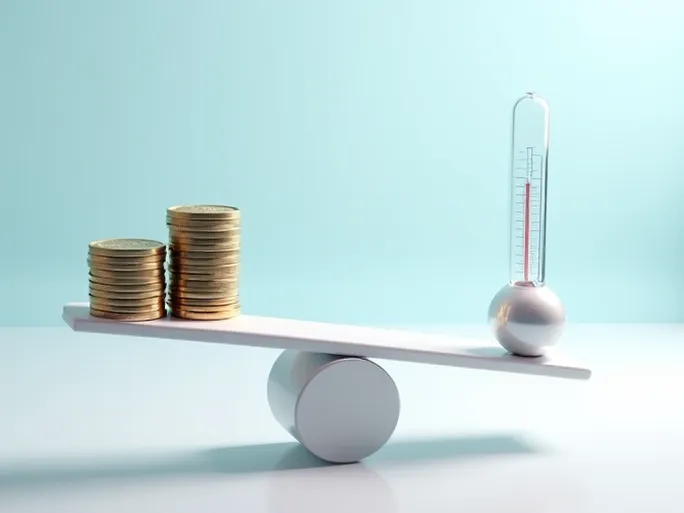

This development undoubtedly provides the Bank of England (BOE) with greater room for interest rate cuts but also raises questions about future monetary policy direction and prompts a reassessment of the UK's economic prospects.

Rate Cut Expectations Rise: Central Bank May Accelerate Easing

The below-expectation inflation figures have reinforced market expectations that the BOE will likely keep rates unchanged at this week's policy meeting while increasing the probability of future cuts. More significantly, if the central bank can convincingly signal sustained disinflation, it may face growing pressure to accelerate monetary easing.

Following the data release, sterling fell sharply, with GBP/USD dropping 0.6% to 1.3345. This reflects market concerns about the UK's economic outlook and a reassessment of the central bank's future policy path. Investors are closely watching the BOE's next moves and its projections for economic growth and inflation.

Behind the Cooling Inflation: Falling Food and Goods Prices

A deeper analysis reveals that declining food prices were the primary driver behind the overall inflation drop. November's food price inflation fell to 4.2% from October's 4.9%, suggesting that previously persistent food price increases are stabilizing and even beginning to reverse—welcome news for consumers facing cost-of-living pressures.

Goods price inflation also declined from 2.6% to 2.1%, largely due to Black Friday promotions that pushed clothing and footwear prices down 0.3% month-on-month and 0.6% year-on-year. Notably, during the same period last year, clothing and footwear prices rose 0.6% month-on-month, indicating deeper discounts this year with more pronounced downward pressure on prices.

However, these promotional-driven price drops may prove temporary, potentially rebounding post-sales. Close monitoring of goods price trends in coming months will be essential to assess the sustainability of disinflation.

Services Inflation Remains Central Bank's Focus

Despite overall cooling, services inflation remains the BOE's primary concern, edging down only slightly to 4.5% in November. This persistent price stickiness in services constitutes the main obstacle to further disinflation, primarily driven by rising labor costs.

With the UK labor market remaining tight, businesses continue raising wages to attract and retain workers, ultimately passing these costs through to service prices. Unless services inflation shows more substantial declines, the BOE will struggle to justify significant further rate cuts next year.

Challenges and Opportunities: Policy Direction Faces Test

The inflation data delivers positive signals that price pressures are easing and beginning to soften further—particularly welcome after months of stagnation. However, without meaningful services inflation moderation, the BOE lacks compelling reasons for substantial additional easing in 2024.

BOE Governor Andrew Bailey has emphasized vigilant monitoring of inflation data and flexible policy adjustments to prioritize price stability. The central bank must now balance inflation control against growth stimulation, with its policy decisions directly shaping the UK's economic trajectory.

Corporate and Investor Strategies: Navigating Risks and Opportunities

Businesses may benefit from easing cost pressures and potential consumption rebounds, possibly lowering prices to boost competitiveness. However, potential sterling depreciation from rate cut expectations could increase import costs and affect exports, requiring adaptive strategies.

For investors, the UK's uncertain outlook presents both risks and opportunities, demanding careful assessment of appropriate assets for preservation and growth.

Expert Views: Cautious Optimism Advised

Economists generally view the inflation surprise positively but urge prudence. "UK inflation is falling faster than expected, giving the BOE greater policy space," said Paul Dales, Chief UK Economist at Capital Economics, "but elevated services inflation requires ongoing caution."

Andrew Goodwin, Chief UK Economist at Oxford Economics, noted: "The UK faces multiple challenges including global slowdowns, geopolitical tensions and Brexit uncertainties—the BOE must carefully balance inflation control with growth support."

Conclusion: Watchful Waiting Recommended

While the inflation cooling marks progress, cautious optimism remains warranted given persistent challenges. The coming months' inflation data, services sector performance and global economic conditions will be critical for assessing the UK's economic direction and informing policy decisions.