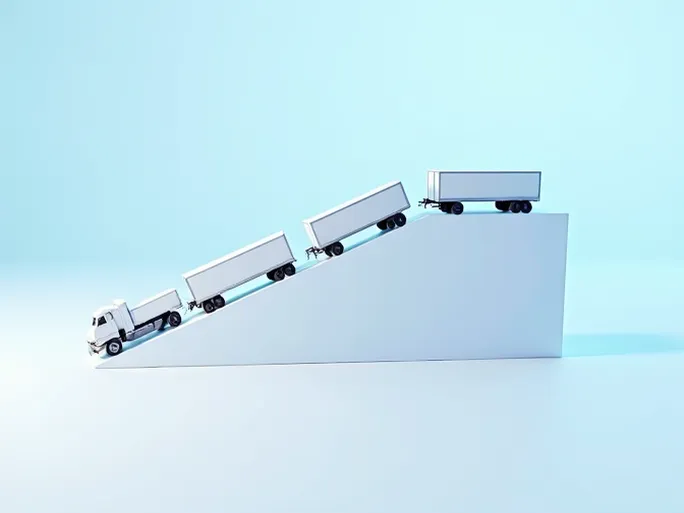

Across the vast American landscape, highways connect cities like arteries while freight trucks serve as the lifeblood of economic activity. Each truck tows various trailers - the engines of commerce and vehicles of product distribution. However, recent data reveals this vital logistics system is experiencing an unexpected "cooling" period in trailer orders. Is this a warning sign of weakening demand or simply a normal market adjustment?

Market Pulse: Declining Orders vs. Strong Backlogs

According to ACT Research's latest data, U.S. commercial trailer net orders declined for the third consecutive month in June, dropping 26% month-over-month. While this cooling trend raises concerns, industry backlogs remain robust at 97,000 units - just 5% below May levels and more than double last year's figures. This simultaneous "cooling" and "strength" suggests not a market collapse but rather a natural adjustment following rapid growth.

Expert Insight: Seasonal Patterns Meet Cyclical Trends

Frank Maly, ACT Research's Director of CV Transportation Analysis, notes the unexpected order decline stems from reduced new orders rather than cancellations. He emphasizes this coincides with seasonal order placement lows, making coming months' data crucial for determining whether this represents a temporary pause or trend reversal.

Steve Tam, ACT Research Vice President, explains truck orders followed nine months of backlogs before June's modest 1% monthly decline. He attributes April's order surge to OEM price increase announcements and reduced discounts that prompted fleet operators to accelerate purchases - creating an artificial spike followed by predictable cooling. Tam anticipates subdued order volumes may persist through October.

Underlying Factors: The Domino Effect

Multiple interconnected factors drive the current slowdown:

- Seasonality: Summer traditionally represents an order placement trough

- Demand Front-loading: April's price-driven order surge borrowed from future demand

- Economic Uncertainty: Inflation, rising interest rates and geopolitical risks foster caution

- Soft Freight Rates: Reduced profitability dampens fleet investment appetite

Strategic Response: Turning Challenges into Opportunities

Industry participants should consider several strategic approaches:

- Enhance market monitoring to adapt production and sales strategies

- Optimize product offerings with efficient, environmentally friendly designs

- Elevate service quality through enhanced maintenance and training programs

- Implement rigorous cost controls to improve operational efficiency

- Explore emerging markets including electric and autonomous vehicles

Industry Outlook: Short-Term Pressure, Long-Term Growth

While current conditions present challenges, several factors support long-term market expansion:

- Sustained economic growth driving freight demand

- Infrastructure investment creating new transportation needs

- Technological advancements in automation and electrification

- Aging fleet replacement requirements

This combination of fundamental strengths positions the commercial trailer and truck market for continued development despite temporary headwinds.

Conclusion: Balanced Perspective for Sustainable Success

The U.S. commercial trailer and truck market's current adjustment reflects normal cyclical patterns rather than structural decline. Industry leaders who maintain strategic focus on innovation, efficiency and customer needs will be best positioned to navigate present challenges and capitalize on future opportunities as market conditions evolve.