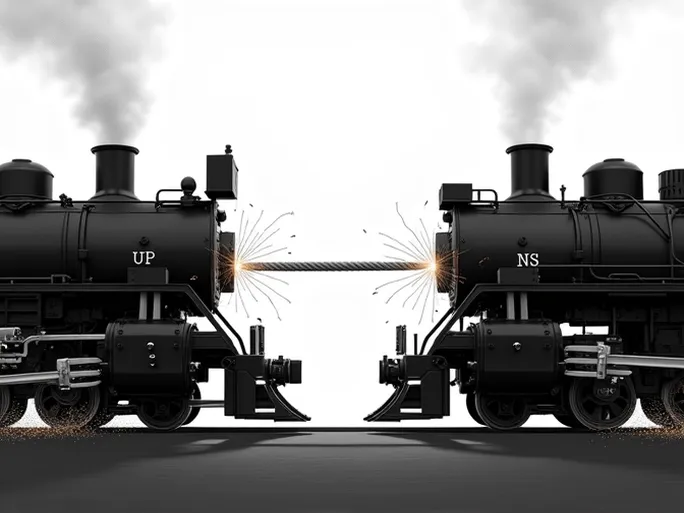

If railroads are the arteries of the U.S. economy, then the proposed $85 billion merger between Union Pacific (UP) and Norfolk Southern (NS) would constitute nothing less than a nationwide "heart surgery." This potential deal could create America's first coast-to-coast rail artery, connecting 43 states through over 50,000 miles of track and nearly 100 ports. Yet what appears as a promising union has sparked fierce opposition from railroad unions and raised concerns among chemical companies and other rail customers.

Union Concerns: Efficiency Gains vs. Lost Competition and Safety Risks

"Highway to hell?" That's how Mark Wallace, president of the Brotherhood of Locomotive Engineers and Trainmen (BLET), characterized the proposed merger. Representing over half of UP and NS union employees through the Teamsters Rail Conference, BLET and the Brotherhood of Maintenance of Way Employes (BMWED) express deep reservations. They argue the merger won't improve rail competitiveness but rather push railroads to abandon less profitable rural lines while running longer, slower trains on main routes - ultimately driving customers to trucking.

These concerns find support from industry groups. The American Chemistry Council (ACC) and its 40 member companies, along with the Rail Customer Coalition, have written to the White House and Surface Transportation Board (STB), warning that railroad mergers historically reduce competition without delivering promised efficiencies.

Safety represents another flashpoint. Unions highlight the challenge of merging companies with different safety cultures, citing NS's 2023 Ohio derailment as a cautionary tale. They criticize UP for resisting NS's Confidential Close Call Reporting System (C3RS) while operating three-mile-long trains that increase safety risks.

On employment, unions dismiss UP's job protection promises as "empty checks," arguing the proposal gives management unilateral control over which positions remain secure.

The Competitive Landscape: Reshaping an Industry

BNSF Railway's Chief Marketing Officer Tom Williams recently noted this would be STB's first major merger review under 2001 rules requiring deals to enhance competition and serve public interest. "We're entering uncharted territory," Williams observed at RailTrends, questioning how eliminating two of four transcontinental routes (UP-NS and UP-CSX) could possibly increase competition.

He particularly challenged claims that reducing rail-to-rail competition somehow strengthens rail's position against trucking: "When you eliminate those two routes, you're eliminating all the competitive options associated with them."

UP's Vision: A More Efficient National Network

UP CEO Jim Vena counters that America lacks a truly national railroad, forcing unnecessary handoffs that cause 15-25% delays. "Why shouldn't we optimize resources to better serve customers competing globally?" he asked at RailTrends. Vena envisions shifting Chicago-area truck traffic to rail and simplifying complex routes like Arizona-to-East Coast copper shipments that currently require multiple railroad handoffs.

Vena cites nearly 2,000 supportive letters from customers who welcome simplified shipping. "We'll adopt both companies' best practices while eliminating transfer points that create safety risks," he said, adding that UP guarantees lifetime union job protection.

Regulatory Crossroads: The STB's Pivotal Role

The STB must ultimately determine whether this merger serves the public interest by enhancing competition - weighing potential efficiency gains against impacts on customers, workers and market dynamics. Even if approved, integrating two massive railroads poses formidable operational and cultural challenges.

Perhaps most consequentially, this deal could accelerate industry consolidation, potentially leaving shippers with fewer choices and higher rates. As America's economic arteries hang in the balance, this proposed merger represents a high-stakes gamble on the future of rail transportation.