The global supply chain has experienced nearly three years of continuous turbulence. The outbreak of COVID-19 acted as an unexpected tsunami, completely upending established international trade systems. Businesses have since navigated cautiously through this evolving landscape. In 2022, challenges persisted as the Ukraine crisis further complicated global economic conditions, while consumer demand showed significant cooling. Facing mounting pressures, the retail sector embarked on profound transformation.

Companies increasingly focused on enhancing operational efficiency and strengthening supply chain resilience. The adoption of automation technology, strategic mergers and acquisitions, and inventory management optimization emerged as key themes throughout the year. Simultaneously, new disruptions forced continuous adjustments—such as strike threats in U.S. transportation networks that reshaped domestic freight routes and exacerbated port congestion along the East Coast. These developments relentlessly tested retailers' adaptability.

Inventory Clearance: An Urgent Priority

Panic buying during the pandemic's early stages led to inventory pileups, now exacerbated by cooling demand. Retailers implemented aggressive clearance strategies including deep discounts and product assortment optimization. More fundamentally, businesses reevaluated overstocking practices, shifting toward precision inventory management. Data-driven demand forecasting to minimize excess stock and reduce operational costs became an industry consensus.

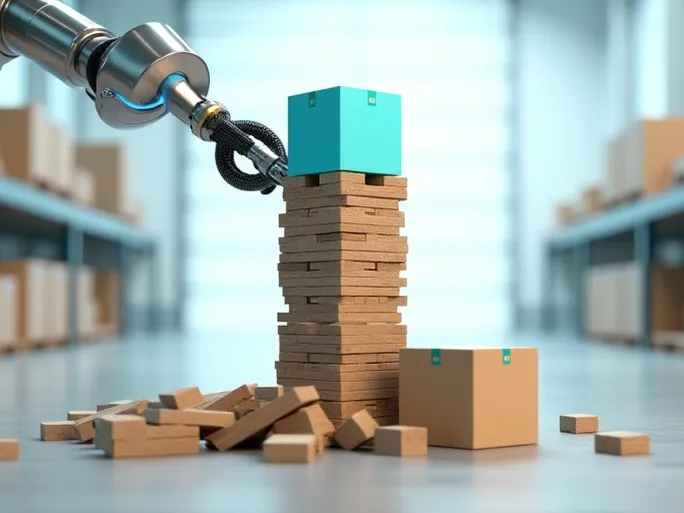

Automation: The Efficiency Catalyst

Confronting labor shortages and rising costs, automation emerged as retail's primary efficiency engine. From automated warehousing and smart logistics to self-checkout systems and robotic assistants, these technologies permeated every operational layer. Automated systems not only boost productivity but also reduce human error while improving service quality.

Mergers & Acquisitions: Consolidating for Competitive Advantage

In an intensely competitive market, M&A activity became a vital tool for resource consolidation. Strategic acquisitions enabled rapid market expansion, access to advanced technologies, and realization of synergies. The retail sector maintained robust M&A momentum throughout 2022, reflecting corporate confidence in future growth and proactive market positioning.

Supply Chain Diversification: Mitigating Risk

The vulnerability of single-source supply chains became painfully evident during disruptions. Retailers increasingly adopted diversification strategies—expanding supplier networks and dispersing production locations to reduce regional dependencies. Many simultaneously explored localized production to shorten supply lines and accelerate responsiveness.

Digital Transformation: Enabling Retail's Next Phase

The industry's digital evolution continues unabated. Omnichannel retail ecosystems blending online and offline experiences better serve diverse consumer needs. Advanced analytics provide deeper customer behavior insights for product and service optimization. Emerging technologies like artificial intelligence and IoT present additional growth opportunities.

While 2022 presented unprecedented challenges for retail, it simultaneously cultivated innovation. In an uncertain future, continuous adaptation remains essential for competitive survival. The industry now watches how these transformative trends will evolve through 2023 and beyond.