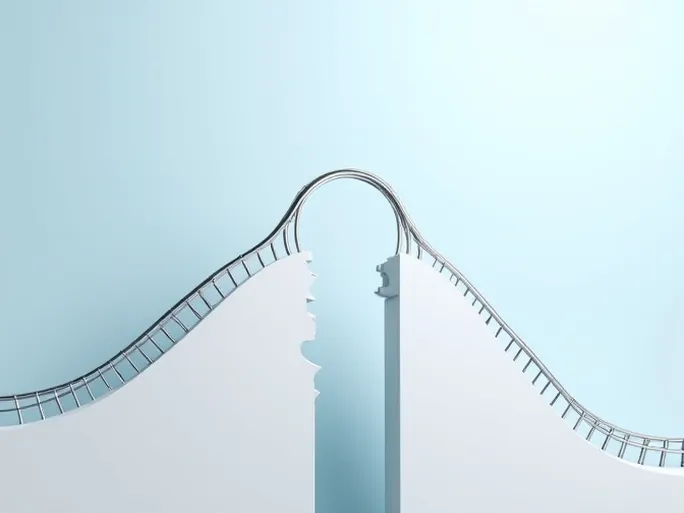

Washington, D.C. – U.S. import-export trade is experiencing dramatic fluctuations reminiscent of a roller coaster ride, driven by frequent changes in trade policy. The latest Global Port Tracker report, jointly released by the National Retail Federation (NRF) and maritime consultancy Hackett Associates, reveals the complexity of current trade conditions while issuing warnings about future trends.

A Fleeting Respite: Summer Import Surge Amid Temporary Tariff Relief

The report indicates that U.S. imports will see significant growth this summer due to temporary tariff reductions on Chinese goods (scheduled to expire in mid-August). This policy has stimulated purchasing activity among retailers rushing to complete orders and shipments before tariffs resume, ensuring consumers can access goods at reasonable prices.

However, this growth may prove temporary. Following the expiration of tariff relief and the clearance of backlogged orders, U.S. import volumes are projected to decline sharply in the second half of 2025. Such volatility creates substantial supply chain uncertainty and increases operational risks for retailers.

Key Ports Covered: Barometers of U.S. Trade Health

The Global Port Tracker monitors America's most critical ports, whose import-export data reflects the nation's overall trade health. Key ports include:

- Los Angeles/Long Beach: The largest West Coast port complex and primary gateway for U.S.-Asia trade.

- New York/New Jersey: The busiest East Coast port and main conduit for U.S.-Europe commerce.

- Houston: The Gulf Coast's largest port and crucial hub for energy exports.

- Savannah: A major Southeastern port handling growing container volumes.

- Seattle/Tacoma: Vital Northwest ports serving as gateways to Alaska and Asia.

Data Insights: Import Volume ≠ Retail Sales

Report authors emphasize that cargo import volumes don't directly correlate with retail sales or employment figures. Import data reflects container quantities rather than merchandise values – meaning increased imports don't necessarily translate to higher sales or jobs.

Nevertheless, import trends remain a crucial indicator of retailer expectations. Businesses typically adjust import volumes based on projected demand, making these fluctuations a revealing gauge of commercial confidence.

NRF Calls for Policy Stability

Jonathan Gold, NRF Vice President for Supply Chain and Customs Policy, stated: "Retailers are navigating their busiest season, preparing for back-to-school and winter holidays. After pausing purchases due to high tariffs, they're now racing to complete orders before reciprocal tariffs and China duty suspensions expire on August 12, ensuring consumers get affordable goods."

Gold highlighted lingering uncertainty about post-suspension conditions, urging continued government negotiations to restore supply chain predictability.

Policy Whiplash: Retailer Challenges

Gold noted that after April's announcement of 145% tariffs on Chinese goods, many retailers canceled orders. When tariffs were temporarily reduced to 30% (through August 12), imports rebounded. Simultaneously, reciprocal tariffs on other nations were paused until July 9 for trade negotiations.

This policy volatility forces constant procurement strategy adjustments, increasing operational costs and potentially raising consumer prices.

Projections: Volatile Months Ahead

- April: 2.21 million TEUs (20-foot containers), up 2.9% monthly and 9.6% annually

- May (projected): 1.91 million TEUs, down 13.4% monthly and 8.1% annually

- June-August: Expected rebound before steep Q4 declines

The report anticipates sharper year-over-year drops in late 2025, partly due to inflated 2024 import volumes as businesses stockpiled ahead of potential East/Gulf Coast port strikes.

Expert Analysis: "Chaos to Confusion"

Ben Hackett, founder of Hackett Associates, observed: "Trade policy keeps cycling from chaos to confusion and back." He cited fluctuating China tariffs, doubled steel/aluminum duties, and mutual U.S.-China accusations of violating trade agreements.

"Our projections show May's import plunge responding to higher tariffs, followed by summer surges as importers exploit temporary suspensions," Hackett wrote. "If elevated tariffs return, expect late-year declines."

Economic Impacts

Policy uncertainty affects multiple sectors:

- Supply Chains: Disruptions raise operational costs

- Inflation: Tariffs increase import expenses

- Investment: Hesitation due to unpredictability

- Growth: Negative GDP impacts

Policy Recommendations

Experts suggest:

- Stabilizing trade agreements through negotiations

- Increasing policy transparency

- Providing adjustment assistance for affected businesses

The path forward requires balancing protectionism with free trade principles to restore supply chain stability and support economic health.