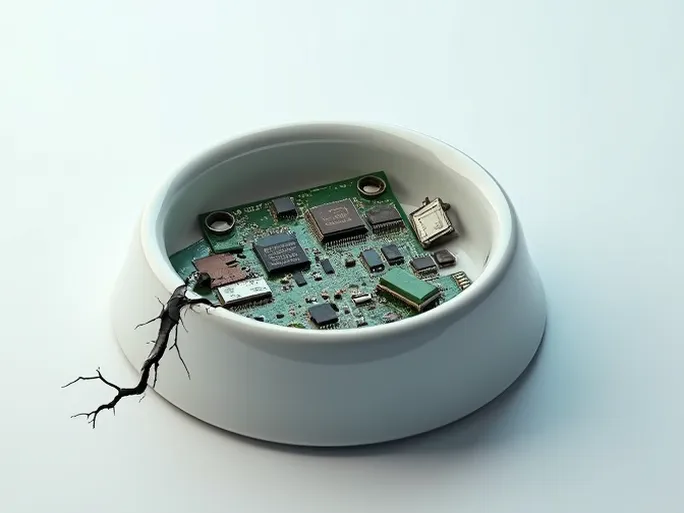

The recent deregistration of Midea Group's wholly-owned pet appliance subsidiary, Zhejiang Minshin Pet Technology Co., Ltd., has poured cold water on what appeared to be a booming market. This is not an isolated case—many entrants have failed, prompting deeper reflection on the current state and future trends of the pet smart device industry.

The Short-Lived Pet Venture of a Home Appliance Giant

In March 2021, Midea Group proudly established Minshin Pet Technology, officially entering the pet smart device sector. The company had previously tested the waters with pet water fountains and air purifiers sold through its JD.com flagship store. It later launched two pet brands—"Cat Gravity" and "Fluffy&Floppy"—garnering significant attention. However, the success was short-lived. By 2023, rumors emerged about Midea's withdrawal from the pet business, with its official flagship store closing down. Today, only a few pet-specific appliances remain available through Midea's general home appliance store. In September of this year, Minshin Pet Technology completed its deregistration, marking the end of Midea's unsuccessful foray into pet tech.

Why Are Industry Giants Failing to Gain Traction?

Midea's experience is not unique. In recent years, home appliance and tech giants including Xiaomi, OPPO, Lenovo, and Haier have rushed into the pet tech market, hoping to claim their share. Yet apart from Xiaomi—which has gained some market presence through strong brand influence and unique marketing strategies—most have achieved limited success. Several key factors explain this phenomenon:

- Brand DNA and User Perception Gap: While established in traditional appliances, these brands struggle to gain consumer trust in pet-specific products, where specialized pet brands dominate.

- Product Development Challenges: Pet tech requires deep understanding of animal behavior—an expertise not easily transferable from conventional appliance development.

- Marketing Misalignment: Traditional marketing channels often fail to effectively reach pet owners, who engage through specialized platforms like pet communities and veterinary clinics.

- Supply Chain Complexities: The fragmented pet tech supply chain and price-sensitive market demand superior cost control capabilities that many giants lack.

Specialized Brands Rise While New Entrants Fall: The Market's "Game of Thrones"

In contrast to struggling conglomerates, specialized brands like CATLINK, PETKIT, and HoneyGuaridan have thrived through focused product development and targeted marketing. However, even market leaders generate modest domestic revenues of $70-140 million annually, while countless others face existential pressures.

The case of Unipal exemplifies the sector's volatility. The startup raised four funding rounds since 2019, with its smart litter box once topping domestic sales charts. However, technical failures in its water fountain product, coupled with unsustainable pricing and overestimated customer retention, led to cash flow collapse and eventual liquidation.

This highlights several industry challenges:

- Severe Product Homogenization: Low technical barriers lead to rampant imitation and destructive price wars.

- Consumer Skepticism: Many dismiss pet tech as "gimmicks" due to superficial "smart" features added to basic products.

- Skyrocketing Customer Acquisition Costs: Reaching pet owners grows increasingly expensive amid rising digital advertising costs.

- Quality Control Risks: Dispersed supply chains make consistent quality difficult to maintain.

Going Global: Lifeline or New Challenge?

Facing intense domestic competition, many brands now prioritize overseas expansion, with some making it their primary focus. Companies like CATLINK, PETKIT, and HoneyGuaridan have established notable presence in international markets.

But is global expansion truly easier?

- Larger Market Potential: Developed markets like North America and Europe show higher acceptance of pet tech.

- Healthier Profit Margins: Less competition allows for better pricing power abroad.

Amazon's top-selling pet products increasingly feature Chinese brands—both established names and generic manufacturers. For instance, HoneyGuaridan's smart water fountain leads Amazon Japan's bestseller list, with products sold in 30+ countries. Similarly, PETKIT and CATLINK have topped sales charts in multiple markets.

Global Expansion: Obstacles Ahead

However, international success comes with its own hurdles:

- Channel Barriers: Major overseas pet store chains often prefer private-label products over branded goods.

- Soaring Customer Acquisition Costs: Limited pet influencers abroad force brands to experiment with alternative marketing approaches.

- Intensifying Price Competition: Smart litter box prices have plummeted from $1,000 to $300 due to market saturation.

- Intellectual Property Risks: Stricter overseas IP protections require careful navigation.

Future Outlook: Smart Innovation as the Path Forward

While global expansion presents opportunities, domestic markets may eventually mature as consumer acceptance of pet tech grows. Future industry trends will likely include:

- Advanced Intelligence: AI and IoT integration will enable more sophisticated pet care solutions.

- Product Diversification: Beyond current staples, expect innovative health monitors and smart toys.

- Personalized Experiences: Customizable features will better serve individual pet needs.

- Fiercer Competition: Only brands excelling in quality, innovation, and marketing will thrive.

For sustainable success, companies must:

- Specialize in niche segments

- Prioritize technological innovation

- Cultivate distinctive brand identities

- Develop omnichannel distribution strategies

Midea's exit serves as a cautionary tale—the pet tech market offers potential but demands genuine understanding of pets and owners, coupled with relentless innovation. Only those meeting these challenges will endure in this dynamic industry.