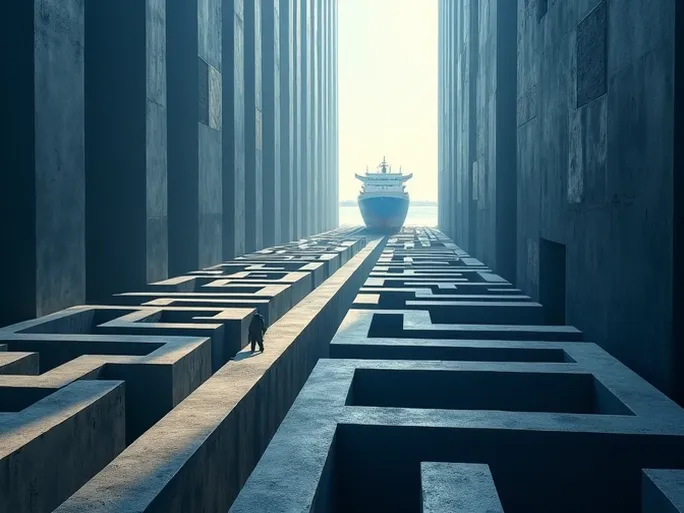

Imagine a cargo-laden vessel arriving at a U.S. port, only to encounter prolonged customs clearance procedures that escalate costs and delay deliveries. Understanding U.S. maritime import customs processes and leveraging efficiency-enhancing tools can help businesses maintain control over their supply chains.

Streamlining Clearance: Essential Software Solutions

Specialized software can significantly enhance customs clearance efficiency by reducing human errors and providing real-time cargo tracking. Here are three industry-recommended solutions:

Customs Declaration Software: The Professional's Choice

Designed for corporate customs brokers, these platforms offer online declaration submission, status monitoring, and data analytics. By interfacing directly with customs systems, they enable accurate, expedited processing. Pricing typically includes free trial versions, with subscription costs varying by functionality and user licenses.

Logistics Tracking Platforms: Comprehensive Cargo Monitoring

Integrated with major shipping carriers and freight forwarders, these systems provide end-to-end visibility including real-time location updates, estimated arrival times, and clearance progress. Pricing ranges from basic plans to premium enterprise solutions.

Import Compliance Assistants: SME-Friendly Solutions

Ideal for small businesses and individual importers, these tools simplify document preparation and status tracking through intuitive interfaces. Licensed versions typically offer cost-effective pricing structures.

Clearance Timelines: Key Variables and Estimates

U.S. maritime import clearance durations vary based on multiple factors including commodity type, declared value, and port-specific procedures. Below are general timeframes for planning purposes:

- General Commercial Imports: Typically require 3-7 days for inspection and documentation processing, plus tax payment completion.

- Standard Commodities: Usually clear within 1-3 days, though holiday periods and peak shipping seasons may extend processing.

- Regulated/High-Value Goods: Food, pharmaceuticals, and luxury items often undergo extended examinations, requiring advance preparation.

- Pandemic Considerations: Port restrictions may unpredictably impact clearance operations, necessitating contingency planning.

Optimization Strategies: Best Practices

To ensure smooth customs processing, importers should:

- Research destination port requirements before shipment

- Verify all declaration details for accuracy

- Partner with established logistics providers

- Monitor shipment status proactively

The Digital Future of Customs Processing

Global customs authorities are increasingly adopting electronic documentation and paperless clearance systems to enhance efficiency. Forward-looking businesses are integrating these technological advancements into their supply chain strategies to maintain competitive advantage.