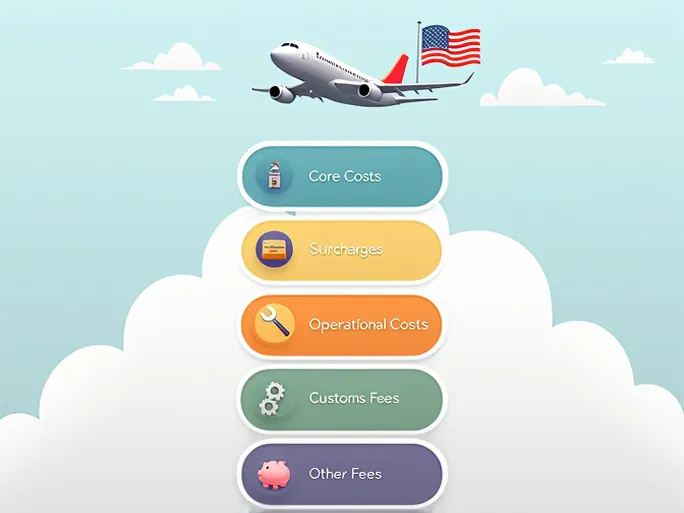

Navigating air freight expenses to the United States can be challenging. Understanding where every dollar goes is crucial for effective budgeting and planning. Here's a comprehensive breakdown of all potential costs involved in air shipping to the US.

1. Core Expense: Cargo Space Fees

The primary cost component is the cargo space fee, essentially the "seat price" for your shipment. Similar to airline tickets, this fee varies based on:

- Total weight and dimensions of your cargo

- Service level selected (standard vs. expedited shipping)

Optimizing package dimensions and selecting appropriate service levels can significantly reduce these costs.

2. Additional Mandatory Charges

Several unavoidable surcharges apply to most air freight shipments:

- Fuel Surcharge: Fluctuates with global oil prices, typically calculated per kilogram or cubic foot

- Security Fee: Mandatory charge covering cargo screening and safety measures

- Remote Area Surcharge: Additional fees for deliveries to less accessible airports

3. Operational Service Fees

These charges cover various handling services throughout the shipping process:

- Documentation: Processing of bills of lading, customs declarations, and other essential paperwork

- Packaging: Professional crating and protective wrapping services when required

- Loading/Unloading: Ground handling fees for cargo transfer between aircraft and transportation vehicles

4. Customs Compliance Costs

All imports must meet U.S. customs requirements, which may include:

- Import Duties: Calculated based on product value, origin, and classification

- Value-Added Tax (VAT): Applied by certain states on imported goods

- Excise Taxes: Special levies on specific product categories like alcohol and tobacco

5. Contingency Expenses

Several optional but recommended costs should be considered:

- Cargo Insurance: Protection against potential transit risks

- Local Transportation: Door-to-door delivery services beyond airport pickup

- Storage Fees: Charges for cargo holding at customs or airport warehouses

Understanding these cost components enables businesses and individuals to make informed shipping decisions, optimize their logistics budget, and ensure smooth cargo delivery to U.S. destinations.