The Harmonized System Committee (HSC) has issued definitive classification rulings for modern technological products including smartwatches and drones, providing clarity for international trade operations. The decisions were finalized during the committee's 55th session in March 2015 and recently published.

Comprehensive Classification Framework

The published rulings comprise three key components: classification determinations, amendments to Harmonized System explanatory notes, and revisions to classification opinion compilations. These decisions directly impact import/export costs and operational efficiency while establishing clear guidelines for customs enforcement.

Smartwatch Classification Criteria

Wearable smart devices with multifunctional capabilities now face specific classification parameters. For wrist-worn smartwatches, customs authorities will assess primary functionality:

• Devices emphasizing data processing and information display will classify as data processing equipment

• Units with predominant communication features will categorize as wireless communication devices

Customs officials will conduct thorough evaluations of product specifications to determine core functionality before assigning classification codes.

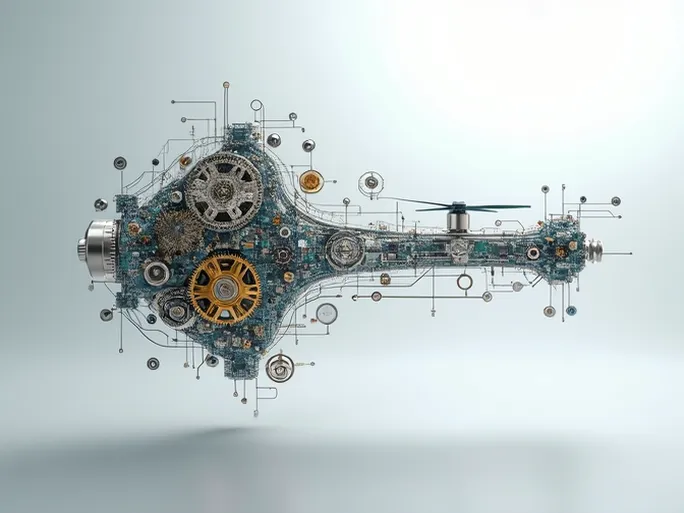

Drone Classification Methodology

The classification process proves more complex for quadcopter drones equipped with integrated digital cameras. Customs determinations will consider primary operational purpose:

• Aerial photography drones will classify as photographic equipment

• Units designed for transport or surveillance operations will categorize under alternative aircraft classifications

Officials will examine design specifications, technical capabilities, and intended applications when making final determinations.

Trade Implications

These rulings carry significant consequences for international commerce. Precise classification enables accurate customs declarations, preventing potential tariff miscalculations and legal complications. The framework also strengthens customs oversight capabilities while promoting equitable trade practices.

The HSC's updated classification system reflects ongoing adaptations to technological innovation in global trade frameworks. As new products continue emerging, the committee's periodic reviews ensure international trade mechanisms remain responsive to market developments.