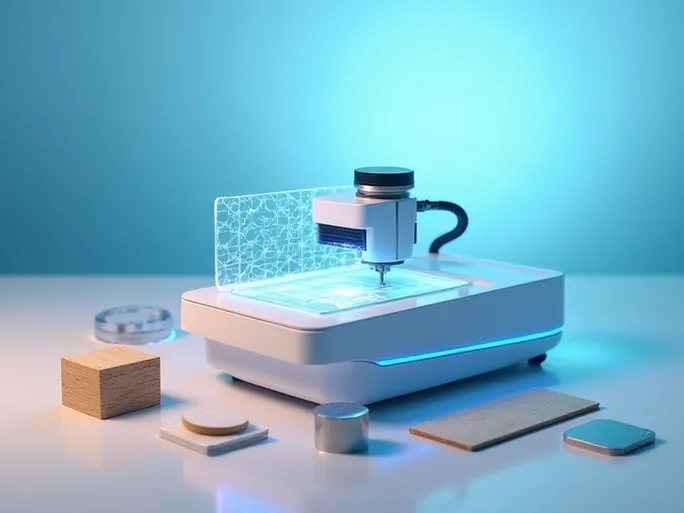

Imagine a future where creative workshops aren't confined to professionals but become accessible in every household. A compact device that transforms digital designs into physical objects—this is the vision driving xTool, the premium consumer technology brand under Shenzhen Makeblock Technology.

The company took a significant step toward this ambition on January 1, 2026, by filing for a main board listing on the Hong Kong Stock Exchange, with Morgan Stanley and Huatai Securities serving as joint sponsors. This move follows xTool's recent $200 million Series D funding round led by Tencent, which will further accelerate its growth in the global creative tools market.

Brand Positioning and Product Ecosystem

Positioned as a premium global consumer tech brand, xTool specializes in "digital-to-physical" creative empowerment. Its product portfolio includes laser-based personal creative tools, material printers, user-friendly software platforms, and compatible consumables. With pricing 10%-30% above industry averages, xTool has successfully penetrated mainstream premium markets in North America and Europe, establishing itself as one of the few Chinese brands achieving high premium pricing, customer retention, and sustained growth overseas.

AI-Driven Technological Edge

xTool's competitive advantage lies in its integrated hardware-software ecosystem powered by artificial intelligence. The company has built technical barriers through deep integration of precision optics, intelligent CNC control systems, and proprietary AI algorithms. Its self-developed xTool Studio software unifies device connectivity across all products, while the AI-driven AImake engine functions as a personalized manufacturing assistant—significantly reducing user learning curves and enhancing creative efficiency.

Capital Infusion and Global Expansion

Prior to its IPO filing, xTool attracted investments from prominent venture capital firms. The September 2025 Series D round led by Tencent, with participation from GGV Capital, Source Code Capital, and Gaocheng Capital, totaled approximately $200 million (¥1.396 billion). Earlier investors include Sequoia Capital China, Shenzhen Capital Group, and CICC Alpha. These capital injections have supported xTool's R&D initiatives and worldwide market expansion.

Financial Performance and Market Penetration

According to its prospectus, xTool demonstrated consistent growth with revenues reaching ¥1.457 billion, ¥2.476 billion, and ¥1.777 billion for full-year 2023, 2024, and the first three quarters of 2025 respectively. Corresponding net profits stood at ¥111 million, ¥149 million, and ¥83 million during these periods.

International markets dominate xTool's revenue streams, accounting for 97% of total sales in 2024. Distribution channels include Amazon, AliExpress, eBay, the company's direct-to-consumer website, and offline dealers—collectively contributing 85% of sales. Notably, xtool.com emerged as the largest direct sales channel, generating ¥774 million, ¥1.539 billion, and ¥1.086 billion during comparable periods—representing 53.1%, 62.1%, and 61.1% of total revenue respectively.

Industry Leadership and Future Prospects

xTool commands a dominant position in laser-based personal creative tools, capturing 37% of the global market share in the first nine months of 2025. Within the laser engraver segment specifically, its 47% market share exceeds the combined total of competitors ranked second through tenth. The Hong Kong listing is expected to strengthen xTool's market position, enhance brand recognition, and accelerate its globalization strategy.