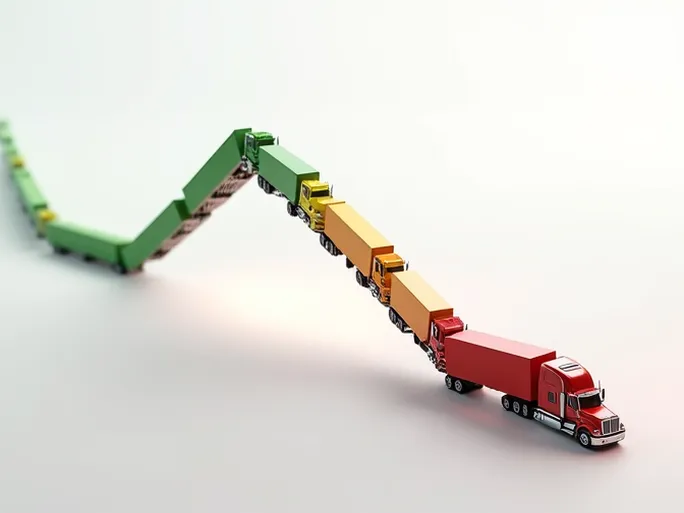

If the economy were a heavy-duty truck, then freight volumes would serve as its barometer. The latest October truck freight data released by the American Trucking Associations (ATA) paints a picture of both uphill momentum and downhill resistance, offering a nuanced view of current economic conditions.

Understanding the ATA Truck Tonnage Index

The ATA's Truck Tonnage Index serves as a crucial indicator of freight market activity in the United States. This comprehensive metric analyzes vast amounts of trucking data to reflect the overall level of goods transportation in the economy. The index comes in two distinct forms:

- Seasonally Adjusted Index (SA): This version employs statistical modeling to eliminate seasonal fluctuations, providing clearer insight into long-term freight market trends. Analysts and policymakers rely on this adjusted data to identify underlying economic shifts and assess the sector's overall health.

- Not Seasonally Adjusted Index (NSA): This raw data presents actual freight volumes without seasonal modifications, offering detailed information about specific periods, including monthly or quarterly peaks and valleys in shipping activity.

The ATA's data primarily reflects contract freight, which typically demonstrates more stable market demand. However, the more volatile spot market, susceptible to short-term influences, requires separate analysis for a complete picture of the industry.

October's Mixed Performance Indicators

Seasonally Adjusted Data Shows Modest Decline: The October 2023 SA index registered at 118.1 (with 2015 as the base year at 100), marking a 0.3% decrease from September's revised 118.5. While the drop appears minor, it suggests weakening momentum in freight market growth. Year-over-year comparisons show a 1.7% increase from October 2022, though this represents the smallest annual gain since June.

Unadjusted Figures Reveal Seasonal Strength: The NSA index jumped to 125.4 in October, an 8.4% surge from September, reflecting typical seasonal demand increases as retailers prepare for holiday shopping. The ATA recommends transportation companies use this unadjusted metric for more accurate operational assessments.

Contract vs. Spot Market Divergence: The data highlights a growing performance gap between stable contract freight and struggling spot market operations. Oversupply of capacity and weak demand have particularly impacted the spot market throughout 2023, while contract arrangements have provided some stability against these headwinds.

Economic Slowdown Impacts Industry Perspectives

ATA Chief Economist Bob Costello notes that October's freight patterns align with expectations of modest fourth-quarter economic growth. He specifically cites manufacturing slowdowns as negatively affecting freight demand, as reduced factory activity decreases needs for raw material, component, and finished goods transportation.

Robert W. Baird & Co. analyst Ben Hartford observes persistently weak freight demand entering October, with contract carriers showing muted peak season expectations compared to 2022's tariff-driven surge. Spot market pricing remains depressed, consistent with the year's overall soft trucking fundamentals.

Celadon CFO Thom Albrecht identifies shifting challenges for trucking firms. While excess capacity and slightly reduced demand dominated early 2023, recent months have introduced growing demand uncertainty. Albrecht emphasizes the predictive value of the Institute for Supply Management's (ISM) manufacturing data, which recently showed contractionary readings for the first time since 2016.

Manufacturing Data as Leading Indicator

The ISM's Purchasing Managers' Index (PMI) serves as a critical forward-looking metric for freight markets. Readings above 50 indicate manufacturing expansion, typically driving increased transportation needs for materials and products. Conversely, sub-50 readings signal contraction and reduced freight demand.

Of particular importance is the New Orders Index component, which directly measures manufacturing demand. September saw this index turn negative for the first time since 2015, ending 43 consecutive months of growth and potentially foreshadowing further freight volume declines.

Industry Outlook: Balancing Challenges and Opportunities

The October freight data reveals an industry navigating complex economic crosscurrents. While contract freight provides stability, spot market weakness and manufacturing slowdowns create significant pressure. Looking ahead, trucking faces both substantial obstacles and potential avenues for growth.

Key Challenges:

- Potential economic downturn reducing freight demand

- Persistent overcapacity in the trucking sector

- Rising operational costs including fuel, wages, and insurance

- Increasing regulatory burdens around safety and emissions

Emerging Opportunities:

- Continued e-commerce growth driving parcel shipping demand

- Global supply chain realignment creating new freight patterns

- Technological advancements in autonomous and smart logistics

- Service diversification into warehousing and supply chain management

Strategic Responses for Trucking Firms

To thrive in this evolving landscape, transportation companies should consider several strategic approaches:

Operational Efficiency: Implementing route optimization, reducing empty miles, improving fuel efficiency, and enhancing maintenance protocols can help offset rising costs.

Service Differentiation: Developing customized solutions, specialized handling, and superior communication can strengthen customer relationships and loyalty.

Technology Adoption: Investing in intelligent dispatch systems, real-time vehicle monitoring, and emerging autonomous technologies can improve both efficiency and safety.

Risk Management: Comprehensive insurance coverage, contingency planning, and market monitoring help navigate economic uncertainties.

The U.S. trucking industry stands at an inflection point, where traditional challenges meet new technological and market opportunities. Companies that successfully adapt through innovation, efficiency, and strategic flexibility appear best positioned for long-term success in this vital economic sector.