The latest rail freight data from the Association of American Railroads (AAR) serves as a revealing economic barometer, painting a complex picture of the nation's recovery trajectory. While overall volumes show improvement, significant sectoral disparities suggest an uneven rebound across industries.

Mixed Performance Across Commodity Classes

For the week ending January 14, U.S. railroads moved 244,171 carloads, marking a 4.2% year-over-year increase. This growth represents the strongest performance in recent weeks, signaling potential stabilization in freight demand. However, the recovery remains highly segmented.

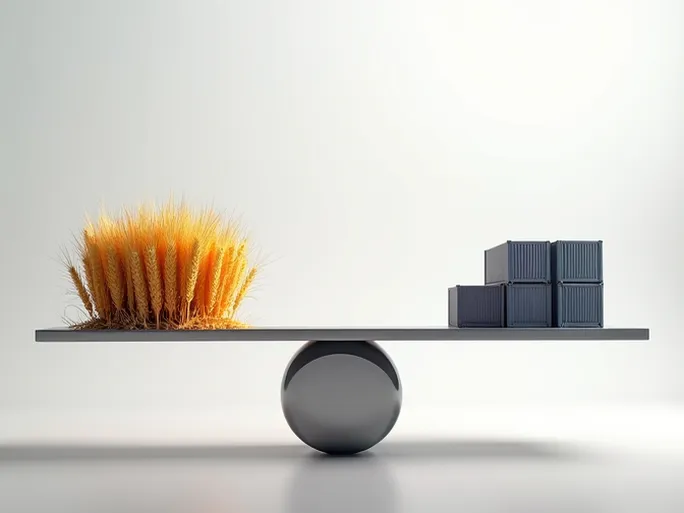

Seven of ten major commodity categories posted gains. Grain shipments led the expansion with 28,008 carloads (up 3,483), likely reflecting both global food demand and strong U.S. agricultural output. Nonmetallic minerals followed closely with 30,380 carloads (up 3,033), potentially indicating infrastructure activity. The automotive sector showed resilience with 14,562 carloads (up 2,176), suggesting continued recovery in vehicle production.

Conversely, chemical shipments declined by 2,226 carloads to 31,793, possibly due to global market volatility and supply chain disruptions. Forest products decreased by 715 carloads to 9,244, potentially tied to cooling housing markets. Miscellaneous freight saw marginal contraction, dropping 117 carloads to 9,580.

Intermodal Challenges Persist

Intermodal volumes presented a contrasting narrative, with containers and trailers totaling 241,829 units—a 7% annual decline. While improved from prior weeks, the sector continues facing headwinds from multiple directions:

• Reduced port congestion shifting cargo to trucking

• Consumer demand softening amid inflationary pressures

• Increased trucking capacity creating competitive pressure

Despite current challenges, intermodal retains significant long-term potential as e-commerce growth and supply chain complexity increase demand for efficient, sustainable transport solutions.

North American Market Overview

Expanding to continental metrics, combined U.S., Canadian, and Mexican rail operations moved 350,991 carloads (up 7.5%) but saw intermodal units fall 6% to 319,854. Total North American rail activity edged up 0.6% to 670,845 carloads and intermodal units.

Year-to-date figures through January 14 show a 0.7% contraction to 1,247,565 units, underscoring ongoing market pressures. Regional variations remain pronounced, reflecting divergent economic conditions, industrial compositions, and trade patterns across the continent.

Sector-Specific Outlook

Grain: Continued global population growth and emerging market development should sustain demand, though climate variability and trade policies pose risks.

Nonmetallic Minerals: Infrastructure investments may drive growth, but environmental regulations and resource depletion could constrain expansion.

Automotive: Market recovery appears underway, though semiconductor availability, supply chain reliability, and electric vehicle transitions warrant monitoring.

Chemicals: Global economic uncertainty, safety concerns, and regulatory scrutiny may continue weighing on shipments.

Forest Products: Housing market adjustments and sustainability initiatives could maintain downward pressure on volumes.

Strategic Imperatives for Rail Operators

To navigate this complex environment, industry participants should consider:

•

Network modernization

to enhance capacity and efficiency

•

Technology adoption

including automation and data analytics

•

Service innovation

to meet evolving customer expectations

•

Diversification

into intermodal, cold chain, and e-commerce logistics

•

Strategic partnerships

across transportation modes

The rail freight sector stands at an inflection point, where proactive adaptation to shifting market dynamics will separate industry leaders from laggards in the coming years.