Executive Summary

This report provides a thorough evaluation of the proposed $85 billion merger between Union Pacific (UP) and Norfolk Southern (NS) railroads. The merger has drawn significant attention due to its potential scale and far-reaching implications for the U.S. rail transportation industry. However, the Surface Transportation Board (STB) recently declared the merger application incomplete, casting uncertainty over this ambitious plan. The report analyzes STB's ruling, examines the merger's background and significance, assesses stakeholder reactions, reviews the regulatory process, and explores future prospects. Our objective is to offer policymakers, industry participants, investors, and the public a comprehensive, objective perspective on this complex transaction.

1. Introduction: Strategic Reshaping of Rail Transportation

Rail transport plays a vital role in the U.S. economy, serving as a critical link between producers, consumers, and markets. Over recent decades, industry consolidation has resulted in a market dominated by a few major carriers that provide efficient, reliable, and cost-effective services.

However, evolving economic conditions and intensifying competition present new challenges. Customers demand higher efficiency, better service quality, and competitive pricing, while alternative transport modes (trucking and waterways) continue advancing. Rail operators must innovate to enhance efficiency, reduce costs, and improve service offerings.

The UP-NS merger proposal represents a strategic response to these challenges. By combining networks and resources, the merged entity could achieve economies of scale, operational efficiencies, and enhanced service capabilities. However, concerns persist regarding potential impacts on competition, service quality, and employment. STB's rigorous review process aims to ensure the transaction serves public interests.

2. Merger Background and Strategic Rationale

2.1 Union Pacific Railroad (UP)

As one of America's largest railroads, UP operates an extensive network spanning western and central states, connecting Pacific ports with industrial and agricultural centers. Its primary commodities include agricultural products, energy materials, industrial goods, and consumer merchandise.

2.2 Norfolk Southern Railroad (NS)

NS serves eastern regions with routes linking Atlantic ports to industrial hubs and population centers. Key shipments include coal, chemicals, automotive parts, and consumer goods.

2.3 Strategic Logic

The merger's strategic rationale centers on:

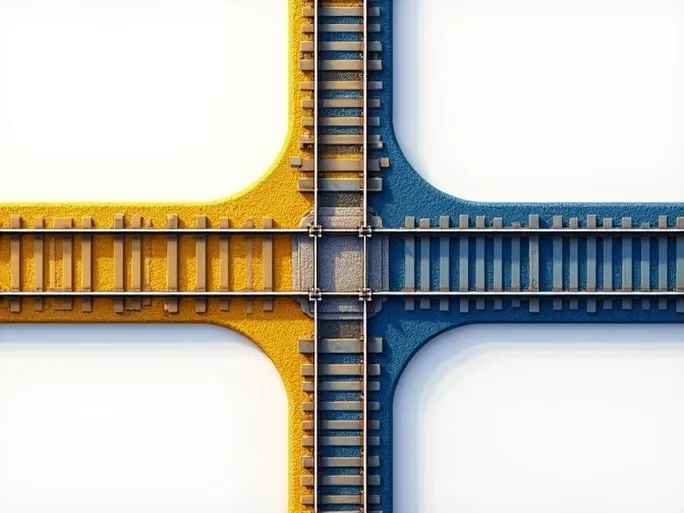

- Network expansion: Creating a coast-to-coast rail network

- Operational efficiency: Optimizing routes and reducing transfers

- Cost reduction: Achieving economies of scale

- Service enhancement: Combining operational strengths

- Competitive positioning: Strengthening market position against other transport modes

2.4 Potential Impacts

The merger could affect:

- Market competition: Increased concentration may reduce competitive pressures

- Service quality: Integration challenges could cause operational disruptions

- Employment: Workforce reductions through operational streamlining

- Public interest: Infrastructure maintenance and service reliability concerns

3. STB's Ruling: Key Findings

3.1 Regulatory Mandate

The STB oversees railroad mergers to ensure fair competition, reasonable pricing, and quality service. Its approval requires demonstrating public benefit without substantial competitive harm.

3.2 Core Deficiencies

STB identified several application shortcomings:

- Incomplete systemic impact analysis: Lacking detailed market share projections and competitive effects assessment

- Missing merger documents: Absence of complete transaction agreements

- Misclassified terminal request: Incorrect designation of St. Louis Terminal Railroad Association control as "minor"

- Technical deficiencies: Various procedural irregularities

3.3 Regulatory Implications

The ruling underscores STB's stringent review standards and the importance of comprehensive submissions. It reflects regulators' role in preventing market dominance and protecting public interests.

4. Stakeholder Reactions

4.1 Merging Parties

UP and NS are expected to revise their application while engaging with STB and stakeholders.

4.2 Analyst Perspectives

TD Cowen's Jason Seidl anticipates extended review timelines, while independent analyst Tony Hatch views the setback as procedural rather than substantive.

4.3 Competitor Concerns

BNSF Railway and Canadian National filed motions requesting greater disclosure, citing potential anti-competitive effects.

5. Regulatory Review Process

5.1 Complex Evaluation

STB's multi-phase review examines competitive impacts, service quality, employment effects, and public benefits through economic analysis and public hearings.

5.2 Timeline Expectations

Major railroad mergers typically require 18+ months for approval, with final decisions potentially extending to 2027.

6. Future Outlook

6.1 Potential Outcomes

Possible scenarios include:

- Approval: With adequate responses to STB concerns

- Rejection: If competitive harms outweigh benefits

- Conditional approval: With asset divestitures or service guarantees

6.2 Industry Implications

The decision will significantly influence U.S. rail transportation's competitive landscape, service quality, pricing, and innovation trajectories.

7. Conclusions and Recommendations

The UP-NS merger represents a transformative transaction requiring careful evaluation. STB's rigorous review process emphasizes the need for comprehensive analysis of competitive and public interest considerations.

Recommendations:

For merging parties: Address STB concerns through revised submissions, expert consultation, and stakeholder engagement.

For regulators: Maintain impartial evaluation through detailed analysis and public hearings.

For policymakers: Ensure adequate regulatory resources and frameworks to oversee industry consolidation.

The merger's ultimate fate hinges on demonstrating net public benefits while alleviating competitive concerns. STB's decision will shape the future of American rail transportation for decades to come.