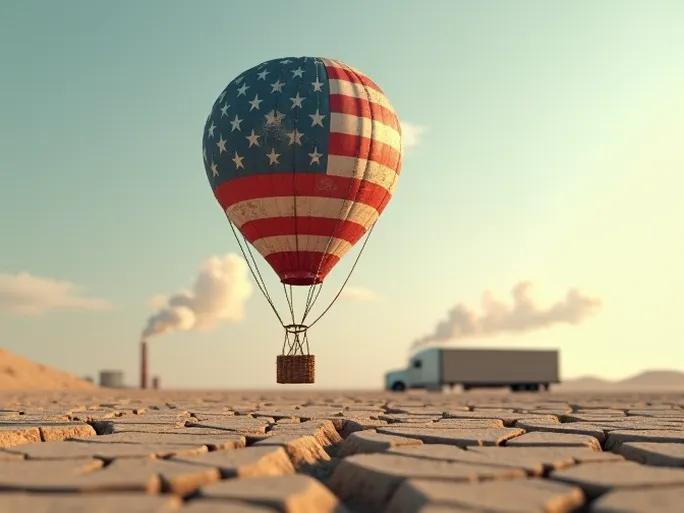

If the heavy-duty truck industry serves as an economic barometer, recent order data from the North American market suggests gathering clouds. While August orders showed a month-over-month increase, the overall performance remains weak—a reflection of the delicate balance between slowing demand and excess capacity, coupled with manufacturers' overly optimistic market projections.

Fleeting Recovery: The Reality Behind August Orders

Preliminary data from freight forecasting firm FTR Associates shows North American Class 8 truck net orders reached 15,593 units in August, a 27% increase from July. While this figure offered momentary optimism, deeper analysis reveals its fragility. FTR notes these represent the second-lowest August orders since 2010. More concerning, the annualized order rate for the past three months (through August) stands at just 179,300 units—significantly below last year's levels. By comparison, the December-February period saw annualized orders reaching 308,000 units, starkly illustrating weakening demand.

FTR President Eric Starks confirmed the August data aligned with expectations, reinforcing their projection of gradually declining production through coming quarters to match demand. He anticipates Q4 orders will fall below current production levels, suggesting manufacturers must further adjust output to prevent inventory buildup.

Manufacturers' Miscalculation: The Looming Threat of Overcapacity

FTR Transportation Analyst Jon Starks acknowledged that while order performance remains subpar, the situation isn't entirely bleak. The core issue stems from manufacturers' excessive optimism about market growth, triggering rapid capacity expansion. He noted OEMs initially expected sustained high growth that never materialized, prompting expectations for significant production cuts in late 2012.

Without a strong order rebound in coming months, production reductions appear inevitable. Starks emphasized that 2011's order weakness has persisted into 2012, requiring manufacturers time to absorb the net impact. Consequently, Class 8 truck sales will likely remain depressed in the near term.

Inventory Overhang: The Production Challenge

Starks further explained that early-year production significantly outpaced sales, creating substantial inventory accumulation. While sales haven't collapsed, their growth has dramatically underperformed expectations, forcing manufacturers to prioritize inventory reduction—a process that will inevitably constrain future production plans.

Cyclical Adjustment or Structural Shift?

The North American heavy truck market has historically followed economic cycles—flourishing during booms when freight demand surges, and contracting during downturns. However, current conditions suggest more than typical cyclicality. Industry observers note that e-commerce growth and supply chain transformations may be driving permanent changes in freight patterns, potentially reshaping long-term heavy truck demand.

E-Commerce Impact: Reshaping Freight Dynamics

The e-commerce boom is fundamentally altering traditional freight models. While online platforms drive demand for light commercial delivery vehicles, their emphasis on logistics efficiency promotes advanced transportation technologies like drop-and-hook systems and intermodal solutions—changes that may reduce heavy truck demand, particularly in long-haul segments.

Supply Chain Evolution: Leaner Models, Fewer Trucks?

As global supply chains grow more complex, companies increasingly adopt lean methodologies like just-in-time (JIT) production that minimize inventory buffers. These approaches may decrease heavy truck utilization by reducing bulk shipments of raw materials and components.

Manufacturer Strategies: Innovation Amid Transition

Facing these shifts, OEMs must adapt through strategic partnerships with e-commerce providers, customized logistics solutions, and accelerated development of alternative-fuel trucks to meet tightening emissions standards. Enhanced after-sales services and financial offerings could further strengthen customer retention.

Technological Frontiers: Automation and Connectivity

Innovation remains critical for the sector's future. Advancements in autonomous driving and vehicle connectivity promise smarter, safer, and more efficient trucks—technologies that could lower operating costs while improving safety. Several manufacturers and tech firms are actively developing autonomous trucks for near-term deployment.

Meanwhile, telematics systems enable real-time fleet optimization through traffic-aware routing and remote diagnostics, while alternative powertrains—including battery-electric, hybrid, and hydrogen fuel cell trucks—gain traction amid environmental regulations and infrastructure improvements.

Market Outlook: Navigating Challenges

The North American heavy truck sector confronts both cyclical pressures and structural transformations. Manufacturers must balance near-term production adjustments with long-term technological investments to remain competitive. While short-term headwinds persist, the market retains significant potential as economic recovery and innovation create new opportunities.

August's modest order rebound shouldn't obscure broader market softness. Manufacturers must recalibrate production plans while embracing technological transformation—from alternative fuels to autonomous systems—to meet evolving demand. In this period of transition, only those proactively addressing challenges while capitalizing on emerging trends will secure sustainable advantage.