The global trade landscape is undergoing unprecedented transformation, presenting both challenges and opportunities for cross-border e-commerce businesses. From shifting tariff policies to innovative platform solutions, industry players must adapt quickly to stay competitive.

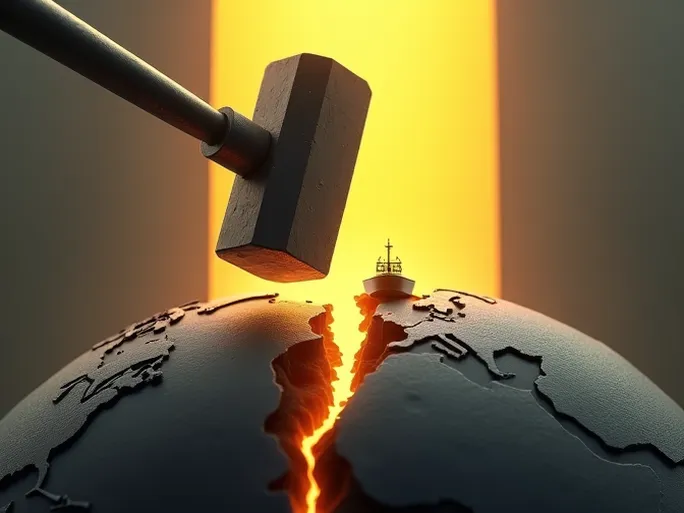

Trump Administration Imposes New Tariffs on European Goods

The U.S. government has announced 10% tariffs on imports from eight European countries—Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland—effective February 1. More significantly, the administration threatened to increase these tariffs to 25% by June 1 if negotiations regarding Greenland's potential acquisition by the U.S. fail to progress.

This unexpected move creates substantial uncertainty for European exporters and adds complexity to global trade dynamics. Cross-border sellers face immediate pressure on profit margins, requiring strategic adjustments to maintain competitiveness.

Amazon's Best-Sellers Reveal Consumer Trends

Amazon's latest kitchenware best-seller list provides valuable insights into evolving consumer preferences:

- Portable Food Sealers: Topping the chart with $3.83 million in monthly sales and over 49,000 units sold, these devices address growing demand for food preservation solutions.

- Cosori Electric Kettles: The "plastic-free water contact" design resonated with health-conscious consumers, generating $1.24 million in monthly sales.

- Bella 2-Slice Toasters: Compact design with wider slots appealed to small-space households, achieving $1.05 million in monthly revenue.

The list also featured low-pile carpets, manual meat grinders, stainless steel can openers, and disposable tableware, demonstrating diverse demand across food preparation and storage categories.

AWS Launches European Sovereign Cloud

Amazon Web Services has commercially launched its European Sovereign Cloud, a dedicated infrastructure physically and logically separated from other AWS regions. Located entirely within the EU, this solution addresses strict data sovereignty requirements from European governments and enterprises.

Planned expansions into Belgium, the Netherlands, and Portugal will provide cross-border e-commerce businesses with enhanced data security and compliance capabilities for European operations.

TikTok Shop Introduces European Local Hosting Model

TikTok Shop has implemented a "Local Hosting" model in Europe, where merchants simply stock products in TikTok's regional warehouses while the platform manages storage, sales fulfillment, and returns. The system also connects sellers with local influencers and agencies, streamlining content creation and conversion processes.

This operational model significantly reduces logistics costs and delivery times while improving customer experience—a compelling proposition for merchants targeting European markets.

TikTok Prepares U.S.-Mexico Cross-Border Program

TikTok Shop plans to launch its "U.S.-to-Mexico" cross-border initiative by April 2026, enabling direct shipments from U.S. warehouses to Mexican consumers without requiring local entity registration or inventory placement in Mexico.

This streamlined approach offers merchants an efficient channel into Mexico's growing e-commerce market while circumventing some tariff-related challenges.

SHEIN Implements Tax Payment Service

SHEIN has introduced an income tax settlement service for platform sellers, automatically deducting export-related taxes from subsequent payments. This automated solution simplifies tax compliance and reduces administrative burdens for cross-border merchants.

Etsy Integrates With Google's Commerce Platform

Etsy's integration with Google's Universal Commerce Platform allows U.S. users to browse and purchase select items directly through Google Search AI Mode and Gemini applications without redirecting to Etsy's website. This enhanced visibility provides sellers with additional sales opportunities through Google's extensive user base.

As the cross-border e-commerce sector navigates tariff uncertainties, platform innovations, and evolving consumer behaviors, adaptability and market awareness remain critical for sustainable growth. The convergence of new logistical solutions, tax compliance tools, and sales channels presents both challenges and opportunities for global online merchants.