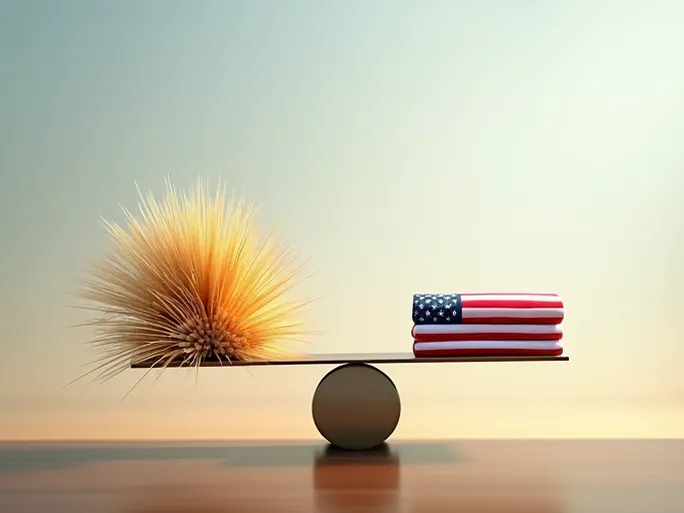

The newly announced trade framework agreement between India and the United States has sent ripples across India's economic and political landscape. While tariff reductions promise to boost Indian exports, potential agricultural concessions have raised alarms among small farmers, creating a national debate about whether this deal will accelerate economic growth or introduce unforeseen risks.

Key Provisions: Tariff Cuts and Purchase Commitments

The preliminary framework outlines several critical components:

- Tariff adjustments: India will eliminate or reduce import duties on select US industrial goods, food items, and agricultural products, while the US will lower its retaliatory tariffs on Indian goods from 25% to 18%.

- Energy cooperation: India committed to increasing US energy imports and halting direct/indirect purchases of Russian oil.

- Defense collaboration: Both nations agreed to deepen defense ties over the next decade.

- Purchase pledges: India vowed to buy $500 billion worth of US goods within ten years, spanning existing projects and new focus areas like data centers and energy.

- Agricultural terms: The government emphasized no provisions allow genetically modified crop imports, while certain Indian fruits like bananas and mangoes gain duty-free US market access.

Government Reassurances vs. Farmer Apprehensions

Commerce Minister Piyush Goyal has sought to allay concerns, stressing that negotiations protected agriculture—particularly dairy—and excluded GM crop imports. However, farmer groups remain skeptical. With full details undisclosed, smallholders fear livelihood threats, prompting nationwide protests scheduled for early February.

Market Turbulence: Currency Surge and Stock Volatility

Financial markets reacted sharply to the announcement. The rupee jumped 1.2% against the dollar, marking its strongest single-day gain in three years, while the Nifty 50 index briefly soared 5%. Analysts attribute this to anticipated export competitiveness improvements and the removal of US sanctions tied to India's Russian oil imports.

Analyst Perspectives: Measured Optimism

Market experts caution against over-enthusiasm. Samco Securities' Apurva Sheth notes that while reduced US tariffs may buoy sentiment, India's exports constitute too small a portion of its $4 trillion GDP for immediate, substantial impact. Sustained equity gains, he suggests, require genuine new buying momentum beyond initial hype.

Hidden Challenges and Strategic Choices

The deal's success hinges on navigating several complexities:

- Implementation risks: Executing $500 billion in US purchases depends on India's economic trajectory and project-level cooperation.

- Energy trade-offs: Shifting from Russian oil demands careful cost-benefit analysis to ensure supply stability.

- Future negotiations: Expanding the framework into a comprehensive agreement will test both nations' willingness to compromise on intellectual property, services, and investment rules.

As India balances opportunity against sovereignty concerns, its ability to diversify trade partnerships while shielding vulnerable sectors like agriculture may determine whether this deal becomes an economic catalyst or a cautionary tale.