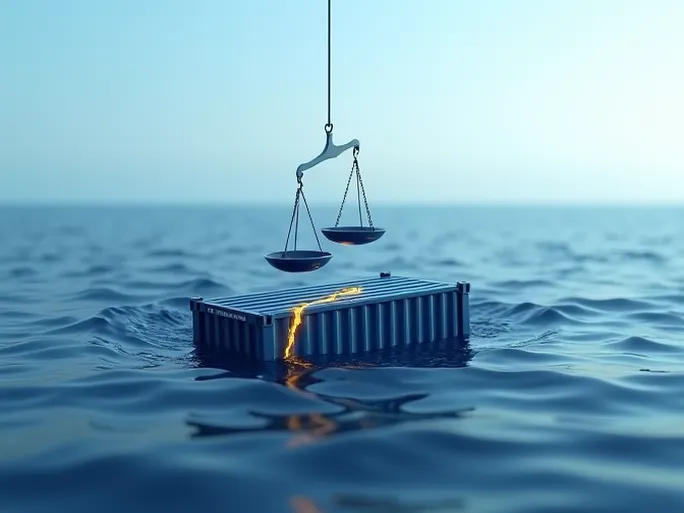

A sudden storm or an unfortunate shipwreck can lead to containers being lost at sea or even the complete sinking of a vessel. When faced with such maritime disasters, cargo owners must understand their options for recourse. This article examines the insurance claim process and general average rules that apply when maritime cargo is damaged or lost at sea.

Insurance Claims: Direct Compensation for Cargo Loss

Coverage Scope and Prerequisites

When cargo owners purchase marine cargo insurance (such as Free From Particular Average, With Particular Average, or All Risks coverage), insurers will compensate for total or partial losses resulting from accidents like shipwrecks or container losses. Different coverage types offer varying protection:

- Free From Particular Average (FPA): Covers total losses caused by natural disasters or accidents (like ship collisions or sinking), as well as the cargo owner's share of general average sacrifices and expenses.

- With Particular Average/All Risks: Expands on FPA coverage to include partial losses and damage from external causes like freshwater damage or leakage.

Key Steps in the Claims Process

- Immediate Notification: Report the incident to the insurer within 48 hours, submitting a loss notice while preserving all relevant documents including the carrier's accident statement and marine protest.

- Evidence Preservation: Collect and organize all supporting evidence, including bills of lading, invoices, packing lists, damage certificates, third-party inspection reports (such as those from SGS), and official records of the shipwreck or container loss.

- Claim Submission: Complete the claim form with all supporting documents, specifying the claim amount (typically calculated as the cargo's actual value plus freight and insurance costs).

- Compensation and Subrogation: After paying the claim, the insurer acquires subrogation rights to seek recovery from the carrier. The cargo owner cannot make duplicate claims.

Important Considerations

- Uninsured Risks: Without marine cargo insurance, cargo owners can only claim against the carrier, who may invoke maritime liability limits, potentially resulting in compensation far below the cargo's actual value.

- Parallel Processing: Insurance claims and general average contributions are separate legal processes that can proceed simultaneously without conflict.

General Average: Shared Sacrifice Among All Parties

Definition and Application

When a ship faces common danger, the carrier may take deliberate and reasonable actions to preserve the vessel, cargo, and freight. Any resulting special sacrifices or expenses (such as jettisoned cargo, refuge port costs, or salvage fees) become general average and are shared proportionally by all benefited parties.

Requirements and Scope

- Requirements: General average applies only when: the danger is real; actions are intentional and reasonable; sacrifices/expenses are extraordinary; and the measures successfully preserve common interests.

- Shared Costs: These may include jettisoned cargo, refuge port expenses, salvage payments, and temporary repair costs for continuing the voyage.

Cargo Owner Responsibilities

Even if their cargo remains undamaged, cargo owners must contribute to general average sacrifices based on their cargo's value. Carriers typically require a general average guarantee or security deposit before releasing goods.

Insurance Coverage

Most marine cargo policies include general average contributions. Insurers will pay the cargo owner's share when general average is declared.

Practical Guidelines

- Prioritize Comprehensive Coverage: Opt for All Risks insurance to protect against both cargo damage and general average contributions.

- Document Thoroughly: Gather all required evidence for both insurance claims and general average processes, including marine protests, accident reports, and cargo valuation documents.

- Secure Guarantees Promptly: Upon receiving a general average notice, immediately arrange for an insurance guarantee to prevent cargo detention.

- Understand Distinctions: Insurance covers direct cargo losses, while general average involves shared obligations among all parties—two fundamentally different legal concepts.

- Observe Time Limits: Insurance claims typically have a two-year statute of limitations, while general average contributions must usually be settled within one year—both counted from the accident date.

When facing major maritime incidents like container losses or shipwrecks, cargo owners should respond methodically, leveraging both insurance mechanisms and general average rules to minimize financial losses. Comprehensive insurance coverage, prompt evidence collection, and active participation in claims and contribution processes remain essential for protecting one's interests.