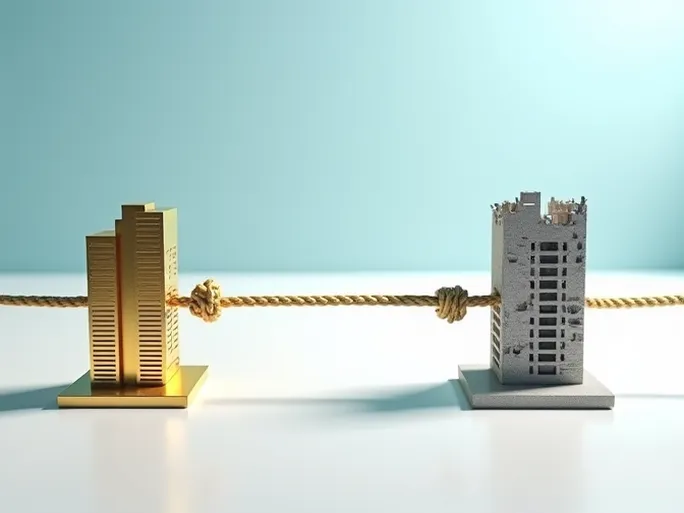

In the ever-changing capital markets, every asset restructuring and equity movement captures investors' attention. While the acquisition battle for Evergrande Property heats up, Hong Kong's luxury property market unexpectedly shines. These seemingly separate events reveal deeper market dynamics that warrant closer examination.

Evergrande Property: Liquidation Nears as Competing Bids Emerge

The liquidation process of Evergrande Property remains in focus. Recent announcements indicate that liquidators have received updated acquisition proposals from multiple interested buyers and are currently reviewing these offers. The liquidators have ceased accepting new informal expressions of interest, with next steps and timelines still under discussion. Notably, no legally binding agreements have been reached with any potential buyer, leaving the final ownership of Evergrande Property uncertain as negotiations continue.

Concord New Energy: Streamlining Operations Through Asset Sales

Concord New Energy (0182.HK) has announced plans to sell three wind power project companies to Zhao Ying Neng He for approximately 517.8 million yuan. The transaction includes:

- Qujing Julong: A 300MW wind farm with 30MW/60MWh storage capacity in Yunnan province

- Wuhe Juhe: A 50MW wind farm in Anhui province

- Anhui Taihe: A 51MW wind farm in Anhui province

This strategic move aims to optimize Concord's asset structure, improve capital efficiency, and allow greater focus on core business operations.

Royal Home Smart: Southeast Asia Expansion Through Share Placement

Royal Home Smart (01575) plans to raise approximately 27.7 million Hong Kong dollars through a share placement to fund its Southeast Asia expansion. The proceeds will be allocated as follows:

- 65% for production capacity and supply chain enhancement

- 15% for product showrooms in Southeast Asia

- 20% for general working capital

Qingdao Doublestar: Advancing International Ambitions Through Acquisition

Qingdao Doublestar has received regulatory approval for its acquisition of a 45% stake in South Korea's Kumho Tire, marking a significant step in its global expansion strategy. The deal is expected to enhance Doublestar's technological capabilities and international market presence.

Hong Kong Luxury Property: Defying Market Trends

Knight Frank's latest Global Super-Prime Property Report reveals Hong Kong's luxury residential market achieved second-highest global sales volume in Q4 2025, with 81 transactions totaling $1.566 billion. This represents a 45% quarterly increase in transaction volume and 51% growth in value, signaling market recovery after previous adjustments.

Road King: Subsidiary Liquidation Hearing Delayed

Road King Infrastructure (01098.HK) faces financial pressures as the British Virgin Islands court postponed the liquidation hearing for its subsidiary New Select Global Limited to February 16, 2026.

Asset Restructuring Continues Across Markets

Other notable corporate movements include:

- Shou Yi Holdings' S$21 million sale of Singapore industrial property

- Huamo Technology's ongoing acquisition process requiring updated financial audits

- Hong Kong Communications International's HK$13.2 million property sale to reduce debt

- Jingrui Holdings' continued liquidation process with appointed administrators

These developments collectively paint a picture of dynamic capital markets where companies must remain agile to navigate complex financial landscapes, while investors require sharp insight to identify emerging opportunities.