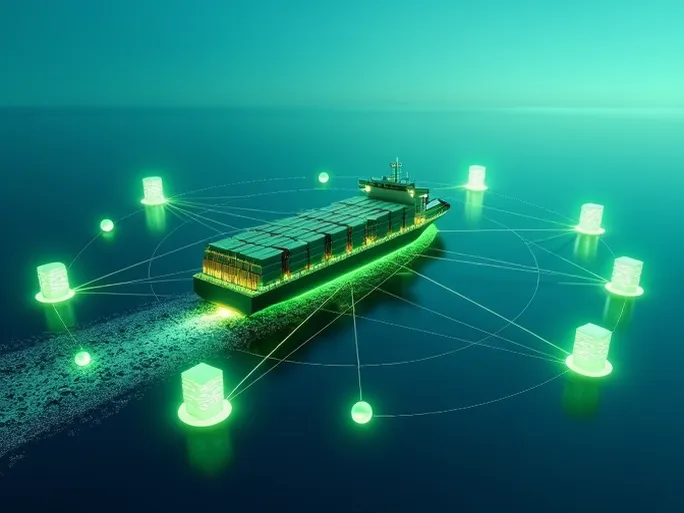

As the global shipping industry faces urgent demands for green transformation and supply chain competition intensifies, COSCO Shipping Holdings has unveiled a comprehensive strategy to navigate these challenges. Through massive investments in eco-friendly vessels and strategic port acquisitions, the company is positioning itself as a leader in sustainable maritime logistics.

Green Shipping: $2.9 Billion Bet on Methanol-Powered Fleet

The company announced that its subsidiaries, Orient Overseas Container Line and COSCO Shipping Lines, have signed contracts with shipyards to construct twelve 24,000-TEU methanol dual-fuel container vessels. The total investment reaches 28.782 billion yuan (approximately $4.1 billion), with each vessel costing about $240 million. Delivery is scheduled between Q3 2026 and Q3 2028.

Key Advantages of the New Fleet:

- Environmental Leadership: The vessels will utilize advanced green methanol dual-fuel technology, incorporating multiple energy-saving features to significantly reduce emissions.

- Competitive Positioning: This investment strengthens COSCO's position on key east-west trade routes while enabling balanced global network development.

- Regulatory Compliance: The technology ensures adherence to increasingly stringent environmental regulations while offering clients sustainable logistics solutions.

End-to-End Supply Chain: Strategic Port Investments

COSCO is expanding its supply chain capabilities through major investments in two Chinese port operators:

- Shanghai International Port Group: Acquiring a 14.93% stake for 18.944 billion yuan ($2.7 billion)

- Guangzhou Port Company: Purchasing a 3.24% stake for 779 million yuan ($111 million)

These transactions await approval from relevant state-owned assets regulators and COSCO's shareholders.

Strategic Rationale:

The port investments aim to optimize network layout, improve operational efficiency, and mitigate cyclical risks. They represent a crucial step in COSCO's transformation from pure shipping operations to integrated digital supply chain solutions.

Financial Performance: Strong Results Amid Challenges

COSCO reported robust financial results for the first three quarters of 2022:

- Revenue: 316.5 billion yuan ($45.2 billion), up 36.75% year-over-year

- EBIT: 143.6 billion yuan ($20.5 billion), a 49.92% increase

- Net Profit: 97.2 billion yuan ($13.9 billion), rising 43.74%

While container volume declined 9.36% to 18.5 million TEUs, average revenue per TEU surged 47.96% to $2,876, reflecting favorable market conditions.

Future Strategy: Digital Supply Chain Transformation

As container markets normalize, COSCO is accelerating its evolution into a "global digital supply chain operation and investment platform" with three strategic priorities:

- Green and low-carbon operations

- End-to-end supply chain integration

- Digital transformation in shipping

The company aims to provide diversified, customized solutions combining shipping, port, and logistics services while enhancing risk resilience and value creation capabilities.

Strategic Analysis

Environmental Impact: Methanol-powered vessels could reduce sulfur oxide emissions by 99%, nitrogen oxides by 80%, and particulate matter by 95% compared to conventional fuel.

Financial Implications: The port investments may yield 8-12% returns while providing stable cash flow to counterbalance shipping's cyclicality.

Market Position: These moves strengthen COSCO's position as the world's third-largest container carrier while addressing growing customer demand for sustainable logistics.