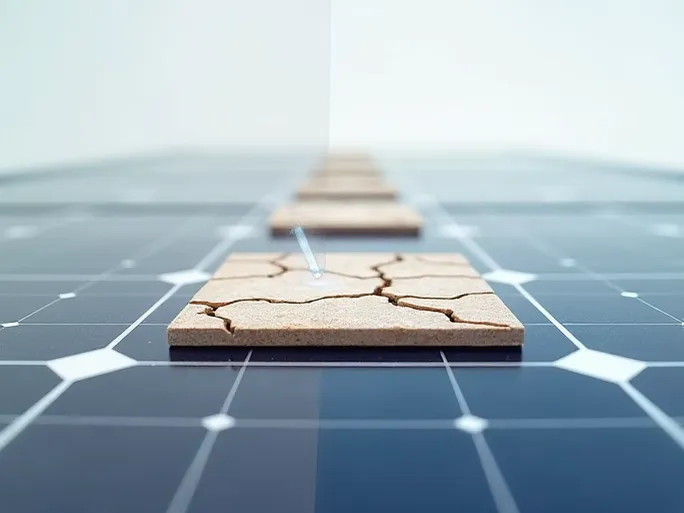

As global markets undergo significant transformations, businesses face new challenges in maintaining stability amid policy changes. A major overhaul of export tax rebates, effective April 1, 2026, will reshape competitive landscapes for photovoltaic, ceramic, glass, and multiple other industries. Strategic adaptation will separate resilient enterprises from vulnerable competitors.

Key Policy Changes

The reform eliminates value-added tax (VAT) export rebates for solar products entirely, immediately increasing export costs for affected manufacturers. Battery products face a phased adjustment: rebates decrease from 9% to 6% during the April-December 2026 transition period before complete elimination on January 1, 2027.

Expansive Industry Impact

Official documentation reveals the policy's broad reach beyond renewable energy sectors. Chemical raw materials (including basic industrial chemicals and organophosphorus compounds), PVC plastics and polymers, kitchenware, ceramic goods, silicone products, cement, and glass manufacturing will all experience operational disruptions. This sweeping change necessitates comprehensive export strategy reevaluations across manufacturing sectors.

Strategic Adaptation Framework

Industry analysts recommend five proactive measures to mitigate policy impacts:

- Technology-driven value enhancement: Increased R&D investment can offset cost pressures through premium product development. Photovoltaic manufacturers might focus on high-efficiency solar panels, while ceramic producers could emphasize innovative designs.

- Geographic market diversification: Reducing dependence on single markets through expansion into emerging economies, particularly along Belt and Road Initiative corridors, provides risk mitigation.

- Supply chain optimization: Strategic partnerships with suppliers and logistics providers can reduce production and transportation expenses, preserving profit margins.

- Policy monitoring mechanisms: Establishing channels for real-time regulatory updates through industry associations and consulting services enables agile strategic adjustments.

- Government support utilization: Proactive engagement with available subsidies, research grants, and export financing programs can ease transition burdens.

This policy shift presents both challenges and opportunities. Manufacturers demonstrating strategic foresight and innovation capacity will likely emerge stronger in the reconfigured global marketplace, while slower-moving competitors risk erosion of market position.