In a move that underscores the accelerating consolidation within the logistics sector, Roadrunner Transportation Systems (RRTS) has acquired select assets of TA Drayage's Southeast regional short-haul operations. This strategic acquisition marks another step in RRTS's methodical expansion strategy, following closely on the heels of its purchase of Marisol International LLC.

The "Asset-Light" Growth Strategy

As a non-asset-based third-party logistics provider, RRTS operates through a unique business model that emphasizes flexibility and scalability. Unlike traditional freight companies that maintain large fleets of trucks and extensive warehouse networks, RRTS builds its service capabilities through strategic partnerships and targeted acquisitions. This approach allows the company to rapidly adjust to market fluctuations while minimizing capital expenditures.

The recent $1.2 million cash acquisition of TA Drayage's Southeast operations exemplifies this strategy. Funded through existing cash reserves, the transaction demonstrates RRTS's financial capacity for continued expansion while maintaining prudent capital management.

Strategic Rationale Behind the Acquisition

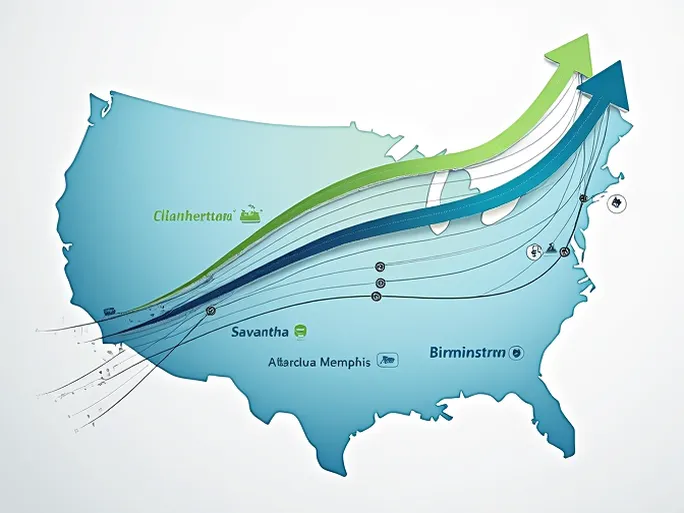

TA Drayage's Southeast operations provide critical port and rail hub coverage across key logistics nodes including Charleston (South Carolina), Norfolk (Virginia), Savannah (Georgia), Atlanta (Georgia), Memphis (Tennessee), and Birmingham (Alabama). With annual revenues of approximately $20 million, the acquired business strengthens RRTS's intermodal service capabilities in this economically vital region.

Ben Kirkland, President of RRTS's Intermodal Services, emphasized the operational benefits: "This acquisition enhances our intermodal service scale and density in the Southeast region. The addition of over 100 independent contractors complements our asset-light service model while expanding our service footprint."

Financial Performance and Growth Trajectory

The Wisconsin-based logistics provider has demonstrated consistent financial growth, with quarterly net income reaching $14 million—a 37% year-over-year increase—and earnings per share growing 15.6% to $0.37. Total revenue climbed 26% to $104 million, providing a solid foundation for continued strategic investments.

Mark DiBlasi, RRTS President and CEO, outlined the company's disciplined acquisition approach: "Since January 2006, we've completed 26 acquisitions, focusing on well-run, profitable companies with non-asset or light-asset models. Cultural alignment remains paramount—when absent, we've walked away from deals."

Industry Analyst Perspective

Stifel Nicolaus analyst David Ross noted the transaction's strategic fit following RRTS's recent public offering of 4.3 million shares: "The TA Drayage acquisition further consolidates RRTS's intermodal capabilities—a low-risk, incremental addition. Management appears to have additional acquisitions planned for this year, maintaining their disciplined approach to earnings-accretive deals."

Ross suggested that while a parcel carrier acquisition could complete RRTS's service portfolio, future transactions would likely remain complementary to existing operations rather than transformative.

Market Implications and Future Outlook

This acquisition reflects broader industry trends toward consolidation and service integration. As shippers increasingly demand comprehensive logistics solutions, providers like RRTS are building more robust networks through strategic combinations. The Southeast's growing importance in U.S. trade flows—with expanding port capacities and inland distribution networks—makes this regional focus particularly timely.

With successful integration, the TA Drayage operations should contribute meaningfully to RRTS's 2013 earnings while strengthening its competitive position in intermodal transportation. The company's consistent execution of its acquisition strategy suggests continued disciplined growth as it builds what industry observers describe as one of the sector's most dynamic service networks.