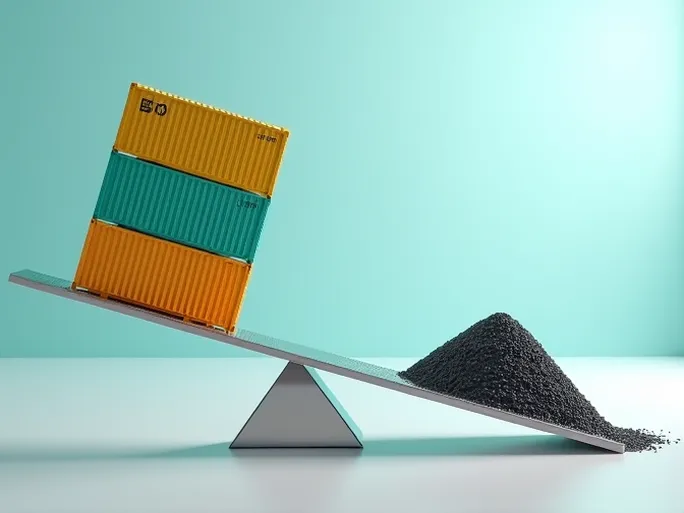

America's rail freight market presents a complex picture, with strong intermodal performance offsetting declines in traditional bulk commodity transportation. The latest data from the Association of American Railroads (AAR) reveals structural shifts in consumer demand and energy policies are reshaping the industry.

Mixed Performance Across Sectors

For the week ending February 10, total U.S. rail freight volume reached 484,840 units, marking a 4.5% year-over-year increase. However, this growth masks significant divergence between sectors. While intermodal operations showed robust expansion, traditional rail carloads declined, reflecting broader economic transformations.

Rail carloads totaled 220,362, down 2.5% compared to the same period last year. This represents a decrease from the previous week's 222,213 carloads but remains above the 208,131 recorded in late January. Meanwhile, intermodal containers and trailers reached 264,478 units, an 11.1% year-over-year increase, demonstrating intermodal's growing dominance.

Commodity-Specific Trends

The AAR's ten major commodity categories revealed striking disparities:

-

Growth Leaders:

- Chemicals: 33,109 carloads (+1,854 YoY)

- Automotive: 15,028 carloads (+1,769 YoY)

- Grain: 21,551 carloads (+1,687 YoY)

-

Declining Sectors:

- Coal: 61,908 carloads (-7,264 YoY)

- Nonmetallic Minerals: 26,637 carloads (-3,111 YoY)

- Miscellaneous Carloads: 8,123 (-1,066 YoY)

Intermodal Emerges as Growth Engine

The 11.1% intermodal growth rate significantly outpaced overall freight expansion, establishing it as the market's primary driver. This shift reflects fundamental changes in supply chain logistics, where the flexibility to integrate rail with trucking and maritime transport provides cost and efficiency advantages.

E-commerce expansion and consumer expectations for rapid delivery have amplified intermodal's importance. Simultaneously, port congestion and truck driver shortages have compelled shippers to explore multimodal alternatives.

Year-to-Date Patterns Confirm Structural Shift

Cumulative data through 2024's first six weeks shows traditional rail carloads down 6.4% (1,245,530 units) while intermodal containers and trailers grew 6.5% (1,470,492 units). These figures confirm an ongoing industry realignment away from bulk commodities toward flexible logistics solutions.

Strategic Challenges Ahead

Rail operators face dual pressures from energy transitions and evolving supply chains. Successful adaptation will require:

- Network optimization through infrastructure investment

- Expanded intermodal service offerings

- Technology adoption for operational efficiency

- Environmental sustainability initiatives

The February 10 data illustrates an industry at an inflection point, where traditional strengths must be balanced against emerging opportunities. Future success will depend on operators' ability to prioritize efficiency, flexibility, and sustainability in an increasingly complex transportation landscape.