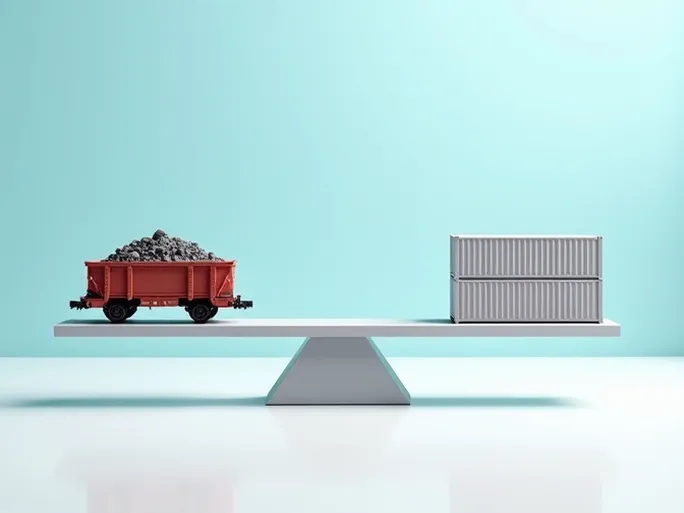

When global supply chains pulse unevenly, what signals does rail freight—the barometer of economic activity—send? The latest data from the Association of American Railroads (AAR) reveals a nuanced "split personality" in the US rail freight market during the week ending July 15, with carload volumes edging up while intermodal shipments declined.

The figures offer a unique perspective on the direction of the US economy. Rail carload volumes reached 225,609 units, marking a 0.9% increase compared to the same period last year. This number surpassed both the 197,086 units recorded on July 8 and the 223,254 units on July 1. Among the ten major commodity categories tracked by AAR, seven showed year-over-year growth, indicating resilient demand in certain sectors.

Key growth areas included:

- Metal ores and products: up 1,243 units to 18,031

- Nonmetallic minerals: up 759 units to 30,033

- Petroleum products: up 445 units to 8,843

These increases reflect sustained demand for raw materials and fuel from manufacturing, construction, and energy industries. However, not all commodities followed this positive trend.

Notable declines were seen in:

- Grain: down 3,685 units to 12,629

- Coal: down 1,745 units to 58,369

- Forest products: down 1,373 units to 7,140

The grain and coal decreases may relate to agricultural yields, energy sector transitions, and international trade dynamics.

Intermodal Contraction Contrasts with Carload Growth

While carload volumes showed modest gains, intermodal container and trailer traffic declined significantly. Weekly intermodal volume stood at 252,544 units, representing a 5.3% year-over-year decrease. Though higher than the 210,757 units recorded on July 8, this figure fell below the 261,189 units from July 1.

The intermodal downturn potentially signals weakening consumer demand, easing port congestion, and increased competition from trucking. Year-to-date figures through the first 28 weeks of 2023 show cumulative carload volumes at 6,266,430 units (up 0.5% year-over-year), while intermodal volumes totaled 6,576,896 units (down 10.0%). Combined rail freight volume decreased by 5.2% compared to 2022.

Drivers Behind the Divergence

The split performance in rail freight stems from multiple economic forces. The carload growth likely benefits from ongoing infrastructure projects and manufacturing reshoring. The Biden administration's infrastructure investment plan continues to boost demand for metals and minerals, while supply chain realignments support domestic production.

Conversely, intermodal declines reflect consumer spending pressures from persistent inflation and higher interest rates. Improved trucking efficiency as port bottlenecks ease may also be diverting shipments from rail to road transport.

Navigating Challenges and Opportunities

The US rail freight sector faces both headwinds and opportunities moving forward. Economic uncertainty, geopolitical tensions, and energy transitions pose challenges, while infrastructure modernization, technological innovation, and sustainability initiatives offer growth potential.

Rail operators must enhance operational efficiency through digital transformation—leveraging IoT and AI for real-time monitoring and smart scheduling. Strengthening multimodal coordination with ports and trucking firms could create more integrated logistics networks.

Policy support remains crucial, including infrastructure investments, balanced regulation, and incentives for rail transport to reduce carbon emissions. As the industry undergoes transformation, proactive adaptation will determine its ability to support broader economic growth.