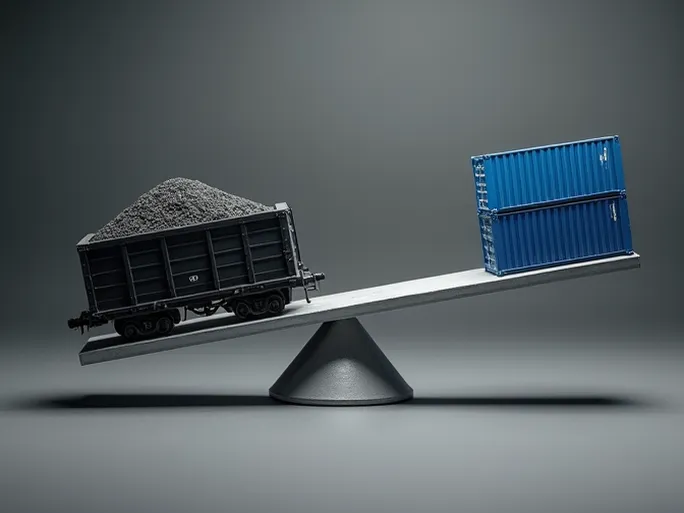

Imagine you're a logistics manager closely monitoring the pulse of the U.S. economy. Rail freight data serves as a mirror reflecting economic health, illuminating both growth prospects and underlying challenges. The latest figures from the Association of American Railroads (AAR) paint a complex picture for the week ending November 4: declining carload volumes coupled with modest growth in intermodal units. What does this divergence signify, and how should it inform your strategic decisions?

Carload Traffic: Overall Decline With Sector-Specific Variations

U.S. railroads moved 224,415 carloads during the measured week, marking a 5.2% year-over-year decrease. This continues a downward trend from previous weeks (227,575 carloads on October 28 and 234,893 on October 21). While concerning for rail-dependent industries, deeper analysis reveals pockets of resilience among the ten major commodity categories tracked by AAR:

- Motor vehicles & parts: Increased by 357 carloads to 14,841 units, reflecting sustained consumer demand and improving supply chain conditions.

- Agricultural products (excluding grain) & food: Grew by 274 carloads to 17,101 units, demonstrating the essential nature of food shipments regardless of economic conditions.

- Petroleum & petroleum products: Rose by 267 carloads to 9,527 units, tracking with global energy market dynamics and domestic production increases.

Conversely, several sectors showed concerning declines:

- Grain: Dropped by 3,655 carloads to 21,395 units, potentially influenced by weather patterns, trade policies, and shifting global demand.

- Coal: Fell by 3,017 carloads to 65,298 units, continuing the long-term trend of energy transition away from thermal coal.

- Nonmetallic minerals: Declined by 2,562 carloads to 31,218 units, possibly signaling cooling in construction activity.

Intermodal Traffic: Modest Growth With Underlying Uncertainties

In contrast to carload declines, intermodal volume (containers and trailers) edged up 1.5% year-over-year to 260,342 units. However, this represents a slowdown from the 271,814 units moved during the October 28 week and 271,092 units the prior week. The marginal growth suggests several contributing factors:

- Resilient consumer spending despite inflationary pressures

- Improved port operations easing container flow

- Sustained e-commerce growth driving logistics demand

Potential headwinds include:

- Global economic deceleration potentially reducing trade volumes

- Geopolitical risks disrupting supply chains

- Potential container shipping overcapacity affecting rates

Year-to-Date Trends: Stabilization Versus Decline

Cumulative data through 2023's first 44 weeks shows U.S. railroads moved 9,920,836 carloads (essentially flat with +0.1% growth) while intermodal volume reached 10,665,407 units (down 7.0%). This reveals diverging long-term patterns:

- Carload stability masks sector-specific volatility as traditional industries contract while emerging sectors expand

- Intermodal fluctuations reflect sensitivity to global trade conditions, policy changes, and supply chain dynamics

Strategic Implications for Logistics Professionals

This mixed freight landscape demands adaptive management approaches:

- Monitor real-time market indicators to inform timely decisions

- Diversify transportation modes to mitigate single-channel risks

- Optimize supply chain networks for efficiency and cost control

- Develop contingency plans for potential disruptions

As an economic barometer, rail freight data provides both warning signals and opportunity indicators. Success in this environment requires continuous analysis and operational flexibility.