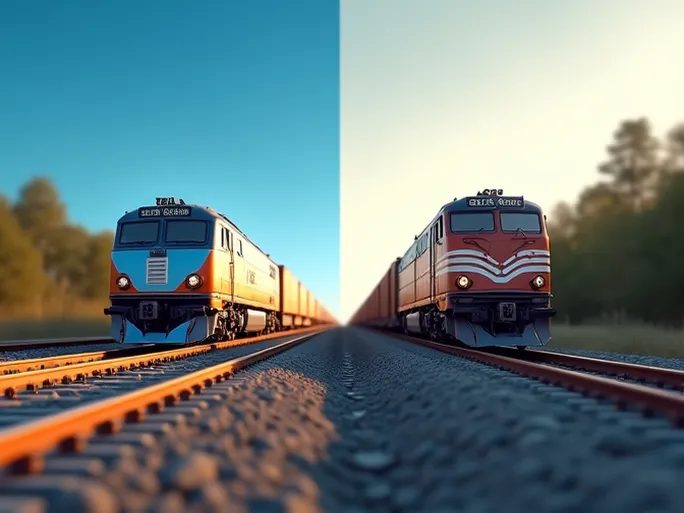

Picture this: highways bustling with traffic, cranes swinging at busy ports, while on the railroad tracks, one side sees container-laden trains speeding past as traditional freight trains crawl along on the parallel track. This is the current state of the US rail freight market - a tale of two very different realities.

Recent data from the Association of American Railroads (AAR) reveals this striking divergence. For the week ending December 7, traditional rail freight volumes declined while intermodal (container) transportation surged - a contrast that demands closer examination.

1. The Big Picture: A Market Divided

The US rail freight market shows clear polarization:

- Traditional freight decline: Weekly rail freight totaled 224,899 carloads, down 1.8% year-over-year. While higher than the Thanksgiving-affected week ending November 30 (189,746 carloads), it remained below the November 23 week (230,036 carloads).

- Intermodal boom: Container and trailer traffic reached 295,995 units, up 9.7% year-over-year, significantly surpassing both the November 30 (249,616 units) and November 23 (290,762 units) weekly figures.

This stark contrast signals accelerating structural changes in US freight transportation, with intermodal's flexibility and efficiency gradually displacing portions of traditional rail freight.

2. Sector Breakdown: Winners and Losers

Performance varied significantly across commodity categories, with five of AAR's ten tracked categories showing growth and five declining:

-

Growing sectors:

- Chemicals: Up 2,614 carloads to 33,599, reflecting stable demand from US manufacturing recovery.

- Grain: Increased 2,436 carloads to 23,143, driven by export demand and domestic consumption.

- Miscellaneous goods: Rose 1,302 carloads to 9,318, indicating diversified consumer demand.

-

Declining sectors:

- Coal: Fell 8,665 carloads to 57,764, continuing its downward trajectory amid global energy transition.

- Automotive: Dropped 2,436 carloads to 15,046, likely impacted by supply chain issues and EV market shifts.

- Nonmetallic minerals: Decreased 892 carloads to 28,164, potentially due to construction sector volatility.

3. Year-to-Date Trends: The Pattern Solidifies

The full-year picture reinforces these trends. Through the first 49 weeks of 2024:

- Total rail freight: 10,693,127 carloads (down 3.1%)

- Intermodal volume: 13,045,681 units (up 9.1%)

These numbers confirm profound structural changes in US rail freight, with traditional operations facing competitive pressure while intermodal gains market share through efficiency and flexibility.

4. Driving Forces: Multiple Factors at Play

Several interconnected factors explain this market divergence:

- Energy transition: Global shifts toward cleaner energy reduce coal demand.

- Supply chain restructuring: Companies prioritize resilient, diversified logistics networks.

- E-commerce growth: Rising online shopping favors intermodal's suitability for small, frequent shipments.

- Technology: IoT, big data, and AI enhance intermodal efficiency and transparency.

- Policy: Environmental regulations advantage intermodal's lower emissions versus trucking.

5. Future Outlook: Navigating Transformation

The road ahead presents both challenges and opportunities:

- Challenges: Traditional operators must adapt to energy, supply chain, and consumption changes.

- Opportunities: Intermodal providers can expand through technological innovation and service improvements.

Rail companies may consider several strategic responses:

- Diversifying service offerings including customized logistics solutions

- Investing in digital transformation technologies

- Adopting cleaner energy and optimized routing

- Forging partnerships across transportation modes

6. Conclusion: Adapting to a New Era

The US rail freight sector stands at an inflection point. Traditional operations face existential pressures while intermodal enjoys unprecedented growth. Success will belong to those embracing efficiency, flexibility, sustainability, and smart technology.

For shippers, understanding these market dynamics becomes crucial for optimizing supply chains. Transportation decisions now require balancing cost, speed, reliability, and environmental impact - with no one-size-fits-all solution.

In this era of transformation, the rail industry's future belongs to those who innovate, collaborate, and evolve with the changing landscape.