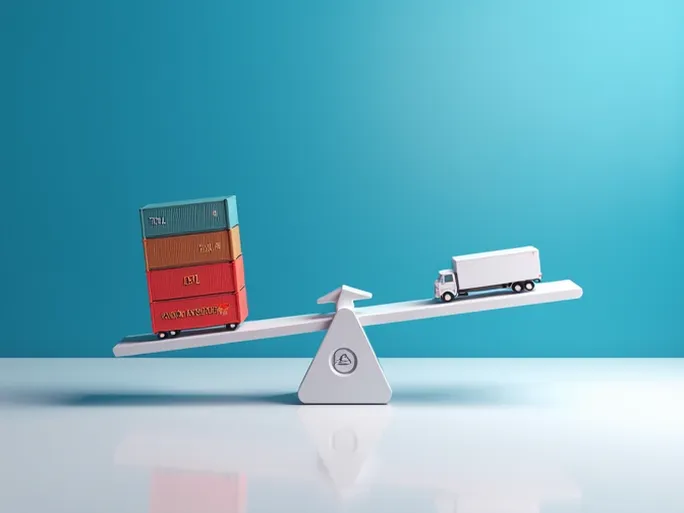

XPO Logistics has made a significant strategic move by agreeing to sell its intermodal business to STG Logistics for approximately $710 million. This transaction marks a pivotal step in XPO's plan to create two separate, publicly traded companies focused on less-than-truckload (LTL) transportation and tech-enabled freight brokerage services.

Strategic Transformation: Sharpening the Focus

The sale represents XPO's commitment to streamlining operations and concentrating on its core competencies. Chairman and CEO Brad Jacobs emphasized that this divestiture prepares the ground for the planned separation, positioning XPO as a leader in both LTL and freight brokerage sectors.

Key elements of XPO's strategic realignment include:

- Business Simplification: By exiting the intermodal business, XPO can allocate more resources to strengthen its LTL network and technology-driven brokerage platform.

- Financial Optimization: Proceeds from the sale will be used to improve the company's capital structure, reduce debt, and work toward investment-grade credit ratings.

- Value Creation: The planned separation into two independent companies is expected to better reflect the intrinsic value of each business segment and provide investors with clearer investment choices.

Transaction Details: STG Expands Capabilities

The divested intermodal operation, acquired by XPO in 2014 through its purchase of Pacer International, generated $1.2 billion in revenue in 2021. The business provides rail brokerage and drayage services across 48 North American locations, with approximately 700 employees expected to transition to STG.

For STG Logistics, this acquisition represents a strategic expansion of its asset-light logistics platform. CEO Paul Svindland noted the combination creates an unparalleled container logistics capability, offering customers complete visibility and single-source responsibility from port to final destination.

Industry Perspective: Rationalizing for Growth

Industry analysts view XPO's move as a response to increasing market specialization in logistics. Ben Gordon of Cambridge Capital observed that XPO is taking appropriate steps to eliminate the conglomerate discount by creating pure-play entities, with this intermodal sale being part of a broader simplification strategy.

The transaction reflects several industry trends:

- Accelerating sector specialization as companies focus on core strengths

- Growing importance of technology in freight brokerage operations

- Increasing demand for customized logistics solutions

Looking Ahead: Separate Paths to Growth

For XPO, the sale completes its exit from intermodal as it prepares to operate as two distinct public companies. The LTL business will focus on expanding its North American network, while the brokerage operation will continue developing its digital platform.

STG gains significant scale in container logistics, positioning it to offer more comprehensive services. The combined operation will handle approximately 1 million container moves annually, creating one of North America's largest intermodal service providers.