As the global economy pulses to the rhythm of supply chains, rail freight volume remains one of the key indicators of economic health. However, recent data suggests the engine of US rail transport may be slowing down. According to the Association of American Railroads (AAR), both rail freight and intermodal volumes showed year-over-year declines for the week ending May 7, casting another shadow over an already challenging economic landscape.

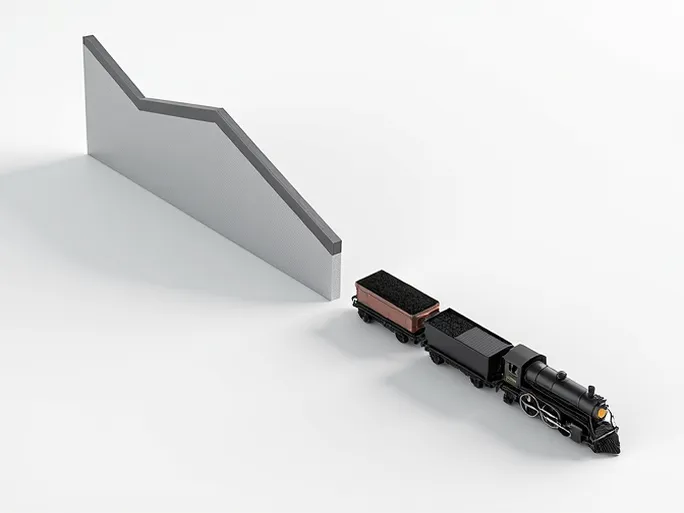

Rail Freight: Overall Decline With Coal Defying the Trend

US rail freight volume reached 231,737 carloads during the observed week, marking a 1.9% decrease compared to the same period last year. While slightly higher than the 229,044 carloads recorded during the week ending April 23, the figure remains below the 232,972 carloads reported for April 30, indicating a broader downward trend.

Among the ten major commodity categories tracked by AAR, only three showed year-over-year growth, with coal standing out as a bright spot in otherwise gloomy data:

- Coal: Defying the overall trend, coal shipments rose to 63,281 carloads, up by 522 carloads year-over-year. The sustained demand for this traditional energy source amid ongoing global energy crises may reflect structural changes in energy markets and heightened focus on energy security.

- Motor Vehicles & Parts: The automotive sector's recovery drove growth in this category to 14,400 carloads, an increase of 3,071 carloads. This likely correlates with easing semiconductor shortages and gradual production recovery, though the stability of global automotive supply chains and market demand require continued monitoring.

- Nonmetallic Minerals: Shipments grew to 33,952 carloads, up 1,671 carloads, potentially driven by infrastructure projects and real estate market demand.

However, most other commodity categories showed concerning declines:

- Metallic Ores & Metals: Plunged to 19,315 carloads, down 4,195 carloads, likely tied to global economic slowdown, reduced manufacturing activity, and metal price volatility.

- Grain: Fell to 22,402 carloads, down 2,813 carloads despite growing global food security concerns, possibly affected by weather conditions, export policies, and international competition.

- Petroleum & Petroleum Products: Dropped to 8,940 carloads, down 1,177 carloads, potentially impacted by energy transition efforts and oil price fluctuations.

Intermodal: Persistent Weakness Highlights Supply Chain Issues

Intermodal transport, comprising container and trailer movements, recorded 273,190 units—a 4.9% year-over-year decline. This figure also falls below the 273,727 units reported for April 30, underscoring ongoing supply chain bottlenecks that continue to hamper transport efficiency.

Year-to-Date Figures: Mixed Results

Cumulative data from early 2022 reveals US rail freight at 4,138,700 carloads, representing a 1% increase. However, intermodal volume stands at 4,726,239 units, down 7%. This stark contrast highlights how intermodal weakness is dragging down overall transport efficiency despite rail freight's modest growth.

North American Rail: Broad Declines With Canadian Resilience

Expanding the view to North America, data from 12 major railroads across the US, Canada, and Mexico shows the region's rail freight volume at 329,158 carloads for the week ending May 7—a 0.5% decline. Intermodal volume reached 367,244 units, down 3.1%. Combined North American transport volume totaled 696,402 carloads and intermodal units, marking a 1.9% decrease.

Year-to-date North American transport volume stands at 12,078,231 carloads and intermodal units, reflecting a 3.9% decline, confirming challenges across the continental rail industry.

Analysis and Outlook

The declines in US rail freight and intermodal volumes mirror multiple global economic challenges, including inflation, supply chain disruptions, geopolitical tensions, and energy market volatility. While coal's growth offers a glimmer of hope, widespread declines in other commodities underscore persistent economic pressures.

Moving forward, the rail industry must proactively address challenges while seizing opportunities. Priorities should include infrastructure upgrades to enhance efficiency and reduce costs, along with service diversification to adapt to evolving market needs. Strengthening coordination with ports and trucking to build robust intermodal systems will be crucial for competitiveness.

Policymakers should support rail transport development through measures like infrastructure investment, streamlined regulations, tax relief, and innovation incentives to foster sustainable growth.

Ultimately, the weakening US rail transport metrics serve as a microcosm of broader economic challenges. Only through coordinated efforts can these obstacles be overcome to achieve sustained economic recovery.