The latest data from the Association of American Railroads (AAR) reveals a complex picture of the U.S. rail freight market, serving as a barometer for broader economic trends. While weekly figures show declines, cumulative annual data demonstrates surprising resilience—a paradox that warrants closer examination.

Weekly Performance: Declines Across the Board

For the week ending April 16, U.S. rail carloads totaled 221,228 units, representing a 6.8% year-over-year decrease. This continues a downward trend from previous weeks' figures of 236,459 (April 9) and 231,963 (April 2). Intermodal traffic—containers and trailers transported by rail—followed a similar pattern, declining 9.2% to 268,573 units.

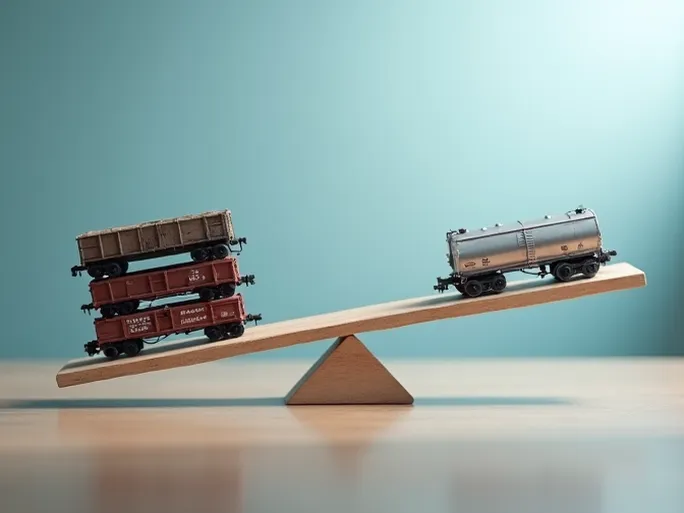

Sector Breakdown: A Tale of Two Markets

Beneath the surface, the data reveals significant sectoral variations. Six of the ten major commodity categories tracked by AAR showed year-over-year growth. Chemicals led with an increase of 849 carloads to 33,090, while coal shipments remained stable at 61,550 units.

However, other sectors faced substantial declines: grain shipments plummeted by 6,632 carloads to 19,602, metal ores and products dropped 4,136 to 20,638, and petroleum products decreased by 2,358 to 8,466 units. These disparities suggest industry-specific factors rather than broad economic weakness.

Annual Perspective: Underlying Resilience

The cumulative data for the first 15 weeks of 2022 presents a more optimistic view. Total U.S. rail carloads reached 3,444,827 units, marking a 1.9% increase year-over-year. However, intermodal traffic told a different story, declining 6.8% to 3,910,355 units—creating a mixed overall picture.

North American Context: Regional Challenges

Expanding the analysis to include Canada and Mexico reveals broader regional pressures. The 12 major North American railroads reported combined weekly declines of 6.8% for carloads (319,064 units) and 8.1% for intermodal traffic (354,060 units). Year-to-date figures show a 3.9% overall decline across the continent.

Structural Challenges and Emerging Opportunities

The rail sector faces multiple headwinds: persistent global supply chain disruptions, rising energy costs, labor shortages, and inflationary pressures. Port congestion and trucking bottlenecks continue to impact rail efficiency.

Yet opportunities emerge from these challenges. E-commerce growth creates potential for intermodal expansion, while environmental concerns position rail as a sustainable alternative to trucking. Technological advancements—including autonomous trains and smart scheduling systems—promise future efficiency gains.

The rail freight industry stands at an inflection point, where adaptation to structural changes will determine competitive positioning. As economic recovery progresses unevenly, rail performance metrics will continue to provide valuable insights into the health of global supply chains.