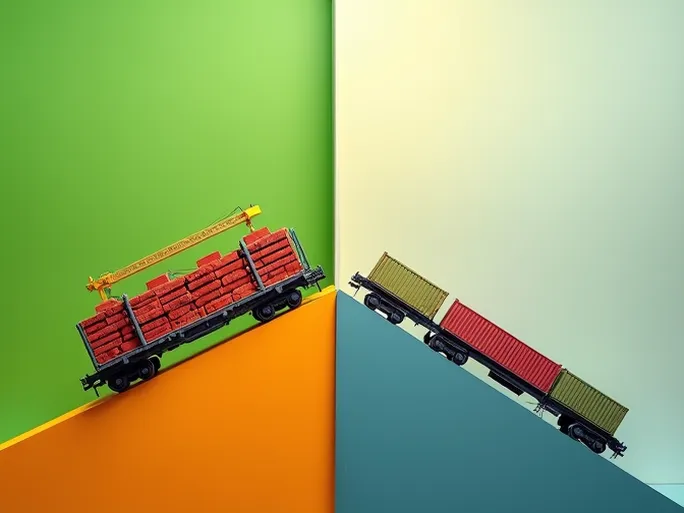

Rail transportation serves as a barometer for economic health, with fluctuations in freight volumes often foreshadowing broader economic trends. Recent data from the Association of American Railroads (AAR) paints a complex picture: while carload traffic shows modest growth, intermodal shipments have declined significantly. This divergence raises questions about the strength and direction of the U.S. economy.

Carload Traffic: Strong Performance in Coal and Nonmetallic Minerals

For the week ending January 21, U.S. railroads reported 230,545 carloads, representing a 3.3% increase compared to the same period last year. This growth was primarily driven by robust performance in certain commodity categories, with five of the ten major commodity groups tracked by AAR showing year-over-year gains.

- Nonmetallic minerals: Volumes surged by 5,895 carloads to 31,264, likely reflecting increased construction activity and infrastructure projects. These materials serve as essential building blocks for the construction industry.

- Coal: Increased by 2,454 carloads to 68,675, demonstrating continued demand despite global energy transition efforts. The rise may indicate seasonal heating needs and regional dependence on coal-fired power generation.

- Motor vehicles and parts: Grew by 2,321 carloads to 13,166, signaling recovery in the automotive sector as semiconductor shortages ease and production rebounds.

However, not all commodities shared in this growth:

- Chemicals: Declined by 2,891 carloads to 31,038, potentially indicating softening in manufacturing activity.

- Grain: Fell by 1,262 carloads to 22,015, influenced by weather patterns, trade policies, and market demand fluctuations.

- Forest products: Decreased by 799 carloads to 9,065, possibly reflecting slower construction and real estate markets.

Intermodal Decline: A Warning Sign for Consumer Demand?

In contrast to carload growth, intermodal units (containers and trailers) fell sharply to 236,940, marking a 6.7% year-over-year decline. As intermodal traffic primarily moves consumer goods, this downturn suggests weakening retail demand.

Several factors may be contributing to this trend:

- Persistent inflation eroding household purchasing power

- Rising interest rates increasing borrowing costs

- Businesses reducing shipments as they work through excess inventory accumulated during supply chain disruptions

Year-to-Date Performance: A Tale of Two Markets

Cumulative data through January 21 reveals this bifurcation more clearly. Carload traffic stands at 687,678 units (up 3%), while intermodal volume totals 682,296 units (down 8.4%). This divergence suggests structural differences within the economy—industrial sectors showing resilience while consumer-facing segments weaken.

North American Perspective: Broadening the View

Expanding the analysis to include Canada and Mexico, data from 12 North American railroads shows 336,113 carloads (up 6.8%) and 309,502 intermodal units (down 6.7%) for the same week. Total combined volume declined 0.1% year-over-year to 645,615 units.

Year-to-date figures for North America show 1,893,180 total units transported, representing a 0.5% decrease compared to 2022.

Economic Implications and Outlook

The rail freight data presents a nuanced economic snapshot. While certain industrial sectors demonstrate strength, consumer demand appears fragile. Key factors that will influence future rail performance include:

- The trajectory of inflation and Federal Reserve monetary policy

- Geopolitical developments affecting global trade patterns

- The pace of energy transition away from fossil fuels

- Inventory correction timelines across retail sectors

As a leading economic indicator, rail freight patterns merit close monitoring. The current mixed signals suggest an economy at a potential inflection point, with different sectors moving at varying speeds. Whether this divergence resolves toward sustained growth or broader contraction remains to be seen.