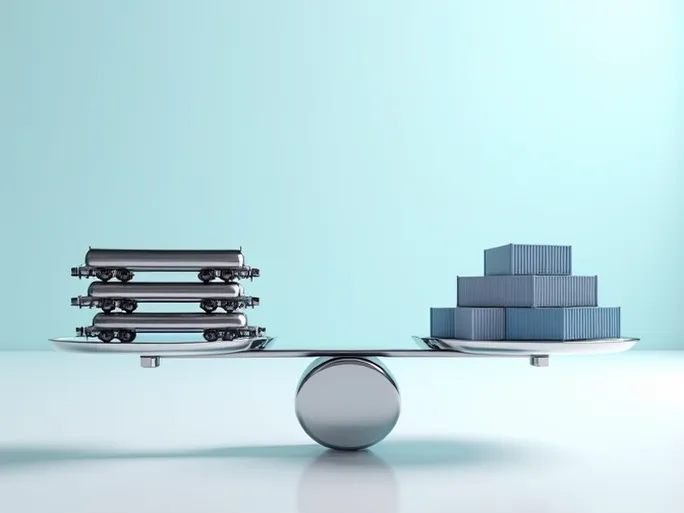

The latest report from the Association of American Railroads (AAR) reveals a nuanced picture of the U.S. rail freight market for the week ending August 20. While carload volumes showed modest growth, intermodal traffic displayed signs of weakening—a divergence that industry analysts are closely monitoring for broader economic implications.

Carload Traffic: Steady Growth with Sector Variations

U.S. railroads originated 237,404 carloads during the reported week, representing a 2.9% increase year-over-year. Although slightly below the 237,857 carloads recorded in the previous week (August 13), the figure remains higher than the 230,573 carloads reported on August 6, suggesting overall stability.

Seven of the ten commodity categories tracked by AAR demonstrated year-over-year growth:

- Coal: The sector led gains with 68,280 carloads—an increase of 4,321 units. The resurgence reflects continued global demand for traditional energy sources amid elevated prices.

- Grain: Transportation reached 20,974 carloads (up 2,825 units) as harvest season approaches, indicating strong agricultural output.

- Food & Agricultural Products (excluding grain): Volumes grew to 17,031 carloads (up 2,128 units), underscoring rail's critical role in maintaining food supply chains.

However, three commodity groups experienced declines:

- Miscellaneous Carloads: Fell to 8,600 units (down 1,951), potentially signaling softening demand in niche markets.

- Metals & Metal Products: Dropped to 22,270 carloads (down 1,248), reflecting global economic pressures on industrial sectors.

- Petroleum Products: Declined to 9,681 carloads (down 627), consistent with broader energy transition trends.

Intermodal: Facing Headwinds

Intermodal volumes painted a different picture, with 264,144 containers and trailers moved—a 2.4% decrease year-over-year. This continues a downward trend from the 264,924 units in the prior week and 265,953 units two weeks prior.

Key challenges include:

- Persistent global supply chain bottlenecks affecting port operations

- Elevated fuel prices increasing operational costs

- Ongoing labor shortages across logistics networks

Year-to-Date Performance

Cumulative data through week 33 of 2022 shows:

- Carloads: 7,606,648 units (essentially flat at -0.01% year-over-year)

- Intermodal: 8,707,653 units (down 5.5%)

The North American market (including Canada and Mexico) reported 334,389 carloads (up 2.3%) and 354,588 intermodal units (down 1.7%) for the week, with total combined volume showing 0.2% growth.

For the first 33 weeks of 2022, North American rail freight totaled 22,296,729 carloads and intermodal units—a 2.8% overall decline compared to 2021.

While traditional rail freight demonstrates resilience, intermodal sectors face transitional challenges. Market observers suggest these patterns reflect broader economic shifts, including energy market volatility, agricultural cycles, and supply chain realignments.