Imagine a bustling port with mountains of containers waiting to be transported inland. Railroads serve as critical arteries connecting these hubs, and their freight volume fluctuations offer a clear barometer of economic health. The latest data from the Association of American Railroads (AAR) provides a window into this economic pulse. For the week ending August 20, 2022, US rail freight presented a nuanced picture: modest growth in carload traffic contrasted with slight declines in intermodal volume. What factors underlie these trends, and what economic signals do they convey?

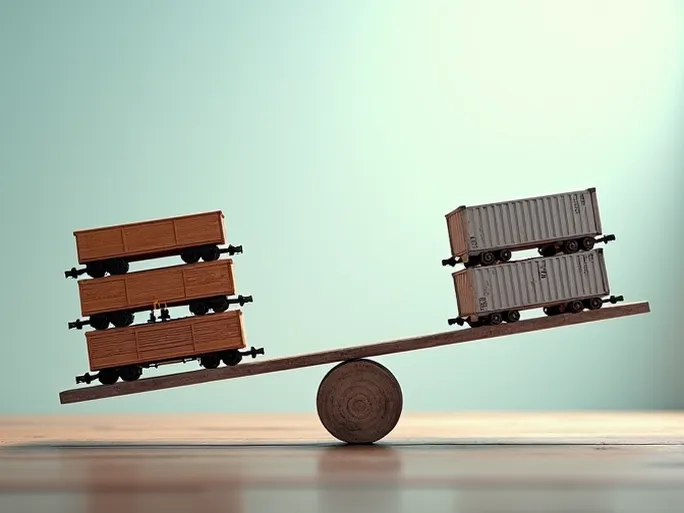

Overview: Carloads Up, Intermodal Down

AAR data for the week ending August 20 reveals these key patterns:

- Carload traffic: Totaled 237,404 units, up 2.9% year-over-year. Though slightly below the 237,857 units recorded the previous week (August 13), it exceeded the 230,573 units from August 6, suggesting resilience in traditional freight demand.

- Intermodal volume: Totaled 264,144 containers and trailers, down 2.4% year-over-year. This also fell below the prior weeks' figures (264,924 on August 13 and 265,953 on August 6), indicating mounting pressure on intermodal transport.

Carload Breakdown: Sector Variations

Among the 10 commodity categories tracked by AAR, seven showed annual growth:

- Coal: Led gains with 4,321 additional carloads (68,280 total), likely reflecting higher energy prices and increased coal-fired power generation.

- Grain: Added 2,825 carloads (20,974 total), potentially driven by growing global food security concerns.

- Agricultural products (excluding grain) and food: Rose by 2,128 carloads (17,031 total), indicating stable consumer demand.

Declines appeared in:

- Miscellaneous carloads: Dropped 1,951 units (8,600 total), possibly signaling broader economic cooling.

- Metallic ores and metals: Fell 1,248 carloads (22,270 total), likely tied to weakening global manufacturing.

- Petroleum products: Declined 627 carloads (9,681 total), potentially affected by oil price volatility and energy transition pressures.

Intermodal Decline: Contributing Factors

Several elements may explain the intermodal downturn:

- Port congestion: Persistent global supply chain bottlenecks continue hampering efficiency.

- Trucking competition: Greater flexibility in short-haul trucking may be diverting shipments.

- Shifting consumption: Changing consumer spending patterns could be reducing demand.

- Inventory adjustments: Retailers' stocked warehouses may have temporarily decreased transport needs.

Year-to-Date Trends

Cumulative data for 2022's first 33 weeks shows:

- Carloads: 7,606,648 units, nearly flat (-0.01%) versus 2021, demonstrating stability in traditional freight.

- Intermodal: 8,707,653 units, down 5.5% year-over-year, confirming ongoing challenges.

North American Context

Expanding to 12 railroads across the US, Canada, and Mexico reveals:

- Weekly carloads: 334,389 units (+2.3% year-over-year)

- Weekly intermodal: 354,588 units (-1.7%)

- Total volume: 688,977 units (+0.2%)

Year-to-date North American freight totaled 22,296,729 units, down 2.8%, suggesting region-wide pressures.

Economic Implications

Rail data serves as an economic leading indicator. While rising carloads offer limited optimism, declining intermodal volumes and broader North American decreases may foreshadow growth headwinds. Sector variations also reflect divergent industry conditions—coal's strength aligns with energy market turmoil, while metals' weakness mirrors manufacturing softness.

Future Outlook

Key factors influencing rail freight include:

- Macroeconomic conditions: Global slowdowns, inflation, and geopolitical risks

- Supply chain normalization: Port operations and labor availability

- Energy transitions: Shifting fuel transportation patterns

- Policy impacts: Infrastructure investments and trade regulations

Conclusion: Cautious Interpretation

The August 20 rail data presents a complex economic snapshot. Carload growth provides measured encouragement, but intermodal declines and macroeconomic uncertainties warrant prudence. Careful analysis of these transportation trends remains essential for understanding underlying economic conditions and preparing for evolving market dynamics.